Just when you had written off biotech stocks as boring, here comes the MIT Technology Review to name its “Three technologies that will shape biotech in 2026.” There’s no moonshot cure for cancer expected just yet, but we can apparently look forward to personalized gene editing; gene resurrection; and even designer babies. (And yes, those of us who recall the more visceral lessons of films like Jurassic Park and The Boys from Brazil might be justified in a double take.)

While much of the focus – and controversy – around artificial intelligence (AI) technology has centered on specialized semiconductors and the resource-hungry data centers they power, many analysts are starting to turn their attention to another market segment that’s tapping heavily into AI's potential: the biotechnology sector.

Agentic AI in biotech and medtech can be used for multiple functions, including research, data analysis, trial design, prototyping, and more. In fact, a recent McKinsey report suggests, "The full potential of enterprise-wide agentic transformation could boost top biopharmas' EBITDA by 3.4 to 5.4 percentage points."

That forecast suggests AI could drive not only breakthroughs in the lab but also measurable results for relatively young biotechs once new treatments are approved.

Although it's difficult to pinpoint when and where the next blockbuster drug or treatment will emerge, exchange-traded funds (ETFs) like the SPDR S&P Biotech ETF (XBI) and the iShares Nasdaq Biotechnology ETF (IBB) offer broad diversification. However, these sector stalwarts could miss out on one of these smaller-cap biotech companies that might, "by chance, cross a diamond with a pearl."

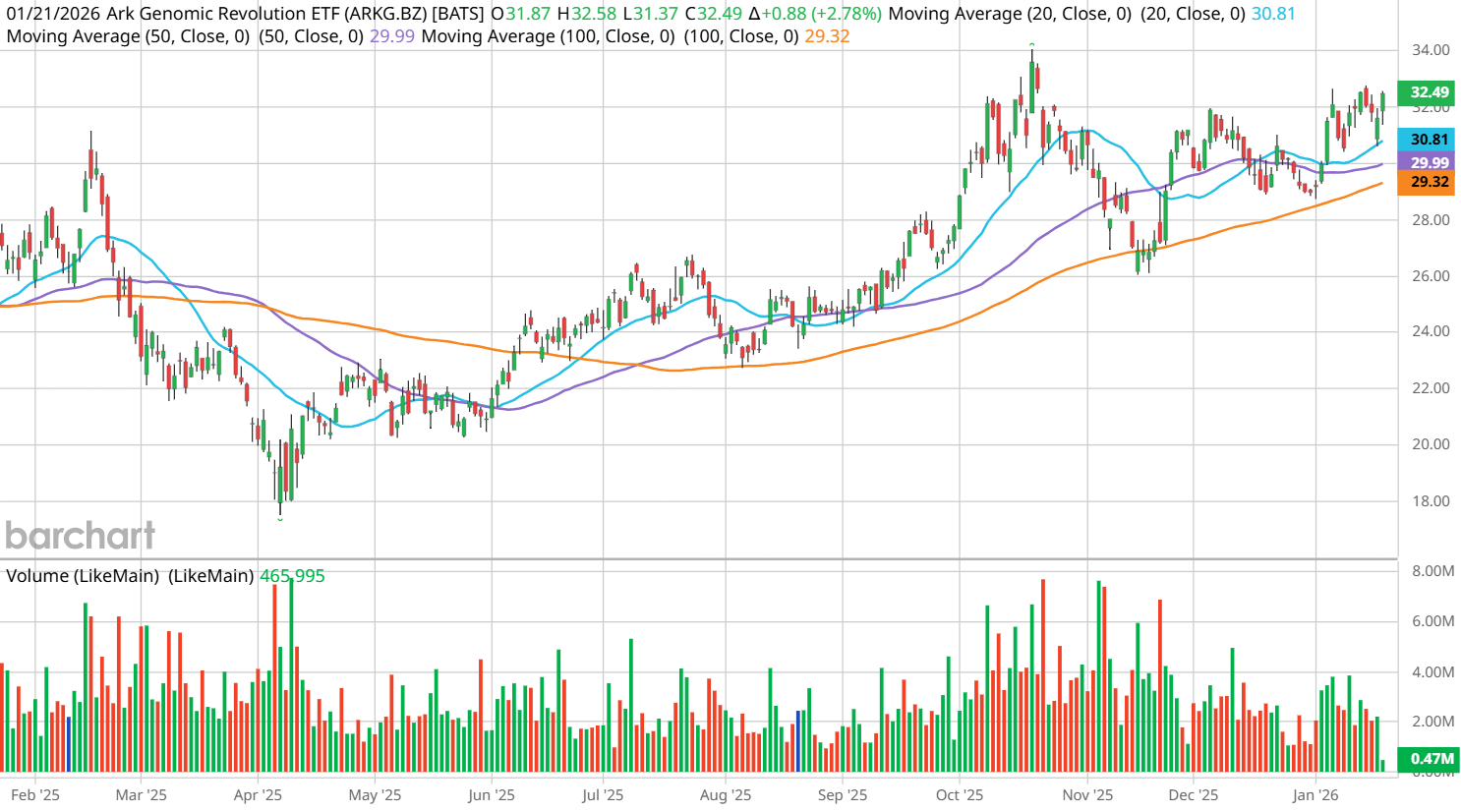

For those investors with a healthier risk appetite, there’s the Cathie Wood-helmed Ark Genomic Revolution ETF (ARKG), which skews more heavily toward AI-powered biotechs and genetic innovators.

– John Rowland is Barchart’s Senior Market Strategist and host of Market on Close.

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- How to Invest in the New Era of Agentic AI for Biotech Stocks

- How to Find High-Alpha Stocks That Can Change the Game for Momentum Traders and Investors

- Morningstar’s New Generative AI Index Could Unlock Opportunities in OpenAI and Anthropic for Everyday ETF Investors

- ETHA: The ‘Other’ Crypto ETF Is About to Step Out of Bitcoin’s Shadow