Software has been a crucial component of the modern economy, powering enterprises, automating decisions, and anchoring predictable, subscription-led revenues. For years, the sector earned a premium for its durability. That confidence has now cracked.

In early 2026, software stocks slid deeper into a sharp sell-off as markets began to question whether artificial intelligence (AI) strengthens incumbents or threatens to hollow them out. Valuations built on steady renewal cycles suddenly look fragile as fears grow that AI-native tools could compress pricing, disrupt workflows, and reset long-term growth assumptions.

That shift in sentiment has been clearly evident in the charts. The iShares Expanded Tech-Software Sector ETF (IGV) has slipped firmly into bear-market territory, marking one of its steepest drawdowns since the global financial crisis and signaling just how fast sentiment has turned.

California-based software maker ServiceNow (NOW) sits squarely in that crosscurrent. The enterprise workflow leader helps large organizations run digital operations at scale, yet its stock has slipped alongside the sector after its Q4 report. Analysts, like Morgan Stanley (MS) summed up the quarterly results as “good, but not good enough” – earnings and guidance came in slightly above estimates, yet failed to change the AI narrative. CEO Bill McDermott pushed back, arguing AI needs workflow platforms like ServiceNow to deliver reliable outcomes. Despite that defense, the stock has slid.

With NOW stock down nearly 24% just a month into 2026, is this fear-driven sell-off a buying opportunity for investors, or a sign of deeper trouble ahead?

About ServiceNow Stock

Founded in 2004, ServiceNow has evolved into a central force in enterprise digital transformation. Through its Now Platform, the company delivers end-to-end workflow automation, using AI and machine learning to modernize IT services, operations, risk, and customer engagement. Its tools help organizations replace fragmented processes with a single system of action across industries such as finance, healthcare, and technology.

With a market cap of about $121.5 billion and a broad global footprint, ServiceNow operates at true enterprise scale. The platform integrates with major cloud providers, large language models, and enterprise data, positioning the company as a “control tower” for modern businesses. A flexible pricing mix of subscription and consumption models, including the Pro Plus tier, supports growth while reinforcing its long-term relevance.

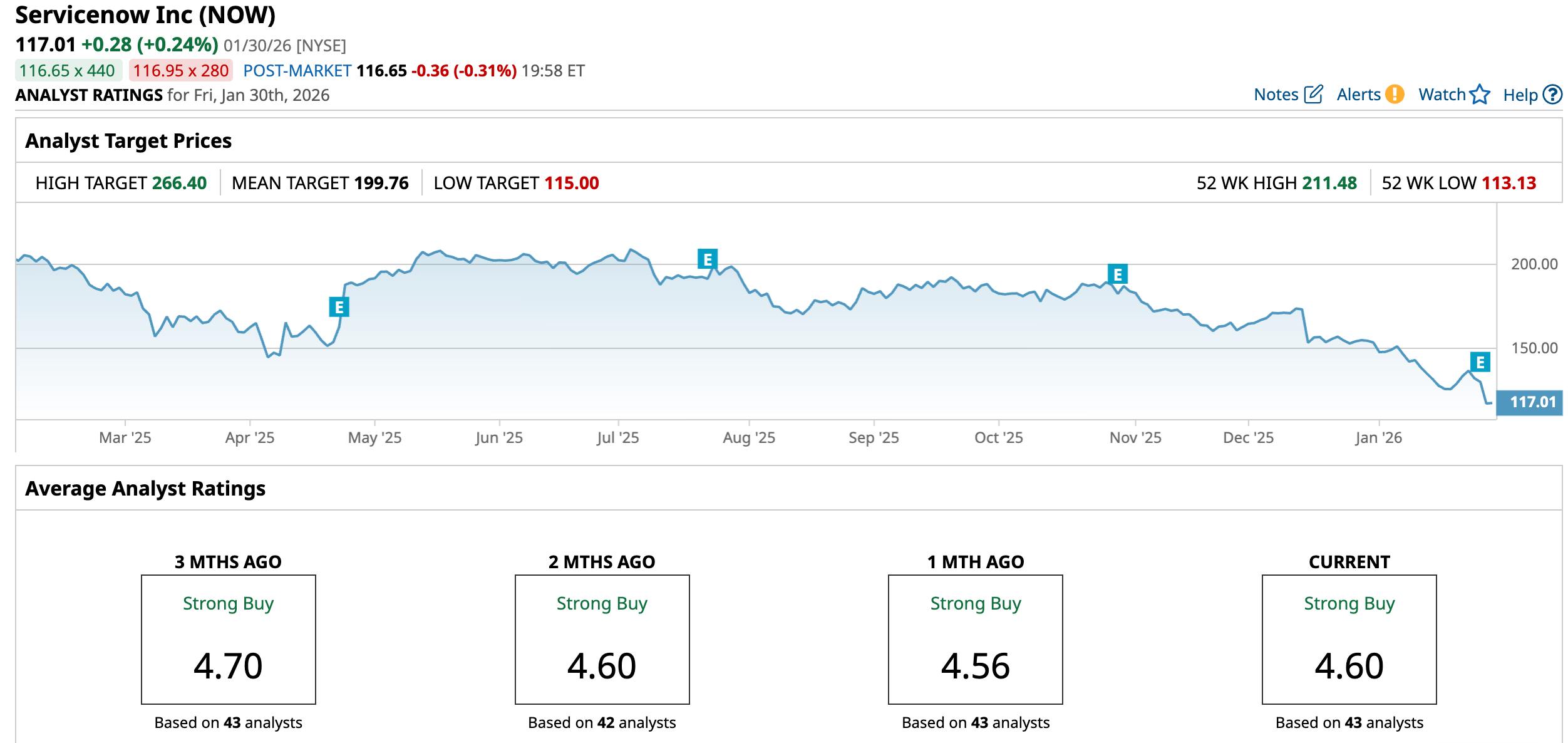

ServiceNow’s shares have been on a long, impressive climb. Over the past decade, shares have surged roughly 840%, reflecting the company’s rise as a cornerstone of enterprise workflow automation. That long-term story, however, has hit turbulence. The past year has been marked by a sharp reset, with NOW down about 42% over the last 52 weeks and more than 40% over the past six months alone, even as the business itself continues to execute well.

The pressure intensified on Jan. 29, when the stock slid nearly 10% following its fourth-quarter earnings release. Results beat expectations, yet concerns that AI could ultimately weigh on traditional software economics kept sentiment cautious.

Technically, momentum has cooled. Trading volumes have eased, and the 14-day RSI has fallen to around 25.34, down from overbought levels seen in May, though it has rebounded from January’s deeper oversold zone. The stock now sits at a crossroads, balancing long-term strength against near-term skepticism.

Meanwhile, the MACD line has slipped below the signal line, signaling fading bullish momentum in the near term. The MACD oscillator reflects weakening upside strength, while the histogram has remained negative since late December, hinting at sustained bearish pressure and limited upside confidence.

The software giant’s stock trades at about 33.34 times forward adjusted earnings and 9.14 times sales, undeniably priced at a premium compared with the broader tech sector. That premium reflects years of consistent growth, strong margins, and its status as a core enterprise workflow platform in the AI era. Yet those multiples sit below the company’s own historical median, suggesting the stock, while expensive, may not be as stretched as headlines imply.

A Snapshot of ServiceNow’s Q4 Results

ServiceNow’s fourth-quarter earnings offered a reminder of why the company has long been viewed as a benchmark in enterprise software. Reported on Jan. 28, the results comfortably topped Wall Street expectations, showed accelerating new business momentum, and set a confident tone for 2026. Revenue rose 20.5% year-over-year (YOY) to $3.56 billion, while non-GAAP EPS climbed 26% annually to $0.92, reflecting both scale and operating discipline.

At the core of that performance was subscription revenue, which grew 21% annually to $3.47 billion. This recurring engine continues to anchor ServiceNow’s model, supported by deep enterprise relationships across industries. Professional services and other revenue added to the picture, increasing 12.1% YOY to $102 million, reinforcing the breadth of the platform’s adoption.

Demand indicators were equally strong. Current remaining performance obligations (cRPO) reached $12.85 billion, up 25% from a year earlier. The company closed 244 deals with more than $1 million in net new annual contract value (ACV) in Q4, nearly 40% growth annually. ServiceNow also finished the period with 603 customers generating over $5 million in ACV, marking roughly 20% annual growth and highlighting its growing footprint among large enterprises.

AI-led offerings played a central role. Products such as Now Assist, Workflow Data Fabric, Raptor, and CPQ gained traction across major deals. RaptorDB Pro more than tripled net new ACV (NNACV) YOY, including 13 deals above $1 million. Workflow Data Fabric featured in 16 of the company’s top 20 Q4 deals, with attach rates rising throughout 2025. The scale of activity expanded meaningfully, as workflows and transactions each grew more than 33% YOY.

Financially, ServiceNow exited the quarter in a strong position. Cash and marketable securities totaled $6.28 billion, while free cash flow surged to $2.03 billion, lifting FCF margins to 57%. Share repurchases accelerated, supported by a new $5 billion authorization.

Looking ahead, management struck an optimistic note. Subscription revenue is projected to land between $15.53 billion and $15.57 billion, implying annual growth of roughly 20.5% to 21% from 2025 levels. Profitability is also set to remain strong, with non-GAAP subscription gross margins projected at 82% and operating margins at 32%. Cash generation continues to improve as well, with FCF margins expected to reach 36%, expanding by 100 basis points YOY. For Q1, subscription revenue is anticipated to be in the range of $3.65 billion to $3.655 billion, representing approximately 21.5% annual growth.

Analysts tracking ServiceNow anticipate its fiscal 2026 EPS to be around $2.39, representing 21.9% YOY growth, and then surge by another 28.87% to $3.08 in fiscal 2027.

What Do Analysts Expect for ServiceNow Stock?

Wall Street’s reaction to ServiceNow’s Q4 report was measured rather than exuberant. Several brokerage firms moved quickly to adjust their views, reflecting cautious confidence around the stock. Citizens analyst Patrick Walravens reiterated a “Market Outperform” rating with a $260 price target, pointing out that while guidance came in ahead of expectations, it stopped short of signaling a clear acceleration in growth.

Meanwhile, Stifel, for instance, took a more tempered stance, trimming its price target to $180 from $200 while maintaining a “Buy” rating. Analyst Brad Reback said the quarter largely unfolded as expected, with roughly 100 basis points of organic upside, though fourth-quarter checks were mixed. While Stifel sees NOW as an “interesting value” at current multiples, it noted that a broader shift in investor sentiment would be needed to drive a meaningful rerating.

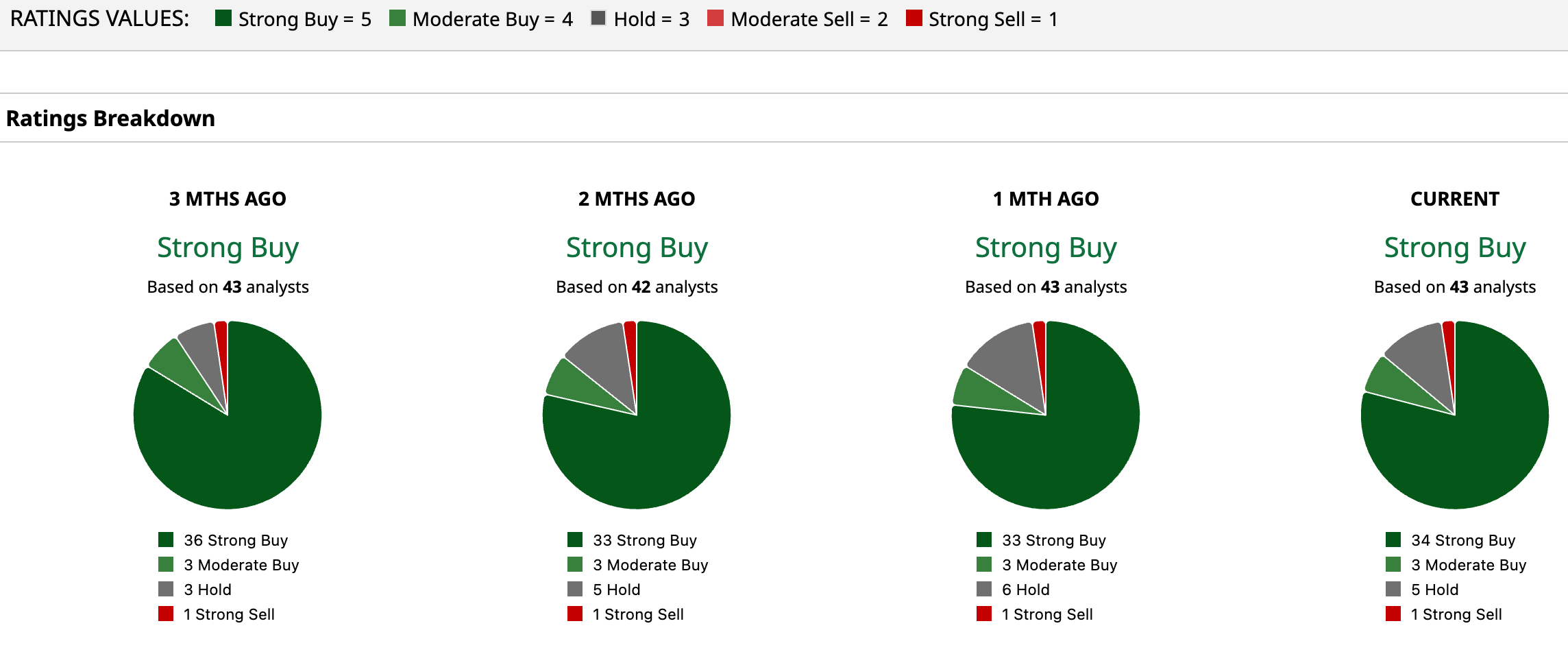

While the stock has struggled to gain traction over the past year, analyst confidence has largely held steady, with NOW still carrying an overall “Strong Buy” consensus across Wall Street. Out of 43 covering the software stock, 34 advise a “Strong Buy,” and three recommend a “Moderate Buy,” Meanwhile, just five analysts are keeping their distance with a “Hold,” while just one marks it as a “Strong Sell.”

NOW stock’s average analyst price target of $199.76 implies an upside potential of 70.7%. The Street-high target price of $266.40 suggests the stock could surge as much as 127.7% from here.

Final Thoughts on ServiceNow

NOW’s sell-off hints at a clash between market anxiety and underlying performance. The stock has been punished not for weak execution, but for uncertainty around how AI reshapes software economics. Yet, the company continues to deliver strong revenue growth, expanding margins, and rising cash generation, even as the broader software sector remains under pressure.

For long-term investors, the pullback appears driven more by caution than fundamentals. The decision now rests on perspective, whether today’s volatility represents a temporary dislocation or a reasonable entry point into a high-quality enterprise software franchise.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart