Semiconductor giant Taiwan Semiconductor (TSM) reported solid fourth-quarter earnings, with profit jumping 35% to beat analyst estimates and reach a record high. While TSM stock surged on the news, legacy chip giant Intel (INTC) also reaped the gains.

Citi analysts raised INTC stock’s rating from “Sell” to “Neutral” and set a $50 price target, citing TSM’s tightness in advanced packaging, which should benefit Intel. Analyst Atif Malik noted that the company has a “unique window of opportunity” to attract foundry wafer customers as it receives U.S. support.

Amid this news, let's take a closer look at Intel and INTC stock.

About Intel Stock

Headquartered in Santa Clara, California, Intel operates in the global semiconductor design and manufacturing industry. The company's operations span Intel Products, including the Client Computing Group (CCG) for PCs as well as Data Center and AI (DCAI) for servers and artificial intelligence (AI) solutions, as well as Intel Foundry, which provides advanced manufacturing services to internal and external customers. Intel has a market capitalization of $224 billion.

Over the past year, Intel has faced challenges through restructuring efforts while advancing its foundry model with significant government support. However, the company has also landed significant deals, including an agreement with President Donald Trump's administration under which the government invested $8.9 billion in Intel’s common stock.

Over the past 52 weeks, the stock has gained 139%, while over the past six months, INTC has risen 107%. This was based on the company’s strong Q3 earnings and the stock’s rebound from lows. New leadership under CEO Lip-Bu Tan drove restructuring, cost cuts, and a focus on AI processors. Following analyst upgrades, INTC stock reached a 52-week high of $50.39 on Jan. 15, although it is now down 6% from that level.

Intel stock has a price-to-sales ratio of 3.9 times, which is higher than the industry average of around 3.5 times.

Intel Turned a Profit In Q3

On Oct. 23, Intel reported solid results for the third quarter of fiscal 2025. The company’s net revenue increased 3% year-over-year (YOY) to $13.65 billion, which was higher than the $13.14 billion that Wall Street analysts had expected. This indicated that the demand for Intel's core x86 platform had recovered.

This topline recovery had wide-reaching effects for the firm's profitability. Intel’s non-GAAP gross profit increased by 128% annually to $5.46 billion. Its adjusted bottom line posted a significant turnaround, improving from a loss per share of $0.46 to EPS of $0.23.

Intel highlighted its partnership with Nvidia (NVDA) to develop multiple generations of custom data center and PC products. The deal also included a $5 billion equity stake in Intel bought by Nvidia. Japanese technology giant SoftBank (SFTBY) also invested $2 billion in Intel common stock.

Wall Street analysts are optimistic about Intel’s ability to reduce its bottom-line losses. They expect the company’s loss per share to remain unchanged at $0.02 for the fourth quarter of fiscal 2025. For fiscal 2025, loss per share is projected to decrease by 84% annually to $0.14, followed by a 221% improvement to EPS of $0.17 in fiscal 2026.

What Do Analysts Think About Intel Stock?

There are some mixed views among Wall Street analysts regarding INTC stock. Recently, RBC Capital analyst Srini Pajjuri initiated coverage on shares with a “Sector Perform” rating and a $50 price target. The analyst noted Intel’s efforts to rightsize its business, healthy PC and server demand, and the firm's improving competitiveness.

In the same week, analysts at UBS raised the price target on INTC stock from $40 to $49 but maintained a “Neutral” rating, citing the tight supply for the company’s products and noting an “upside bias” for its Q4 results due to strong PC and server demand.

Keybanc Capital Markets analysts recently took a bullish view on Intel, upgrading its rating to “Overweight” and setting a Street-high price target of $60. Analysts noted that Intel has made “significant progress” in its manufacturing, especially relating to AI-driven chip sales.

Melius Research analysts also raised their rating from “Hold” to “Buy” this month with a $50 price target. Analysts believe there’s a strong possibility that both Nvidia and Apple (AAPL) will consider Intel’s 14A node for production during the 2028 to 2029 period.

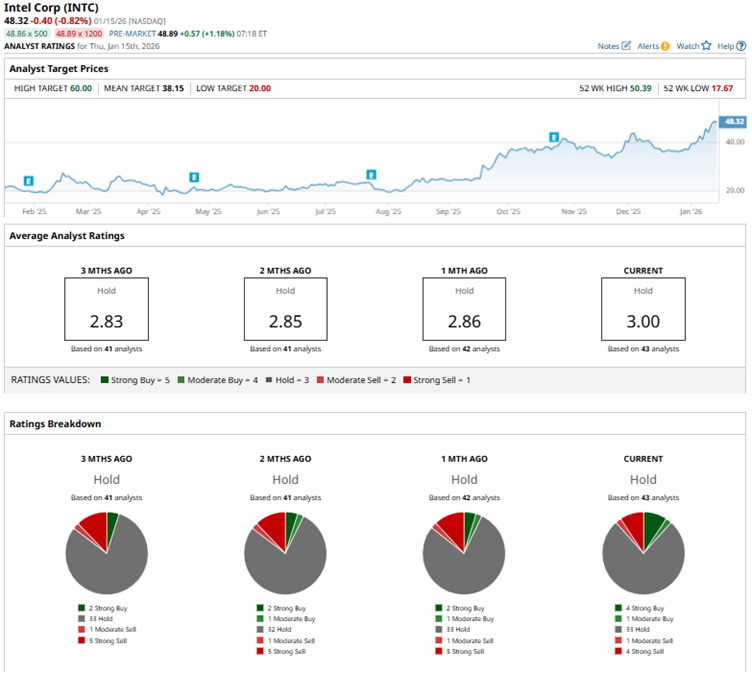

Wall Street analysts are taking a cautious stance on INTC stock now with a consensus “Hold” rating overall. Of the 43 analysts rating the stock, four analysts have a “Strong Buy” rating, one analyst has a “Moderate Buy” rating, 33 analysts play it safe with a “Hold,” one analyst suggests a “Moderate Sell,” and four analysts have a “Strong Sell” rating. The mean price target of $39.62 represents 16% potential downside from current levels. However, KeyBanc's Street-high price target of $60 indicates 28% potential upside from current levels.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- After Rigetti Announced a Quantum Computing Delay, How Should You Play RGTI Stock in January 2026?

- Wells Fargo Says You Should Buy the Dip in Broadcom Stock

- Taiwan Semi Crushed Q4 Earnings. That Makes This 1 AI Chip Stock a Top Buy.

- As Trump Hits AMD MI325X Chips with a 25% Tariff, How Should You Play AMD Stock?