As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the industrial packaging industry, including Crown Holdings (NYSE: CCK) and its peers.

Industrial packaging companies have built competitive advantages from economies of scale that lead to advantaged purchasing and capital investments that are difficult and expensive to replicate. Recently, eco-friendly packaging and conservation are driving customers preferences and innovation. For example, plastic is not as desirable a material as it once was. Despite being integral to consumer goods ranging from beer to toothpaste to laundry detergent, these companies are still at the whim of the macro, especially consumer health and consumer willingness to spend.

The 8 industrial packaging stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 0.8%.

In light of this news, share prices of the companies have held steady as they are up 3.5% on average since the latest earnings results.

Best Q3: Crown Holdings (NYSE: CCK)

Formerly Crown Cork & Seal, Crown Holdings (NYSE: CCK) produces packaging products for consumer marketing companies, including food, beverage, household, and industrial products.

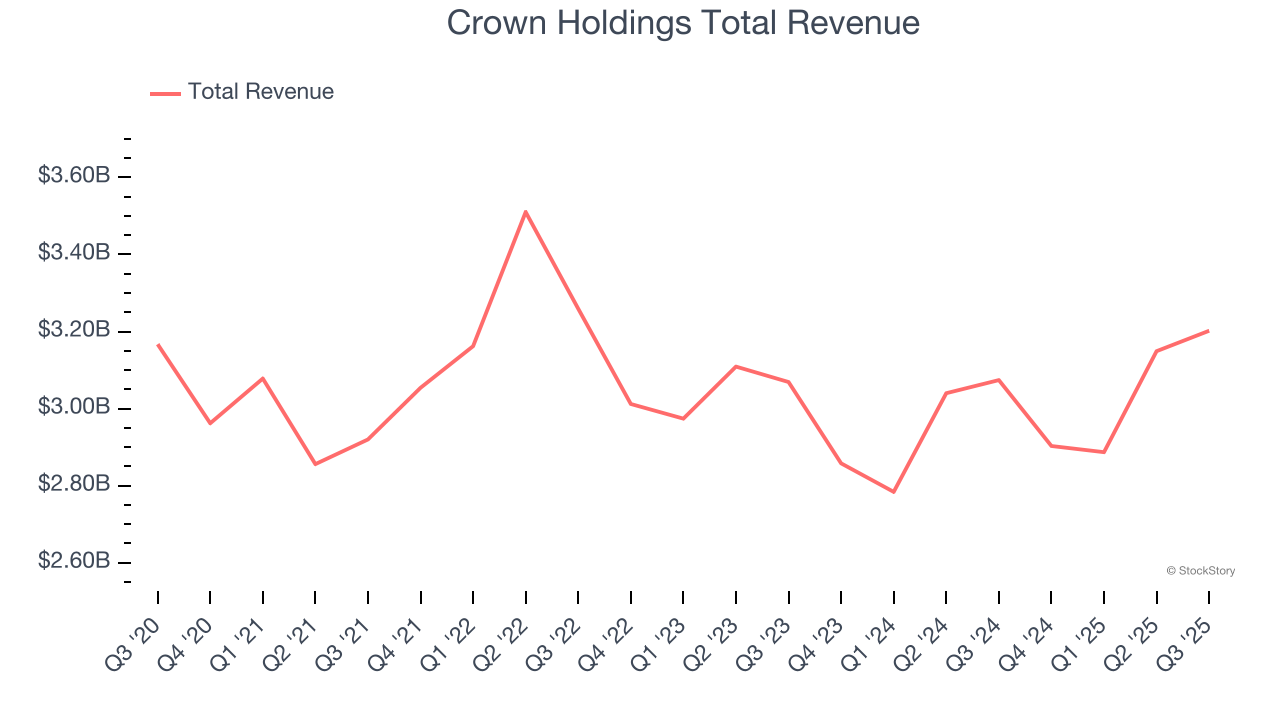

Crown Holdings reported revenues of $3.20 billion, up 4.2% year on year. This print exceeded analysts’ expectations by 1.5%. Overall, it was an exceptional quarter for the company with EPS guidance for next quarter exceeding analysts’ expectations and full-year EPS guidance exceeding analysts’ expectations.

Commenting on the quarter, Timothy J. Donahue, Chairman, President and Chief Executive Officer, stated, "The Company continued its robust 2025 performance during the third quarter, with adjusted diluted earnings per share increasing 13% and segment income 4% above a very strong prior year quarter. Driving the results was 12% volume growth in European Beverage, leading to a gain of 27% in European segment income. Global beverage can volumes were mixed during the quarter with softness in Asia and Latin America offsetting double-digit advances in Europe and the Middle East.

Interestingly, the stock is up 8.2% since reporting and currently trades at $103.08.

Is now the time to buy Crown Holdings? Access our full analysis of the earnings results here, it’s free for active Edge members.

Sealed Air (NYSE: SEE)

Founded in 1960, Sealed Air Corporation (NYSE: SEE) specializes in the development and production of protective and food packaging solutions, serving a variety of industries.

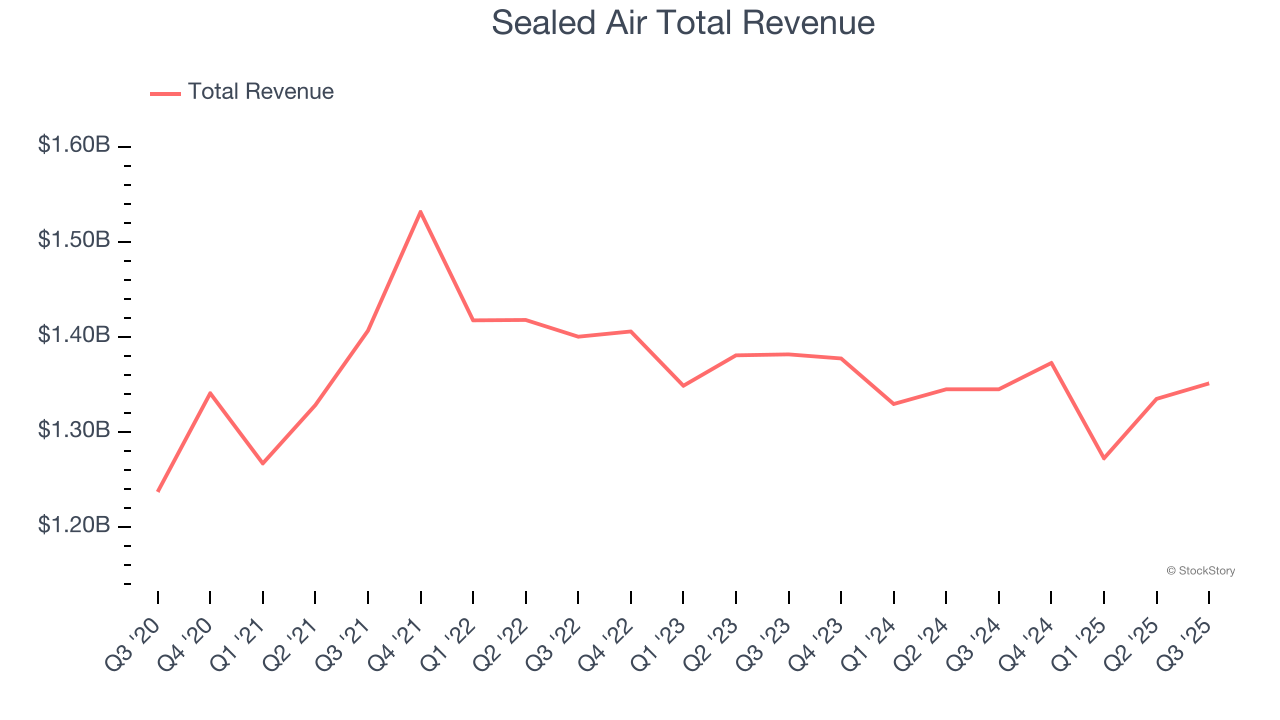

Sealed Air reported revenues of $1.35 billion, flat year on year, outperforming analysts’ expectations by 2.7%. The business had an exceptional quarter with a solid beat of analysts’ sales volume and adjusted operating income estimates.

Sealed Air pulled off the highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 21.4% since reporting. It currently trades at $41.24.

Is now the time to buy Sealed Air? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: International Paper (NYSE: IP)

Established in 1898, International Paper (NYSE: IP) produces containerboard, pulp, paper, and materials used in packaging and printing applications.

International Paper reported revenues of $6.22 billion, up 32.8% year on year, falling short of analysts’ expectations by 3.6%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue and adjusted operating income estimates.

International Paper delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. As expected, the stock is down 10.1% since the results and currently trades at $39.78.

Read our full analysis of International Paper’s results here.

Silgan Holdings (NYSE: SLGN)

Established in 1987, Silgan Holdings (NYSE: SLGN) is a supplier of rigid packaging for consumer goods products, specializing in metal containers, closures, and plastic packaging.

Silgan Holdings reported revenues of $2.01 billion, up 15.1% year on year. This number surpassed analysts’ expectations by 3.8%. It was a strong quarter as it also put up a solid beat of analysts’ organic revenue estimates and an impressive beat of analysts’ revenue estimates.

Silgan Holdings scored the biggest analyst estimates beat among its peers. The stock is down 9% since reporting and currently trades at $40.73.

Read our full, actionable report on Silgan Holdings here, it’s free for active Edge members.

Ball (NYSE: BALL)

Started with a $200 loan in 1880, Ball (NYSE: BLL) manufactures aluminum packaging for beverages, personal care, and household products as well as aerospace systems and other technologies.

Ball reported revenues of $3.38 billion, up 9.6% year on year. This result beat analysts’ expectations by 1.3%. Overall, it was a strong quarter as it also recorded a narrow beat of analysts’ organic revenue estimates and a narrow beat of analysts’ revenue estimates.

The stock is up 10.8% since reporting and currently trades at $52.22.

Read our full, actionable report on Ball here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.