Applied Materials (AMAT) is a leading provider of materials engineering solutions critical for manufacturing advanced semiconductor chips, displays, and solar products worldwide. The company specializes in equipment for wafer fabrication processes like deposition, etching, rapid thermal processing, and inspection, enabling atomic-level precision for next-generation nodes. Its technologies optimize fab productivity and accelerate the commercialization of cutting-edge electronics.

Founded in 1967 and headquartered in Santa Clara, California, the company operates globally with manufacturing, R&D, and service facilities around the globe.

AMAT Stock Hit a New High

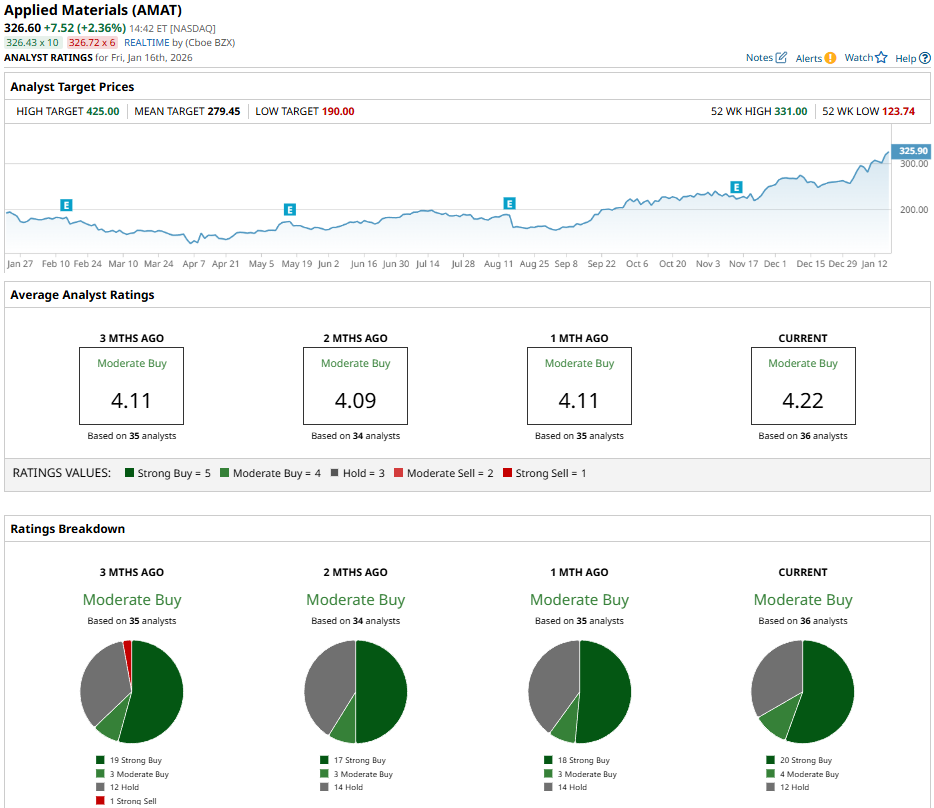

AMAT stock is up sharply amid semiconductor strength, hitting a 52-week high of $331 on Jan. 15 after a 167% rise from $124 lows in July 2025. AMAT has gained almost 9% in the last five days, 26% in one month, 68% over six months, and 75% over 52 weeks, trading above 50-day and 200-day moving averages (MAs).

The stock crushes the S&P 500's ($SPX) performance, with a 75% gain vs. the index's 52-week gain of 17%, fueled by AI chip demand. Meanwhile, the index also trails at lower single-digit monthly gains. A high beta further amplifies volatility, with Applied Materials' market capitalization of nearly $260 billion signaling robust fab equipment leadership.

Applied Materials' Q4 Results

Applied Materials reported fourth-quarter fiscal 2025 revenue of $6.8 billion, down 3% year-over-year (YOY) but surpassing analyst estimates of $6.68 billion. GAAP diluted EPS hit $2.38, up 14% YOY and exceeding expectations. Full-year revenue reached a record $28.37 billion, up 4% YOY, while GAAP EPS came to $8.66, up 1% YOY.

Non-GAAP gross margin stood at 48.1%, with operating margin down 70 basis points at 28.6%. Non-GAAP net income was $1.7 billion, down 10% YOY. The company's non-GAAP free cash flow was $2.04 billion quarterly (down 6% YOY) and $5.7 billion annually (down 24% YOY). Cash and equivalents totaled $7.3 billion.

Looking closer at the report, Semiconductor Systems revenue came in at $4.76 billion while Applied Global Services came in at $1.62 billion. China represented 29% of Applied Materials' revenue.

For Q1 fiscal 2026, Applied Materials guided for revenue of $6.85 billion, aligning with estimates of around $6.87 billion. The company also guided for non-GAAP EPS of $2.18. Executives are eyeing a second-half 2026 demand surge in AI logic, DRAM, and HBM.

Applied Materials Receives an Upgrade

Applied Materials recently received a rating upgrade to “Overweight” from Barclays. Analyst Tom O'Malley raised the price target to $360 from $250, signaling potential upside of 10% from the current market rate. The firm views China-related concerns — such as competition and exposure — as overblown, given AMAT stock's 2025 underperformance. AMAT saw a 58% gain in 2025 versus peers KLA (KLAC) (up 93%) and Lam Research (LRCX) (up 137%).

O'Malley highlighted rising foundry/logic and DRAM spending, positioning Applied Materials' exposure as a key advantage amid AI-driven demand. Shares closed Jan. 15 in the green by almost 6%, buoyed by Taiwan Semiconductor's (TSM) strong Q4 results and expanded 2026 capex plans, lifting the broader semiconductor equipment sector.

Should You Buy AMAT Stock?

As shares of Applied Materials trade near all-time highs, analysts give AMAT stock a “Moderate Buy” consensus rating and a mean price target of $289.94. That reflects downside potential of 11% as analysts play catch-up against the recent rally.

AMAT stock has been rated by 36 analysts as tracked by Barchart, receiving 20 “Strong Buy” ratings, four “Moderate Buy” ratings, and 12 “Hold” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- After Rigetti Announced a Quantum Computing Delay, How Should You Play RGTI Stock in January 2026?

- Wells Fargo Says You Should Buy the Dip in Broadcom Stock

- Taiwan Semi Crushed Q4 Earnings. That Makes This 1 AI Chip Stock a Top Buy.

- As Trump Hits AMD MI325X Chips with a 25% Tariff, How Should You Play AMD Stock?