Born in Shanghai in 1919, American International Group, Inc. (AIG) has traveled a long arc to its present home in New York, growing along the way into one of the world’s most recognizable insurance franchises. Over the decades, AIG has built its reputation, stepping in where risks are difficult to price and even harder to manage. From small businesses to global corporations, its reach now spans commercial property, liability, workers’ compensation, environmental exposure, and crisis management.

Operating across more than 200 countries and jurisdictions, the company has made a business out of protecting individuals, institutions, and entire industries against uncertainty. With a market capitalization of about $39.4 billion, AIG is established, resilient, yet still adjusting to a world shaped by shifting economic conditions and emerging risks.

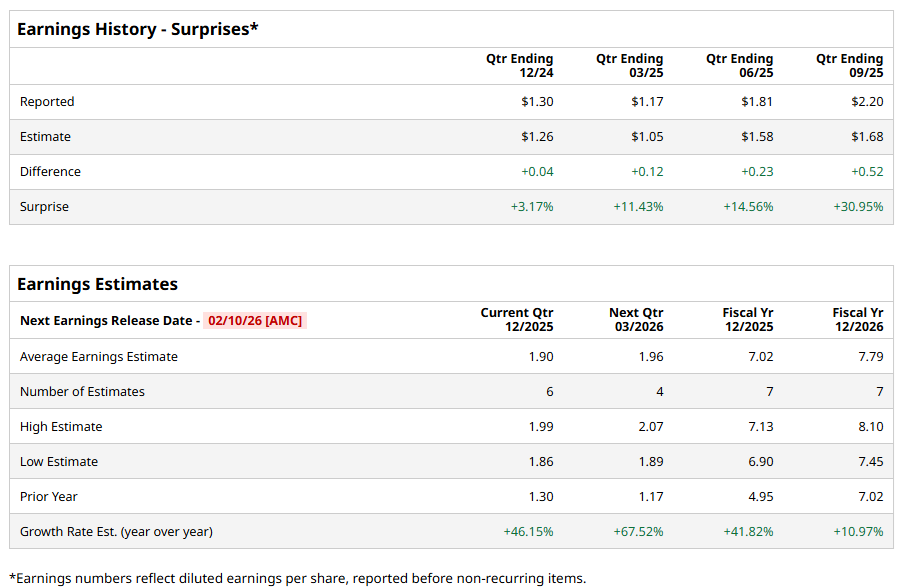

Looking ahead, attention turns to its upcoming fourth-quarter 2025 earnings report, due after the market closes on Tuesday, Feb. 10, and Wall Street is optimistic. Analysts are forecasting earnings of $1.90 per share, a sharp 46.2% jump from $1.30 per share reported in the year-ago quarter. What’s fueling that confidence is consistency. AIG has beaten earnings estimates in each of the past four quarters, steadily rebuilding trust with investors.

For fiscal 2025, analysts expect earnings per share of $7.02, up 41.8% from $4.95 reported in fiscal 2024, before rising by another 11% year over year (YoY) to $7.79 in fiscal 2026.

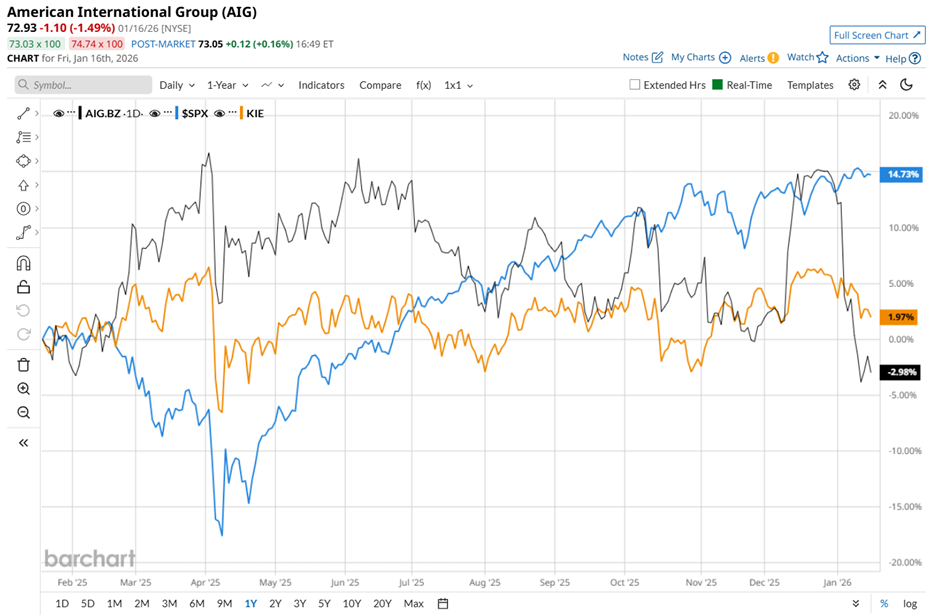

However, the stock's performance has not been impressive. AIG has declined 2.3% over the past 52 weeks, underperforming the S&P 500 Index’s ($SPX) 16.9% rise and trailing behind the State Street SPDR S&P Insurance ETF’s (KIE) 2% surge over the same time frame.

AIG started 2026 under pressure, unsettled by an unexpected leadership change and lingering financial concerns. Early in January, investors were caught off guard when the company announced that CEO and Chairman Peter Zaffino would step down as chief executive by mid-year. While he will remain executive chairman, the surprise timing of the transition introduced uncertainty – something markets typically price in quickly. On Jan. 6, that uncertainty translated into a nearly 8% drop in AIG shares.

The company tried to steady the story by naming Aon veteran Eric Anderson as CEO-elect, praising his track record in reshaping businesses and tightening operations. But markets tend to react first and ask questions later. Leadership transitions, even well-planned ones, create a pause, and AIG found itself in that uncomfortable silence.

That unease was already brewing following AIG’s Q3 earnings report in November. Despite posting adjusted EPS of $2.20, the stock slid after GAAP EPS came in much lighter, investment income fell sharply, and premiums softened. Losses tied to the company’s Corebridge stake added further pressure.

Analysts, overall, remain cautiously positive on the stock, assigning it an overall “Moderate Buy” rating. Among the 25 analysts covering the stock, eight are recommending a “Strong Buy,” two advise a “Moderate Buy,” and the remaining 15 suggest a “Hold.”

AIG’s average analyst price target of $88.45 suggests upside potential of 21.3%. The Street-high target of $101 implies the stock could rally as much as 38.5% from the current price levels.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart