Apple (AAPL) is facing some headwinds in India after the nation’s antitrust watchdog warned that it will go ahead with enforcement action if Apple delays its response any longer. According to the Competition Commission of India (CCI), Apple has not responded to the commission’s questioning for over a year. This could force the regulator to move on with unilateral action against the iPhone maker.

The case carries a high risk for Apple, which could face up to $38 billion in fines if regulators apply global turnover as the basis for its penalty calculation. However, Apple has not only denied any wrongdoing, but has also challenged the legality of this penalty framework in court. The company's challenge is due to be heard by an Indian court on Jan. 27.

Even if the CCI were to move forward, it would have to deal with further litigation before the imposition and recovery of the potential fine. While this case continues to cause anxiety among AAPL stock investors, it's also a big test for India’s antitrust watchdog in front of a company that not too long ago had a market capitalization akin to India’s GDP.

About Apple Stock

Apple is headquartered in Cupertino, California but manufactures and supplies its products and services across the globe. Apple is known for its high-quality devices like the iPhone and Mac, helping it generate more than $400 billion in annual revenue.

Apple’s lack of innovation since the emergence of AI has kept AAPL stock in check of late, although the underperformance has not been too damaging. Over the past 12 months, shares have gained 12% against the S&P 500’s ($SPX) 17% gain. Things could also look a lot different in 2026, as analysts have picked AAPL stock as a top AI play for 2026.

If Wedbush analyst Dan Ives is picking Apple as a top AI play for 2026, there must be some merit to it. On Jan. 12, the company announced that it had selected Alphabet's (GOOGL) Google Gemini for its next version of Siri. This development confirmed one thing: Apple does have an AI strategy, and Dan Ives’ optimism isn’t unfounded. With that in mind, although there are no deep insights into the firm's strategy as of yet, investors can look at AAPL’s valuation to decide whether it's worth betting on at this point.

Apple’s forward price-to-earnings (P/E) ratio of 31.8 times is quite reasonable, even though it is somewhat high. The company is expected to grow its earnings by 9% in 2026 and 12% in 2027. This growth is reasonable, and for a company with a strong ecosystem, it adds to the strength. Apple is also trading just below its five-year average forward price-to-book value. That's another valuation metric that suggests the stock hasn’t run ahead of its fundamentals just yet.

iPhone Revenue Disappoints in Fiscal Q4 2025 Earnings

Apple posted impressive earnings on Oct. 30, declaring an EPS of $1.85 versus a consensus estimate of $1.73. Quarterly revenue came in at $102.5 billion, also beating estimates. While iPhone revenue came in marginally below expectations, all other segments reported revenue above estimates. Going forward, management expects iPhone revenue to grow at double digits, so the lower revenue during the quarter did not impact AAPL stock negatively.

Apple is also expanding its footprint in India, together with partners like Foxconn, to produce its devices in the country. However, apart from the present regulatory tension, things aren't as straightforward on the political front. For example, U.S. President Donald Trump has often publicly threatened India with tariffs, which may eventually affect Apple as well. Still, considering the fact that Apple is investing in India to reduce reliance on China — something that Trump wanted — it is possible that the current administration may have a soft spot for the iPhone maker.

What Are Analysts Saying About Apple Stock?

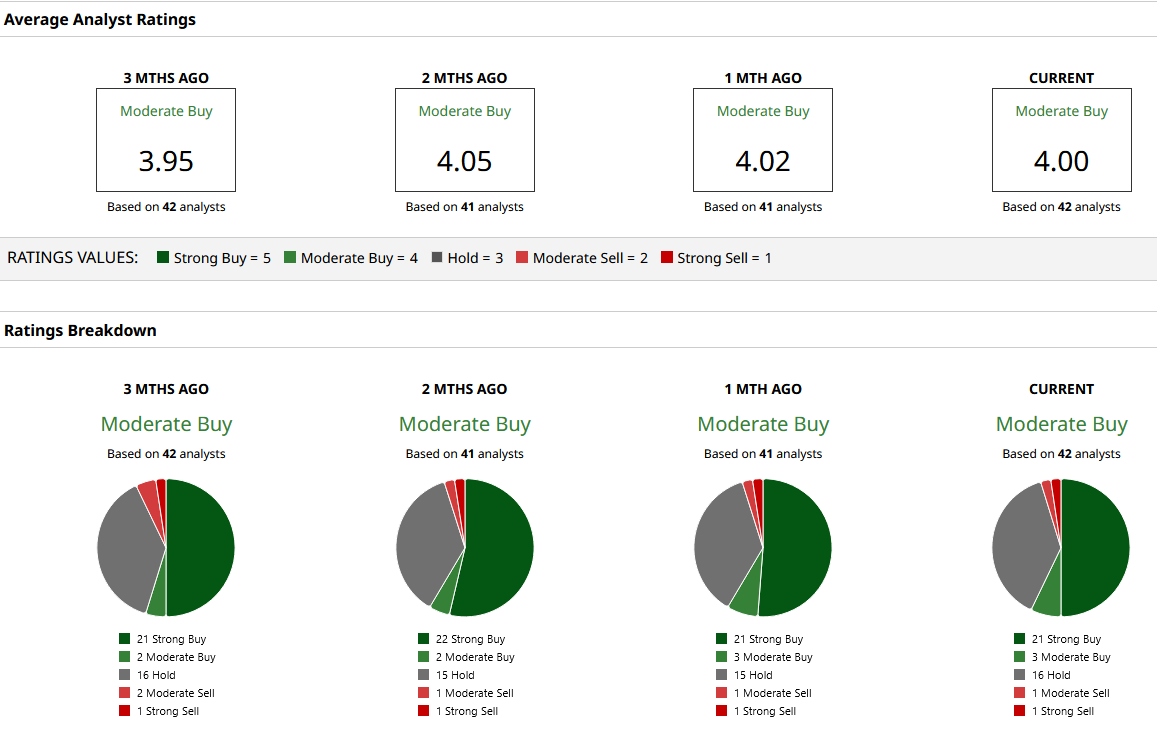

Wall Street analysts continue to have mixed opinions on AAPL stock. Currently, the stock has a consensus “Moderate Buy” rating from 42 analysts. That rating is based on 21 “Strong Buy” ratings, three “Moderate Buy” ratings, 16 “Hold” ratings, one “Moderate Sell,” and one “Strong Sell.”

Apple’s 52-week high of $288.62 is quite close to Wall Street's mean target price of 289.61. The current retracement is not a bad buying opportunity, especially considering the fact that the most bullish analyst on the Street — none other than Dan Ives of Wedbush — has a $350 price target on AAPL stock. That high target translates to potential upside of 37% from current levels.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- After Rigetti Announced a Quantum Computing Delay, How Should You Play RGTI Stock in January 2026?

- Wells Fargo Says You Should Buy the Dip in Broadcom Stock

- Taiwan Semi Crushed Q4 Earnings. That Makes This 1 AI Chip Stock a Top Buy.

- As Trump Hits AMD MI325X Chips with a 25% Tariff, How Should You Play AMD Stock?