Health insurance stocks were jolted last week after U.S. President Donald Trump said he plans to summon executives from the nation’s largest health insurers and press them to “ease up and start cutting prices.” The remarks immediately put the sector on edge as the message was clear: pricing power in health insurance may once again be moving into the political crosshairs.

For UnitedHealth Group (UNH), the largest and most influential player in the sector, the stakes are especially high. UNH has already faced challenges in 2025, including rising Medicare Advantage costs and heightened regulatory scrutiny. Trump’s push for lower premiums now introduces another layer of uncertainty heading into 2026, forcing investors to ask a critical question: if political pressure translates into real pricing constraints, what does that mean for UnitedHealth’s stock in the year ahead? Let's dig into it.

About UnitedHealth Group Stock

Founded in 1974, UnitedHealth Group is a health and well-being company that provides a diverse range of health insurance and healthcare services. The company is organized into two primary divisions: UnitedHealthcare and Optum. UnitedHealthcare provides health insurance plans, whereas Optum delivers healthcare services and technology. The company has established a formidable competitive moat by combining these segments, forming a powerful, self-reinforcing ecosystem that is transforming how healthcare is delivered and managed. It has a market cap of $294.2 billion.

Shares of the healthcare conglomerate have dropped 35.2% on a year-to-date (YTD) basis. UNH stock cratered earlier this year after the company first cut and then withdrew its full-year earnings guidance. Adding to the pressure were reports of a U.S. Department of Justice investigation into the company’s billing practices, along with the sudden resignation of its CEO.

However, UNH stock has mounted a strong rebound since early August, climbing to as high as $381, buoyed by Berkshire Hathaway (BRK.A) (BRK.B) taking a new stake in the company and better-than-expected 2026 Star Ratings. Since then, the stock has pulled back slightly and moved into a consolidation phase.

Trump Asks Health Insurers to Lower Premiums

U.S. President Donald Trump said last Friday that he plans to call in executives from the country’s largest health insurance companies and ask them to lower the cost of premiums for consumers. The president said the idea came to him on the spot during an event where pharmaceutical executives pledged to donate medications as part of an agreement to avoid tariffs. Mr. Trump said he wants health insurers to “ease up and start cutting prices,” adding that many insurers have delivered share returns well above 1,000%, though he did not specify the time frame for those gains.

“I’m going to call a meeting of the insurance companies,” Trump told reporters at the White House. “I’m going to see if they get their price down, to put it very bluntly.” He said the meeting could take place this week while he is at his Mar-a-Lago estate in Florida for the holidays or during the first week of January after he returns to Washington.

UnitedHealth shares plunged nearly 10% on Trump’s remarks before rebounding to finish the session slightly below the flatline. Health insurance stocks have already come under pressure this year, as premiums struggle to keep pace with rising healthcare costs. Patients are returning for more surgeries and outpatient procedures following years of underuse, putting pressure on insurers’ earnings.

Trump’s Push Comes Amid ACA Uncertainty

President Trump’s push for lower premiums largely stems from the scheduled expiration of enhanced Affordable Care Act (ACA) subsidies at the end of 2025. Congress remains at an impasse over whether to extend the enhanced ACA tax credits. Without these subsidies, out-of-pocket premiums for tens of millions of Americans are expected to more than double on average in 2026, potentially pricing many people out of coverage.

Last week, four moderate Republicans joined Democrats to move forward with a discharge petition that could force a House vote on extending the subsidies. House Speaker Mike Johnson has pushed back against the effort, arguing that bypassing party leadership is not the proper way to make law. GOP leaders are instead advancing an alternative plan that would help insurers offset lower deductibles and copays for ACA enrollees and expand association health plans without extending the enhanced subsidies. Still, Senate Majority Leader John Thune said any effort to move the plan forward will likely be pushed back until January.

President Trump said that while he still favors a plan that would provide Americans with direct subsidies to buy insurance, a deal to lower costs could help sustain the Obamacare exchanges. Insurers “are making so much money, and they have to make less, a lot less,” he said. “And maybe we can have reasonable health care without having to cut them out and let it all go awry.”

What Would Lower Premiums Mean for UNH Stock?

Well, I think the clearest indication of what Donald Trump’s push for lower premiums could mean for UNH stock is the market’s initial reaction to his remarks—and it wasn’t encouraging. But that reaction is hardly surprising when a sector built on pricing power and predictability faces government pressure that could squeeze profits.

The math here is simple. Health insurance premiums are largely determined by the underlying cost of medical care, administrative expenses, and desired profit margins. Forcing a reduction in premiums without a proportional decline in medical costs would directly compress margins and weigh on profitability. As a result, lowering premiums would likely lead to further sustained declines in valuation as investors adjust for lower future earnings.

Meanwhile, AHIP, a trade group representing health insurers, stated that premiums are driven by the cost of medical care and noted that insurers’ margins and administrative expenses are regulated. “Health plans are doing everything in their power to shield Americans from the high and rising costs of medical care,” according to AHIP Chief Executive Officer Mike Tuffin.

To sum up, while lower premiums would benefit consumers, they would represent a significant financial headwind for UnitedHealth, impacting its business model and stock performance. UnitedHealth Group has already faced challenges in 2025 from rising medical costs in its Medicare Advantage business. And lowering premiums would add a significant new hurdle as the company attempts to stabilize for a projected earnings recovery in 2026.

What Do Analysts Expect for UNH Stock?

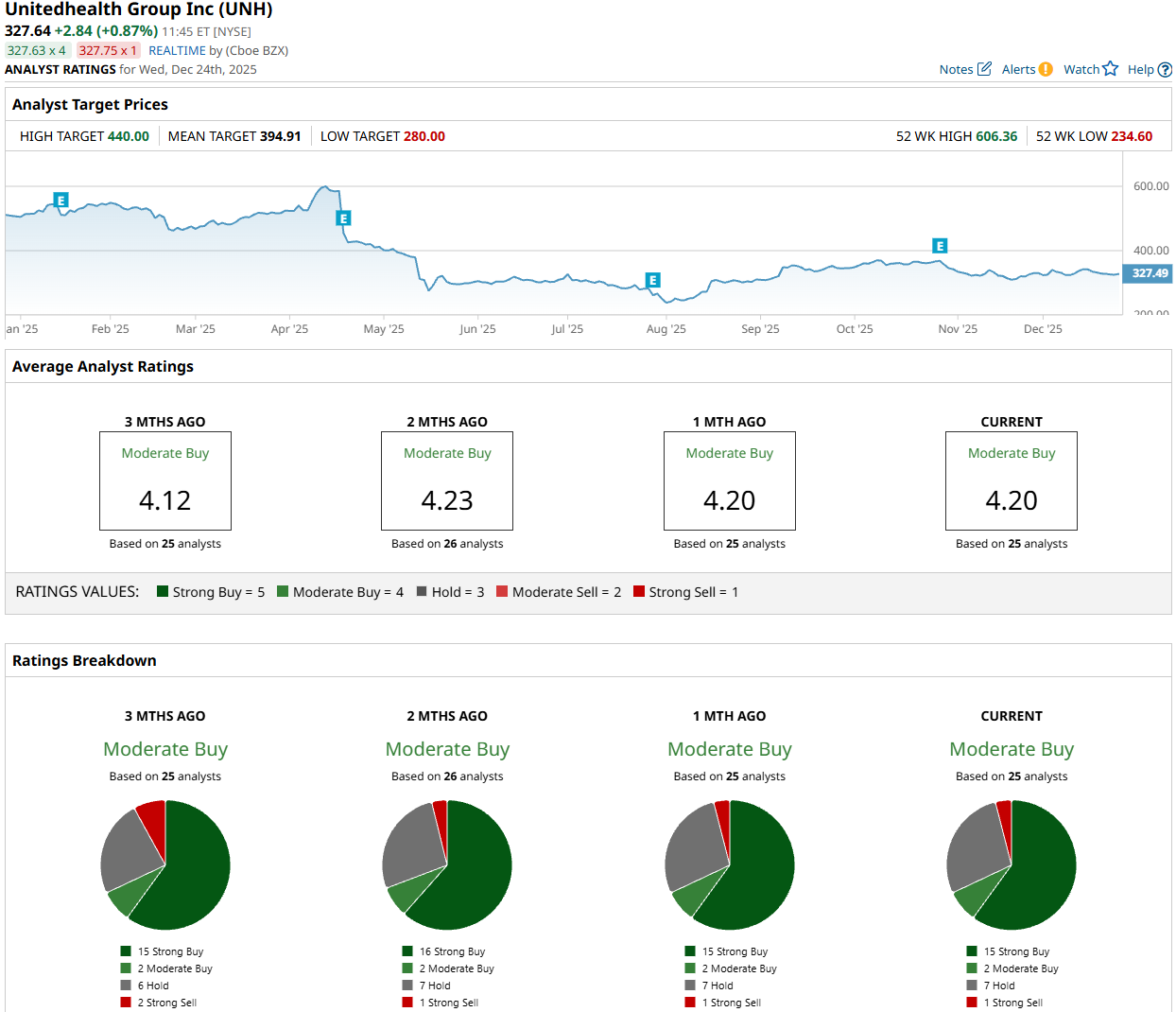

Despite UNH’s underperformance this year, most Wall Street analysts remain bullish, as reflected in the stock’s consensus “Moderate Buy” rating. Of the 25 analysts covering the stock, 15 rate it a “Strong Buy,” two assign a “Moderate Buy” rating, seven suggest holding, and one gives it a “Strong Sell” rating. The mean price target for UNH stock stands at $394.91, indicating an upside potential of 20.5% from current levels.

On the date of publication, Oleksandr Pylypenko had a position in: UNH . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- A Big China Catalyst Could Be Coming for AMD Stock in 2026. Should You Buy Shares Now?

- Trump Wants Health Insurers to ‘Ease Up and Start Cutting Prices.’ What Does That Mean for UNH Stock in 2026?

- Super Micro Computer Stock Tumbles, But Investors are Piling into Its Call Options - Time to Buy SMCI?

- Chipotle Just Launched a New Protein-Packed Menu. Should You Buy CMG Stock for 2026?