Valued at a market cap of $150.1 billion, Lockheed Martin Corporation (LMT) is an aerospace and defense company based in Bethesda, Maryland. It designs and manufactures advanced technology systems, including fighter jets, missiles and air defense systems, military helicopters, satellites, and space exploration technologies.

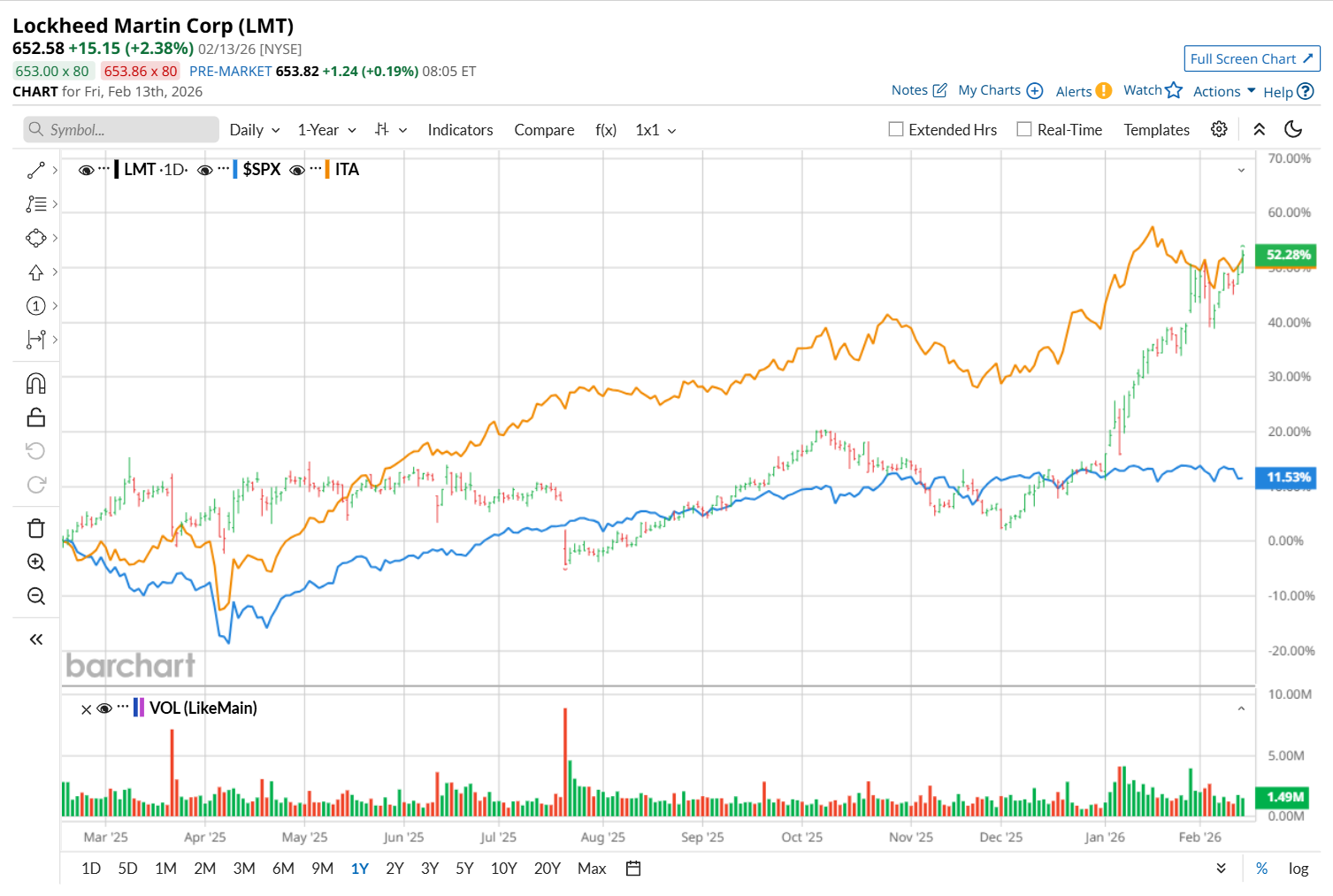

This aerospace and defense company has notably outpaced the broader market over the past 52 weeks. Shares of LMT have surged 50.1% over this time frame, while the broader S&P 500 Index ($SPX) has gained 11.8%. Moreover, on a YTD basis, the stock is up 34.9%, compared to SPX’s marginal drop.

Narrowing the focus, LMT has lagged behind the iShares U.S. Aerospace & Defense ETF’s (ITA) 51.5% uptick over the past 52 weeks. Nonetheless, it has outperformed ITA’s 9.4% YTD rise.

On Jan. 29, shares of LMT soared 4.2% after delivering stronger-than-expected Q4 results. The company’s total sales improved 9.1% year-over-year to $20.3 billion, surpassing consensus estimates by 2.5%. Meanwhile, its net income per share increased by a staggering 161.3% from the year-ago quarter, reaching $5.80.

For fiscal 2026, ending in December, analysts expect LMT’s EPS to grow 4.5% year over year to $29.81. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

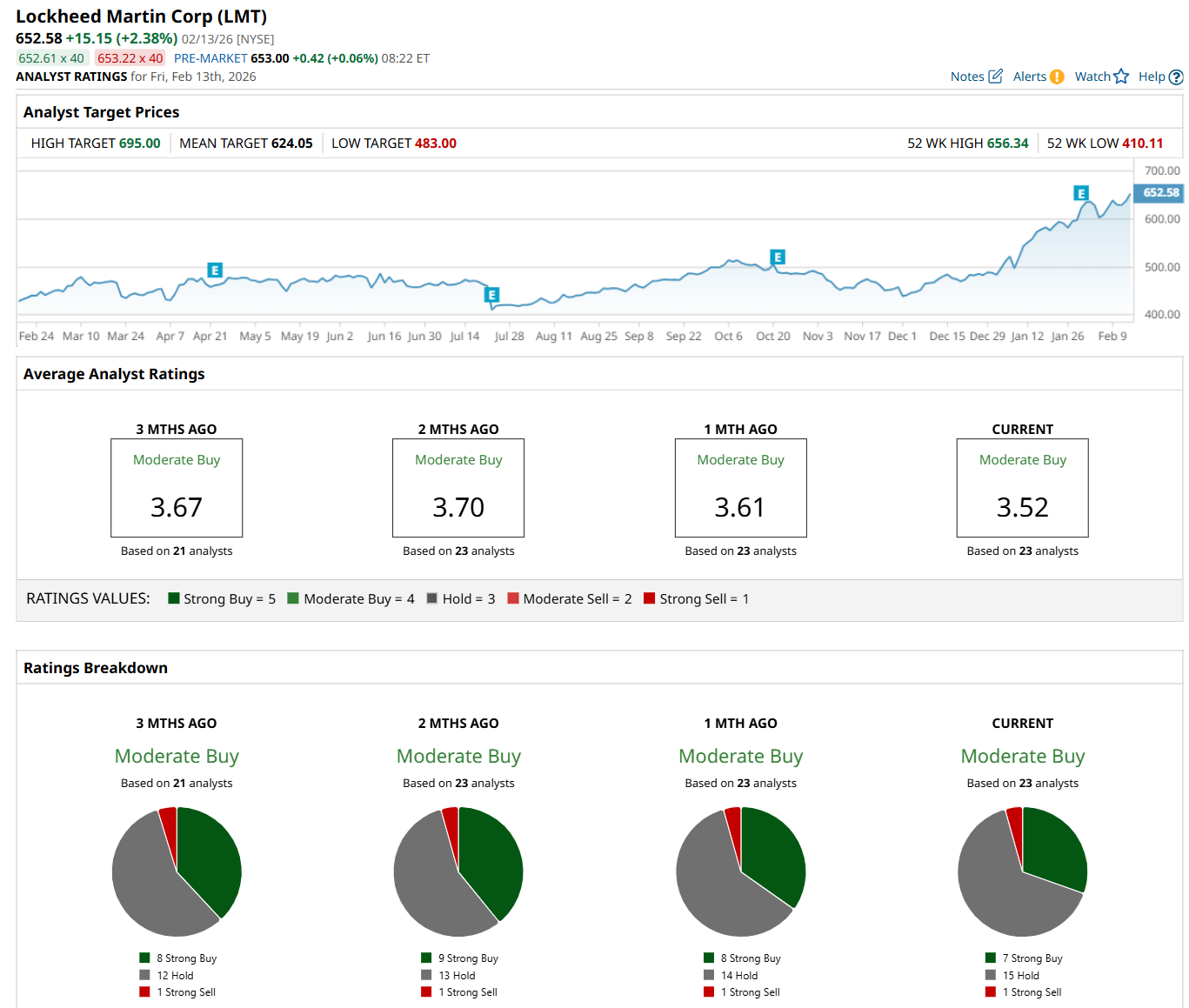

Among the 23 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on seven “Strong Buy,” 15 “Hold,” and one "Strong Sell” rating.

The configuration is slightly less bullish than a month ago, with eight analysts suggesting a “Strong Buy” rating.

On Feb. 5, BofA maintained a "Neutral" rating on LMT and raised its price target to $660, indicating a 1.1% potential upside from the current levels.

While the company is trading above its mean price target of $624.05, its Street-high price target of $695 suggests a 6.5% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart