MP Materials (MP) is a rare earth materials and magnetics company that owns and operates the Mountain Pass mine in California, the only large-scale rare earth mining and processing site in the Western Hemisphere. The company produces neodymium-praseodymium (NdPr) and other rare earth products used in high‑performance magnets for electric vehicles, wind turbines, robotics, defense systems, and advanced electronics. Additionally, it builds downstream capacity to manufacture metals, alloys, and magnets at its Independence facility in Fort Worth, Texas.

Founded in 2017, MP Materials is headquartered in Las Vegas, Nevada.

About MP Stock

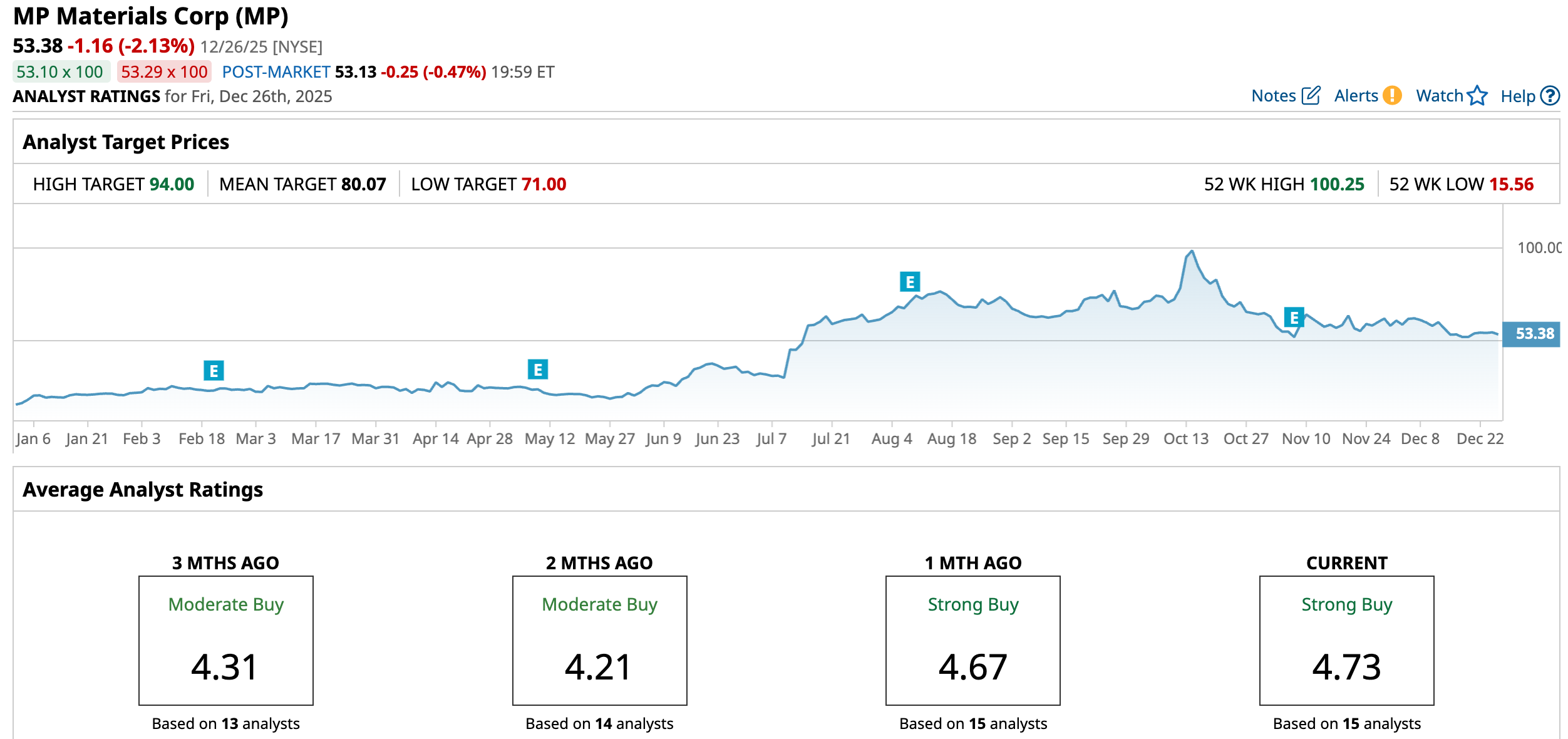

MP Materials trades roughly midway in its 52-week range after a massive 250% gain over the past year, driven by rare earth demand and policy tailwinds. The stock is up 2.57% over the past five days, but is down 11.26% over the past month, amid profit-taking, while it has moved up 48.32% over the past six months.

MP has dramatically outperformed the Russell 1000 Index (IWB), which returned about 14.4% over the last year, thanks to extreme momentum despite negative profitability metrics like -48% net margins. This past July, a high RSI hit near 80, signaling overbought conditions in the short term, with elevated volatility compared to the broad large-cap index.

MP Materials Results

MP Materials reported Q3 2025 results on Nov. 6 with a revenue of $53.6 million, down 15% year-over-year (YOY) due to ceasing China concentrate sales, but slightly ahead of analyst estimates of $54.46 million. Adjusted diluted EPS was -$0.10, beating consensus expectations of -$0.17 by 41%, though the GAAP net loss widened to $41.8 million from $25.5 million a year ago.

REO production hit 13,254 metric tons (second-best quarterly), with record NdPr oxide output of 721 metric tons, up 21% sequentially and 51% YOY. Materials segment revenue fell to $31.6 million (Adj. EBITDA -$14.5 million), while Magnetics rose to $21.9 million (Adj. EBITDA +$9.5 million). Consolidated adjusted EBITDA was -$12.6 million while cash reserves stood strong post-capital raises, supporting capex, though free cash flow remained negative amid expansion.

Management expects return to profitability in Q4 2025 and beyond, driven by Department of Defense (DOD) Price Protection Agreement (started Oct. 1) and magnet production ramp with 2025 capex guided to the low end of the $150–175 million range, targeting mid-2026 heavy rare earth separation.

A Chance for MP Materials

China’s near-monopoly on rare earths, with 60% of global mining and over 90% of magnet production, has intensified Western efforts to build independent “mine-to-magnet” supply chains amid export restrictions and tariffs, creating tailwinds for U.S. leaders like MP Materials. These magnets power critical technologies, including EVs, wind turbines, defense systems, robotics, AI hardware, and precision weaponry, with demand exploding as electrification and advanced manufacturing scale globally.

MP Materials, being the West’s only scaled rare earth site, is ideally positioned to take the chance. Its record Q3 2025 NdPr oxide demonstrates execution on upstream strength, while its Texas magnetics facility ramps toward full downstream integration. For 2026, MP benefits from the DOD PPA (effective Q4 2025), expected profitability return, and U.S. policy support projecting 6x magnet capacity growth by 2036.

Geopolitical tensions accelerate customer shifts from China, boosting MP’s revenue visibility, margins, and market share as Western OEMs prioritize supply security. Capex at the low end of $150–$175M supports mid-2026 heavy rare earth separation, cementing MP’s role in America’s critical minerals independence.

Should You Buy MP for 2026?

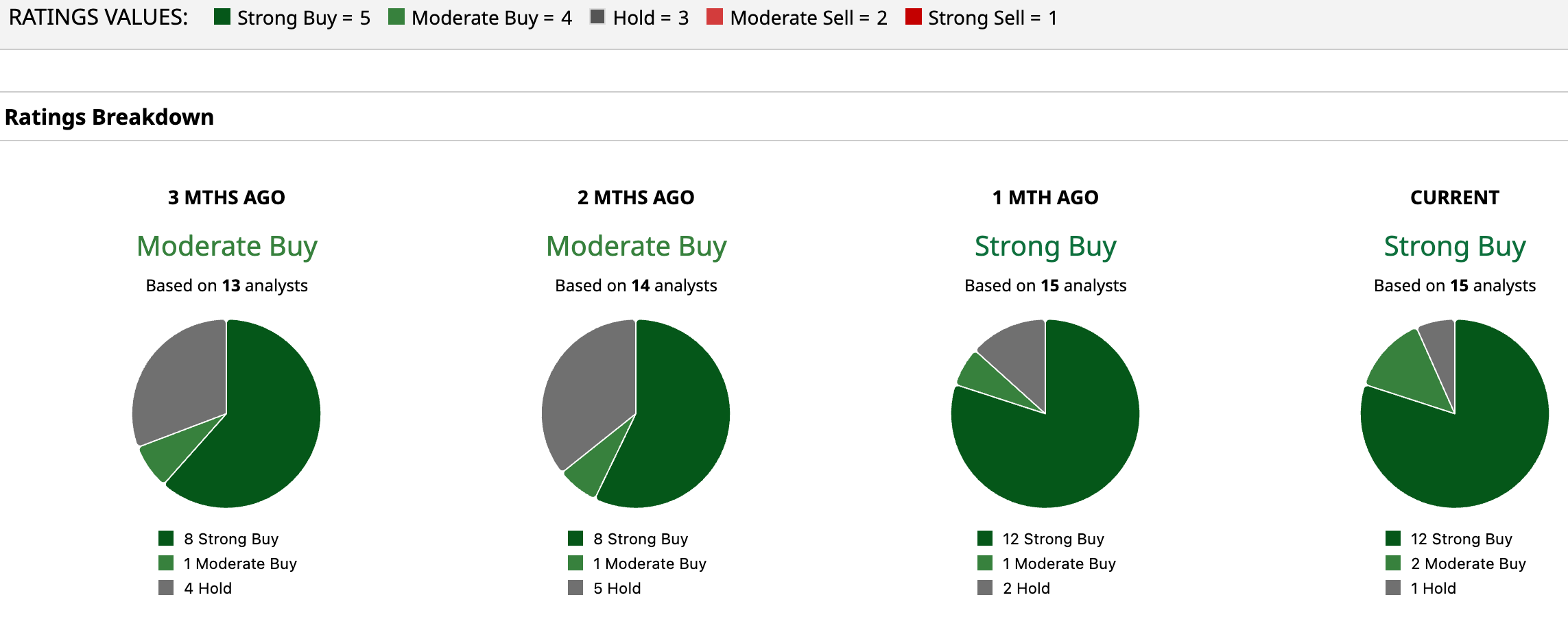

MP Materials has witnessed a growth in support from Wall Street experts as the stock has been upgraded from a consensus “Moderate Buy” rating two months ago to a “Strong Buy” rating currently, with a mean price target of $80.07, reflecting an upside potential of 50% from the market rate. MP Materials has been rated by 15 analysts, receiving 12 “Strong Buy” ratings, two “Moderate Buy” ratings, and one “Hold” rating.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- MP Materials Gained 230% in 2025. Should You Buy, Sell, or Hold MP Stock for 2026?

- Costco Has Tumbled Despite Higher FCF and FCF Margins - Time to Buy COST Stock?

- Nvidia Stock Had a Volatile 2025: What’s the 2026 Forecast?

- As Tesla Faces a New Investigation Over Door Safety, How Should You Play TSLA Stock Heading into 2026?