While the AI-driven rally in technology stocks has created immense wealth, there is an underlying concern about valuations. As Microsoft (MSFT) reported Q2 earnings, the stock fell by almost 12% on concerns related to high capital expenditures and Azure’s revenue growth being just above expectations. This triggered a broader selloff in the technology sector, with quantum computing stocks being among the victims.

However, for investors focused on long-term fundamentals, the correction seems like a good buying opportunity. To put things into perspective, McKinsey believes that the quantum computing market is expected to grow from $4 billion in 2024 to $72 billion by 2035. Further, if quantum computing, quantum communication, and quantum sensing are included, the market is likely to swell to $97 billion by 2035.

Clearly, it’s just early days for quantum computing, and some of the top stocks are positioned for significant value creation. D-Wave Quantum (QBTS) and Rigetti Computing (RGTI) are the two top-rated stocks to buy on corrections.

Quantum Computing Stock #1: D-Wave Quantum (QBTS)

Headquartered in Palo Alto, D-Wave is a developer of quantum computing systems, software, and services. The company claims to be the first commercial supplier of quantum computers. Further, it’s the only company offering dual-platform quantum computing that includes both annealing and gate-model quantum computing technologies.

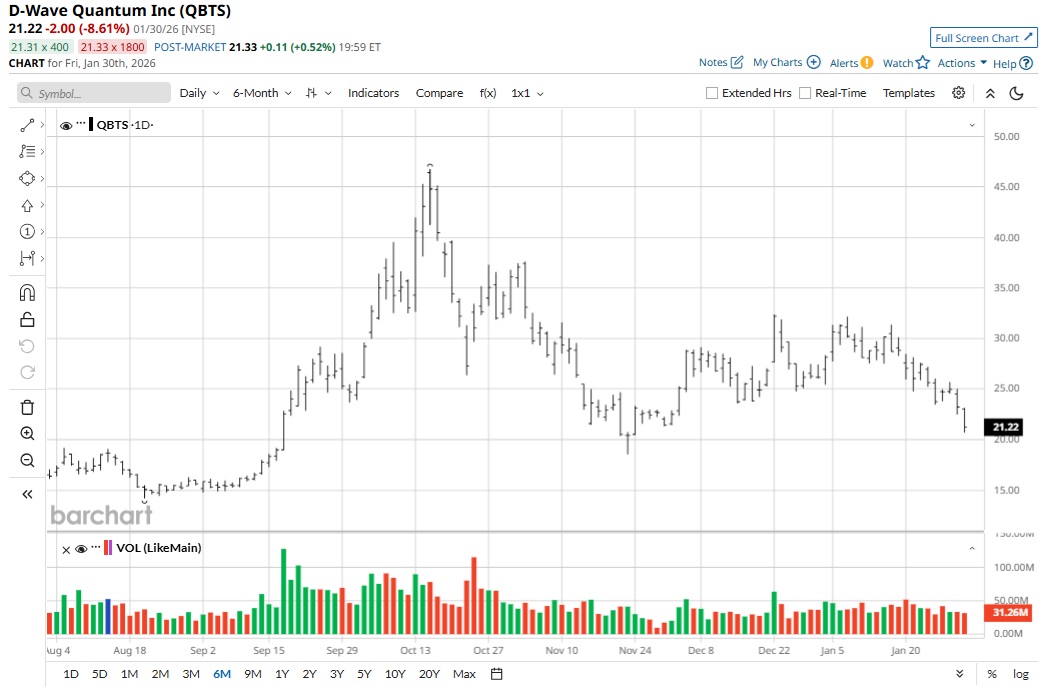

Even after the recent correction, QBTS stock has witnessed a strong upside of 245% in the last 52 weeks. This rally has been supported by the growth potential considering the significant addressable market.

From a valuation perspective, QBTS stock trades at a price-to-sales ratio of 255.9. Further, a price-to-book value of 11.98 seems stretched. However, with the company at an inflection point of growth, the metrics are likely to change meaningfully in the next few years.

For Q3 2025, D-Wave reported revenue of $3.7 million, which was higher by 100% on a year-over-year (YoY) basis. With bookings accelerating, it’s likely that top-line growth will remain robust. While adjusted EBITDA loss was $20.6 million, cash burn is unlikely to be a concern in the early stages of growth. As of Q3, a cash buffer of $836 million provides ample headroom for investment in growth, innovation, and potential acquisitions.

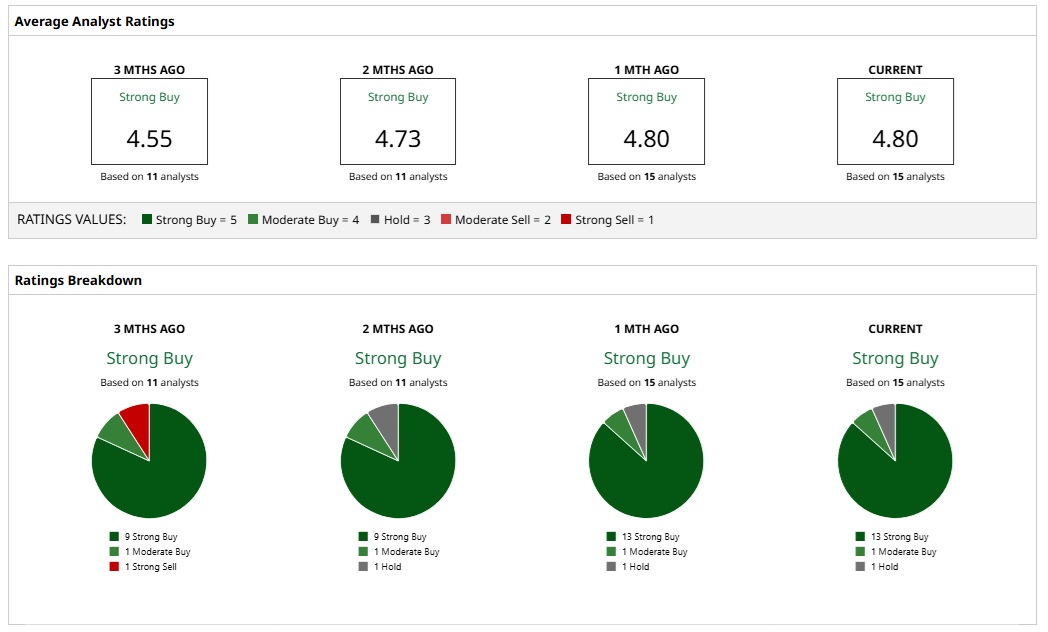

Therefore, even with the recent correction, QBTS stock has a “Strong Buy” rating based on the consensus estimate of 15 analysts. Further, a mean price target of $40.36 implies an upside potential of 90%.

Quantum Computing Stock #2: Rigetti Computing (RGTI)

Headquartered in Berkeley, Rigetti builds quantum computers and superconducting quantum processors. Currently, the company’s quantum computing systems have achieved gate speeds of 50-70 ns. This is around 1,000 times faster than other modalities such as ion traps and neutral atoms. Rigetti is high on innovation with a robust IP portfolio of 281 issued and pending patents across quantum engineering, fabrication, and algorithms.

RGTI stock has trended higher by almost 34% in the last 52 weeks. However, there has been a sharp correction from all-time highs, and it seems like a good opportunity to accumulate.

From a valuation perspective, RGTI stock trades at a price-to-sales ratio of 688. Further, a price-to-book value of 17.37 seems stretched. However, these metrics are not the best indicator of the valuation of an early-stage company with a big addressable market and an innovation edge.

For Q3 2025, Rigetti reported revenue of $1.9 million. Operating loss for the period was $20.5 million. However, a cash buffer of $600 million ensures flexibility for aggressive investments in innovation. The cash burn is unlikely to be a concern if the top-line growth accelerates. From a technology roadmap perspective, the company expects to deploy a 150+ qubit system by the end of 2026. Further, a 1,000+ qubit system is expected to be deployed by the end of 2027.

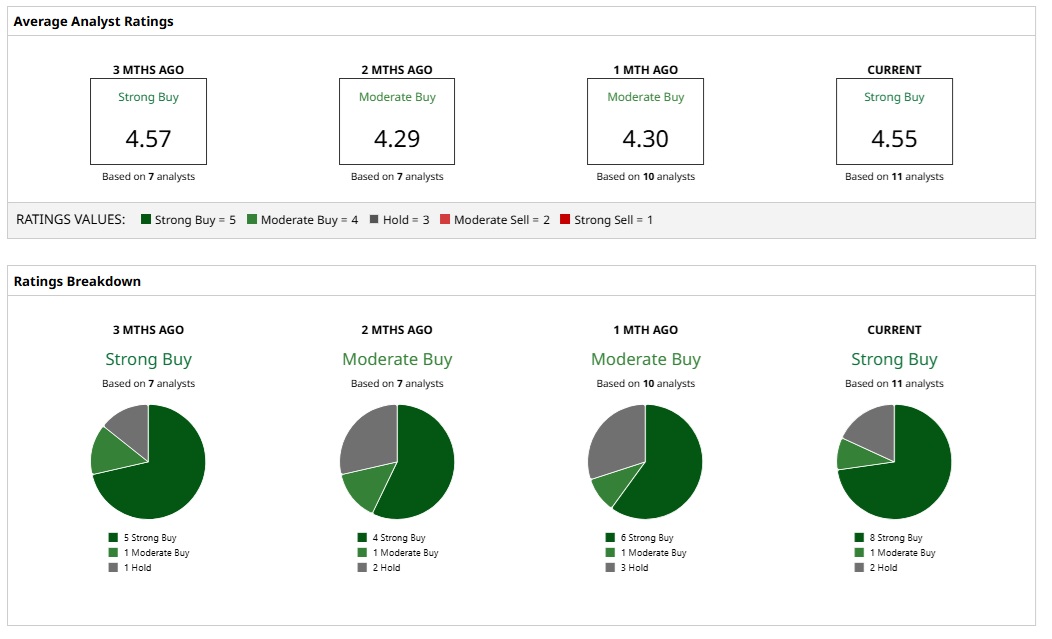

Therefore, with a positive outlook for the next 24 months, RGTI stock has a “Strong Buy” rating based on the consensus estimate of 11 analysts. Further, a mean price target of $40.30 implies an upside potential of 129%.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart