Visa (V) stock has dropped by more than 6% in the last five trading days, although the overall market has remained fairly stable. The reason for this drop is not related to earnings or guidance but rather politics. Instead, President Donald Trump has renewed his attack on the swipe fees associated with credit cards.

A market is likely to move quickly when politics meets profit pools, especially when it is as visible as it is with interchange rates. The value of Visa already embeds a degree of stability and predictability, and any degree of disruption can lead to a rapid de-risking. Nevertheless, it is a historical truth that headline risk and long-term implications rarely align. This is where the debate resides.

Here's what investors should know about V stock moving forward.

About Visa Stock

Visa (V) is operating the world's most extensive electronic payments network, linking consumers, merchants, banks, and governments in more than 200 countries. The company is headquartered in Foster City, California, with a market capitalization of nearly $600 billion, making it one of the most prominent financial infrastructure companies in the world.

Over the past year, the price of V stock has ranged from a low of $299 to a high of $375, but shares are currently closer to the lower end of this range. The relative strength indicator is also below 40, indicating that there has been selling pressure in V stock. In comparison to Visa stock, the S&P 500 ($SPX) has fared relatively better, up 17% for the past 52 weeks versus Visa's 3% gain.

In terms of valuation, Visa is trading for about 25.6 times forward earnings and close to 15 times sales. These are certainly rich multiples, there’s no doubt about it. But Visa also sports a profit margin of 50% and a return on equity of over 60%. In other words, this is no delicate business model with growth stock price tags.

Visa Beats on Earnings Despite the Noise

The most recent fiscal fourth quarter for Visa came in strong, even if it looked confusing at first blush. GAAP Net income was $5.1 billion, down slightly from last year due primarily to a $899 million litigation reserve related to interchange lawsuits. Take that out, and things look very good.

On a non-GAAP basis, EPS increased 10% to $2.98, while revenue grew 12% to $10.7 billion. Payments volume, cross-border volume, and processed transactions grew at high single-digit to low double-digit levels. Processed transactions grew to 67.7 billion, an increase of 10% year-over-year (YOY). That is scale doing what scale does best.

Management didn’t issue any alarming guidance changes, and the balance sheet remains strong, with $20 billion in cash and investments and interest coverage above 40 times. Political risks may grab headlines, but operationally, Visa continues to execute almost boringly well.

What Do Analysts Expect for Visa Stock?

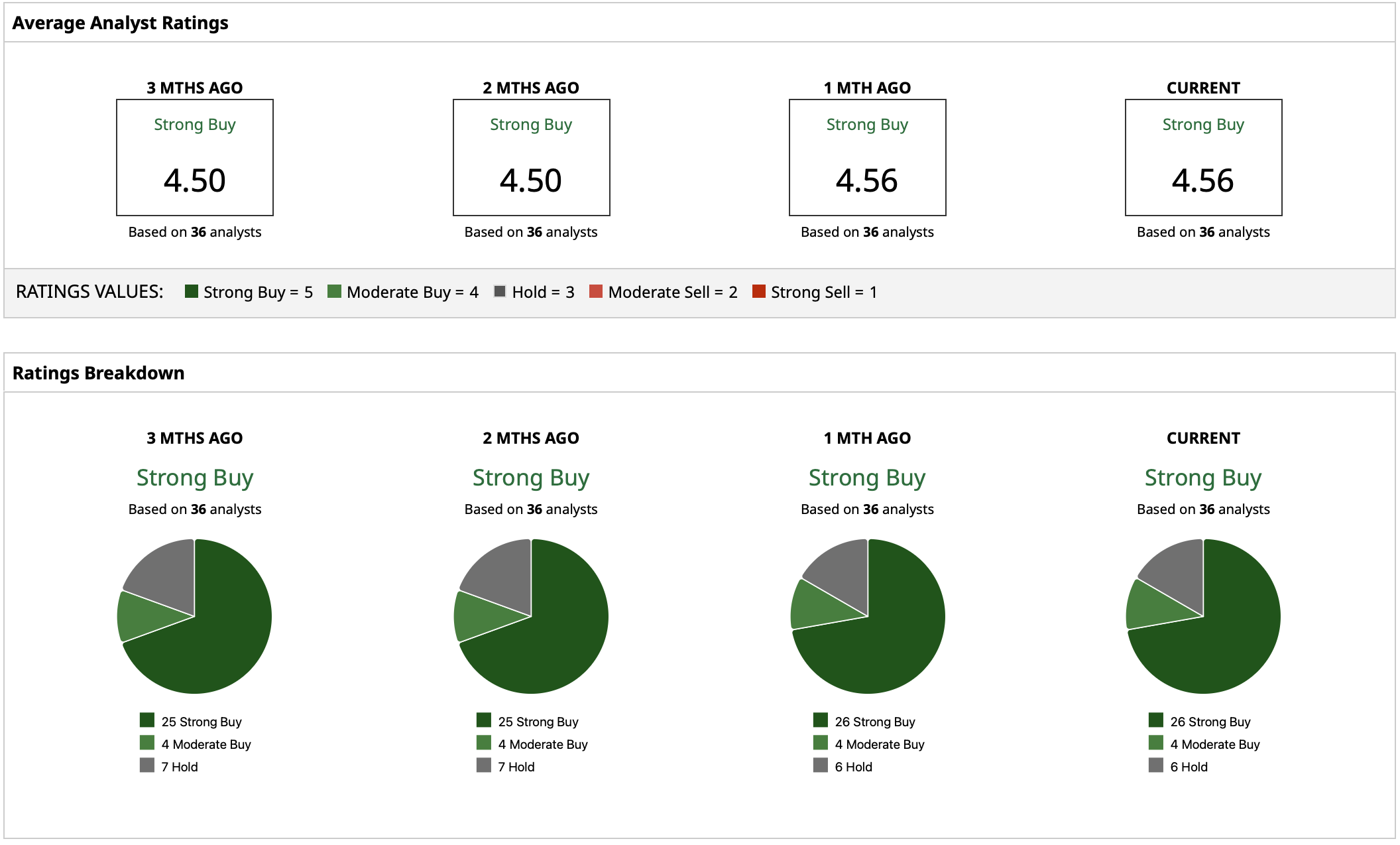

Wall Street is still constructive on V stock with a “Strong Buy” consensus rating and a mean price target of $403.09, which is significantly higher than the current market price. The highest price target is $450. At today’s price, the mean target implies potential upside of 23% while the high target indicates potential upside of about 37%. Even the lowest target of $327 is near the current price, indicating little room for error in base-case analysis.

Analysts seem to be taking swipe fees as an ongoing risk when it comes to Visa stock, not a paradigm shift.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- After Rigetti Announced a Quantum Computing Delay, How Should You Play RGTI Stock in January 2026?

- Wells Fargo Says You Should Buy the Dip in Broadcom Stock

- Taiwan Semi Crushed Q4 Earnings. That Makes This 1 AI Chip Stock a Top Buy.

- As Trump Hits AMD MI325X Chips with a 25% Tariff, How Should You Play AMD Stock?