Equinix, Inc. (EQIX), based in Redwood City, California, is a leading digital infrastructure company that delivers global data center colocation and interconnection solutions. Its global platform connects enterprises, cloud providers, networks, and content creators for seamless digital connectivity.

Equinix empowers businesses’ digital shifts through dependable, interconnected platforms that boost app performance, network flexibility, and secure data sharing across diverse online environments. The company has a market capitalization of $78.72 billion.

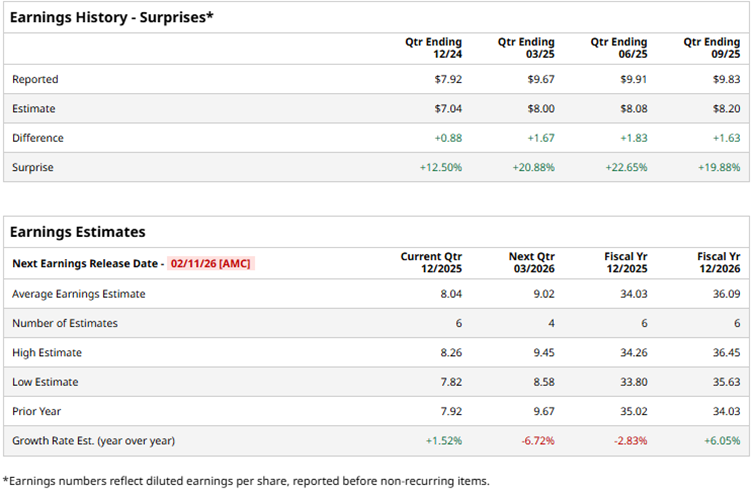

The company is expected to report its fourth-quarter results for fiscal 2025 on Feb.11, 2026, after the market closes. Ahead of the release, Wall Street analysts are tepid about the company’s bottom-line trajectory.

Analysts expect Equinix to report a profit of $8.04 per share on a diluted basis for Q4, up 1.5% year-over-year (YOY). The company has a solid history of surpassing consensus estimates, topping them in all four trailing quarters. For the full fiscal year 2025, Wall Street analysts expect Equinix’s diluted EPS to decline by 2.8% annually to $34.03, followed by a 6.1% improvement to $36.09 in fiscal 2026.

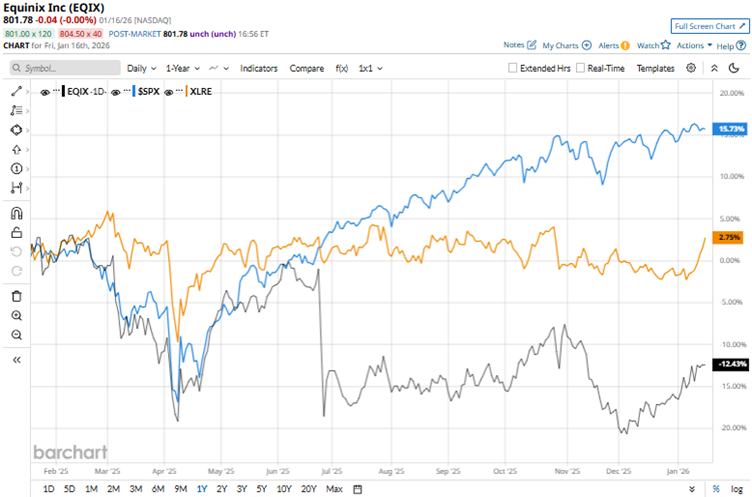

The stock has declined 12.8% over the past 52 weeks but gained 4.7% over the past six months. On the other hand, the broader S&P 500 Index ($SPX) has increased by 16.9% and 10.8% over the same periods, respectively. Therefore, the stock has underperformed the broader market.

We now compare Equinix’s performance with that of its sector. As a specialty REIT, the stock falls under the real estate sector. The State Street Real Estate Select Sector SPDR ETF (XLRE) has increased 2.7% over the past 52 weeks and 1.1% over the past six months. Therefore, while the stock has underperformed the sector over the past year, it has outperformed over the past six months.

On Oct. 29, Equinix reported robust third-quarter fiscal 2025 results. The company’s revenue increased by 5.2% YOY to $2.32 billion, matching Street forecasts and reflecting an increase in recurring revenues. Equinix’s annualized gross bookings reached a record of $394 million, up 25% YOY. Its adjusted FFO increased 8.6% annually to $9.83 per diluted share, beating the Street estimate. Based on strong performance and business growth, the stock gained 4.4% intraday on Oct. 30.

Wall Street analysts are highly bullish on Equinix’s prospects. Among the 31 analysts covering the stock, the consensus rating is “Strong Buy.” The ratings configuration is less bullish than it was three months ago, with 21 “Strong Buy” ratings, down from 22. The stock also has three “Moderate Buys” and seven “Holds.” The mean price target of $963.25 implies a 20.1% upside from current levels, while the Street-high price target of $1,218 implies 51.9% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- After Rigetti Announced a Quantum Computing Delay, How Should You Play RGTI Stock in January 2026?

- Wells Fargo Says You Should Buy the Dip in Broadcom Stock

- Taiwan Semi Crushed Q4 Earnings. That Makes This 1 AI Chip Stock a Top Buy.

- As Trump Hits AMD MI325X Chips with a 25% Tariff, How Should You Play AMD Stock?