The race to power the AI boom is quickly becoming one of the market’s most profitable stories as data centers scramble for dependable electricity. McKinsey now expects U.S. data‑center power use to jump from 147 terawatt‑hours in 2023 to 606 terawatt‑hours by 2030, with data centers consuming about 11.7% of total U.S. electricity. This surge is straining an already aging grid, making new connections slower and costlier, and pushing more capital toward fuel cells as an alternative.

Bloom Energy (BE) has landed squarely at the center of that narrative. Shares of BE stock jumped 50% in early January after American Electric Power (AEP) disclosed a landmark $2.65 billion agreement for Bloom’s solid‑oxide fuel cells. BE stock is up more than 500% for the past 52 weeks as a result. But is this deal a reason to buy the stock in January 2026? Or a sign that expectations have finally run too far ahead? Let’s take a closer look.

Bloom Energy’s Surging Financials

Based in San Jose, California, Bloom Energy is a clean‑energy company with a market capitalization of about $32 billion. The company designs and sells solid‑oxide fuel cell systems for on‑site power. Shares of BE stock closed at nearly $140 on Jan. 13, reflecting a 61% gain year-to-date (YTD) and a 507% rise over the past 52 weeks.

BE stock now trades at a forward price-to-earnings (P/E) ratio of 282.2 times and a price‑to‑sales ratio of 17.4 times, far above sector medians. This highlights how much the market is willing to pay for Bloom’s growth prospects.

Bloom Energy's latest quarter, reported on Oct. 28, showed an adjusted EPS loss of $0.01 versus an expected $0.03 loss, a 67% positive surprise. This modest beat indicates improving execution as Bloom scales into larger data center‑driven projects.

The quarter showed sales of about $519.05 million, representing year‑over‑year (YOY) revenue growth of 57%, while net income remained negative at roughly -$23.09 million, although that figure improved 46% from the prior quarter. This indicates that Bloom is still spending heavily to support growth, yet losses are narrowing as volume increases and the model gains operating leverage.

Operating cash flow for the same quarter stood at approximately -$304.12 million, with a 6% sequential improvement. Net cash flow was around -$323.96 million, also improving by 6% sequentially. While Bloom is not cash‑flow positive yet, the direction of travel is constructive.

Bloom Energy’s Growth Pipeline Is Filling Fast

Bloom Energy’s $2.65 billion agreement with American Electric Power is the latest sign that large customers are willing to commit serious capital to its fuel-cell platform. The deal covers a long‑term supply of solid oxide fuel cell products for a major power project, supporting a planned 900 megawatt facility in Wyoming that is backed by a 20‑year offtake agreement with a high‑grade customer.

Bloom also has a separate $5 billion agreement in place with Brookfield Asset Management (BAM), which will use fuel cells to power a planned network of “AI factories." Under this partnership, Brookfield expects to invest up to $5 billion to deploy Bloom’s systems across multiple sites, including a planned European location.

On top of these commercial wins, the company recently secured a new $600 million credit facility with Wells Fargo (WFC), a move aimed squarely at giving management more room to execute. The agreement provides additional financial flexibility for funding research, product innovation, and potential acquisitions, while also supporting the build‑out required to deliver on large fuel cell commitments.

Analysts See Earnings Building

Wall Street’s view on Bloom now hinges on the Feb. 26 earnings release, with Q4 EPS expected at $0.15 versus $0.33 last year, a 55% YOY decline. However, the following quarter (March 2026) carries an average EPS estimate of -$0.10 versus -$0.11 in the prior year, reflecting a modest improvement of 9% as seasonal patterns and execution efficiencies kick in.

For fiscal year 2025, the Street is looking for EPS of $0.06 compared with a loss of $0.08 in the previous year, which translates into an estimated 175% YOY improvement. The step‑change in expectations further shows up in fiscal 2026, with an EPS estimate of $0.47 compared to $0.06 in the prior year. That implies a massive 683% growth rate and suggests analysts see the combination of existing backlog.

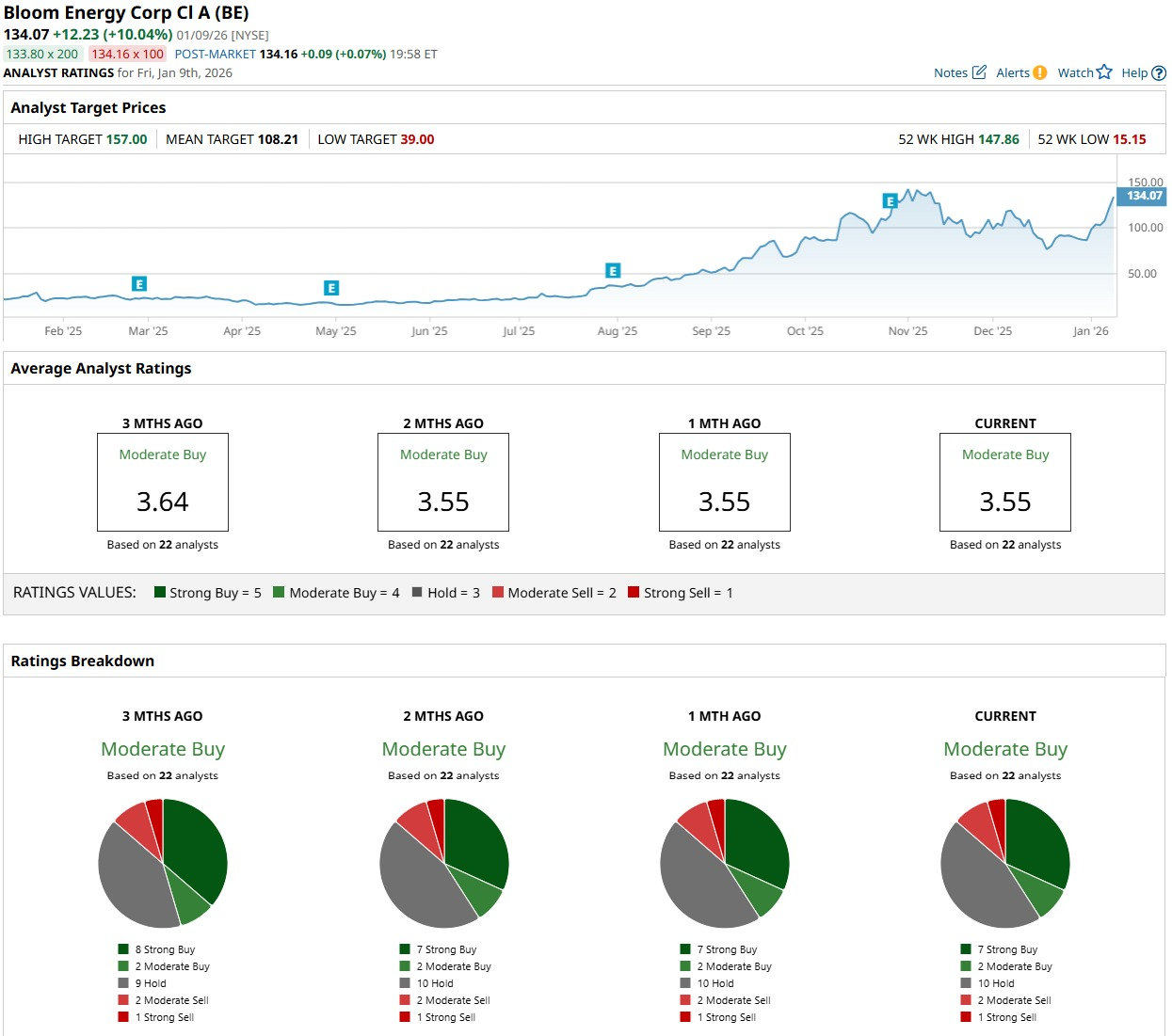

Sentiment around BE stock reflects that bigger picture. The 22 analysts covering Bloom Energy collectively land on a consensus rating of “Moderate Buy,” signaling a generally constructive stance. The average price target sits at $106.20, which actually represents 24% potential downside from the current price. That's a reminder that BE stock has already run hard.

The Bottom Line

Bloom Energy now has what many growth stories lack, with big signed deals, a clearer path to earnings, and enough liquidity to chase more opportunities. Between the $2.65 billion contract, the $5 billion Brookfield framework, and the $600 million credit facility, the setup leans more positively than not, even though the valuation already bakes in a lot of future success. Overall, the odds still look skewed toward BE stock working higher over time rather than collapsing — so long as management keeps turning these headline contracts into sustained revenue and real cash flow.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- A $2.65 Billion Reason to Buy Bloom Energy Stock in January 2026

- Meta Platforms Just Gave Oklo a Nuclear Boost. Should You Buy OKLO Stock Here?

- Should You Buy VST Stock in January 2026 as Vistra Strikes a Major Nuclear Deal with Meta Platforms?

- 6 Strategic Stocks to Watch as Trump Tries to Buy Greenland