With a market cap of $12.1 billion, Hasbro, Inc. (HAS) is a global toy and game company offering a wide range of products, including action figures, dolls, trading cards, and creative play items. It also develops entertainment content, licenses its popular brands, and partners with digital game developers, with well-known properties such as NERF, TRANSFORMERS, DUNGEONS & DRAGONS, PLAY-DOH, and STAR WARS.

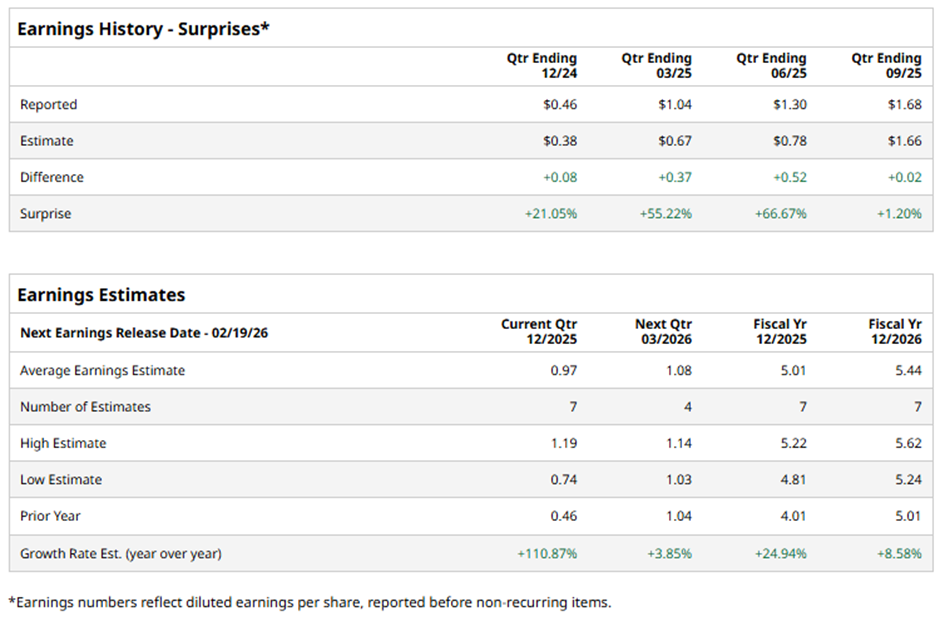

The Pawtucket, Rhode Island-based company is set to announce its fiscal Q4 2025 results soon. Analysts predict HAS to report an adjusted EPS of $0.97, a surge of 110.9% from $0.46 in the year-ago quarter. It has surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts forecast the toy and game maker to report an adjusted EPS of $5.01, an increase of 24.9% from $4.01 in fiscal 2024.

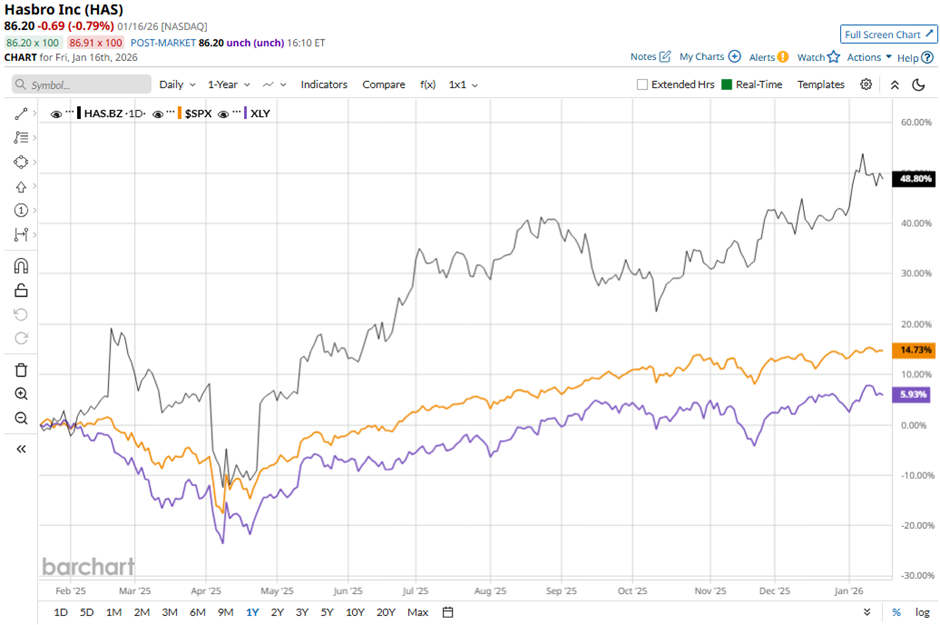

Shares of Hasbro have climbed 49.3% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 16.9% return and the State Street Consumer Discretionary Select Sector SPDR ETF's (XLY) 8.2% rise over the period.

Shares of Hasbro rose 3.7% on Oct. 23 after the company reported strong Q3 2025 results, with revenue up 8% year over year and operating profit increasing 13% to $341 million, driven by a 42% revenue surge in the Wizards of the Coast and Digital Gaming segment. Investor sentiment was further boosted by MAGIC: THE GATHERING revenue jumping 55%, adjusted EPS of $1.68, and a high 44% operating margin in the Wizards segment, highlighting strong profitability and operating leverage.

Additionally, Hasbro raised its full-year outlook, projecting high-single-digit revenue growth, adjusted operating margins of 22% - 23%, and adjusted EBITDA of $1.24 billion - $1.26 billion.

Analysts' consensus view on HAS stock is bullish, with a "Strong Buy" rating overall. Among 13 analysts covering the stock, 10 recommend "Strong Buy," one gives "Moderate Buy," and two indicate “Hold.” The average analyst price target for Hasbro is $94.08, suggesting a potential upside of 9.1% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- After Rigetti Announced a Quantum Computing Delay, How Should You Play RGTI Stock in January 2026?

- Wells Fargo Says You Should Buy the Dip in Broadcom Stock

- Taiwan Semi Crushed Q4 Earnings. That Makes This 1 AI Chip Stock a Top Buy.

- As Trump Hits AMD MI325X Chips with a 25% Tariff, How Should You Play AMD Stock?