Oracle (ORCL) stock declined nearly 5% this past week after a group of bondholders reportedly filed a lawsuit over losses incurred because of the company's investments in artificial intelligence (AI). The suit is a proposed class-action lawsuit filed in a New York state court and represents investors who bought approximately $18 billion of the company's debt offered in September.

This legal matter has reignited concerns about Oracle’s balance sheet among investors, and it comes at a time when Oracle is increasing its expenses for developing AI cloud data centers. Oracle has turned out to be one of the most crucial infrastructure players in the AI industry, which has sparked hopes about its long-term growth. However, this has also meant high expenses for Oracle’s debt investors.

Adding to the debate, BNP Paribas recently indicated that Oracle may require another infusion of funding to the tune of $25 billion to $30 billion to aid its AI plans. This is much lower than previous estimates that had indicated a potential requirement of around $100 billion. Finally, on a different note, shares of Oracle were recently labeled as undervalued by KeyBanc Capital Markets.

About Oracle Stock

Oracle is a worldwide provider of enterprise software and cloud infrastructure solutions with headquarters located in Austin, Texas. The corporation is widely recognized as a major provider of database software. However, over the past few years, Oracle has shown significant efforts aimed at the development of cloud infrastructure solutions, cloud application solutions, and AI-driven solutions. The company's current market capitalization stands at approximately $549 billion.

ORCL stock has been quite volatile over the last year, ranging between a 52-week low of about $118 and a high of roughly $346. Presently, the stock has declined by about 4% over the last five trading days, with its Relative Strength Index close to 40, signifying heavy selling activity. Conversely, the S&P 500 ($SPX) index has remained relatively stable over the same period, which signifies company-specific challenges for Oracle related to leverage.

On a valuation basis, Oracle currently trades at a trailing price-to-earnings (P/E) ratio of 33.4 times and a forward P/E of 31.8 times. Meanwhile, its price-to-sales (P/S) ratio of approximately 9.5 times is high relative to traditional software companies. That points to a belief in continued cloud/AI-based revenue growth at a pace well in excess of the traditional enterprise software industry. Leverage is also in play here. Oracle's debt/equity ratio is above 3, while its interest coverage ratio is just below 5.

Oracle Beats on Earnings as Cloud and AI Momentum Accelerates

Despite the legal and balance sheet headlines, Oracle’s latest earnings release offered a different story. For its fiscal second-quarter 2026 earnings, Oracle posted GAAP EPS of $2.10 and non-GAAP EPS of $2.26, which were up a stunning 91% and 54%, respectively. Revenue was up 14% from last year to $16.1 billion.

Cloud revenue grew 34% to $8 billion, with cloud infrastructure revenue growing 68% to $4.1 billion. The most interesting part, perhaps, was the company’s Remaining Performance Obligations (RPO), which grew an astonishing 438% year-over-year (YOY) to $523 billion. This was attributed to new long-term contracts with large customers such as Meta Platforms (META) and Nvidia (NVDA), reflecting the company’s involvement in large-scale AI initiatives.

Strategic flexibility, not vertical integration, was the thrust of management's comments. Oracle just sold its interests in Ampere, a move to indicate neutrality on the chip side and a willingness to work more closely with third-party CPU and GPU suppliers. The firm also touted the explosive growth of its multicloud database business, which was up more than 800% from a year ago as customers increasingly chose to run Oracle databases on rival clouds.

What Are Analysts Predicting for Oracle Stock?

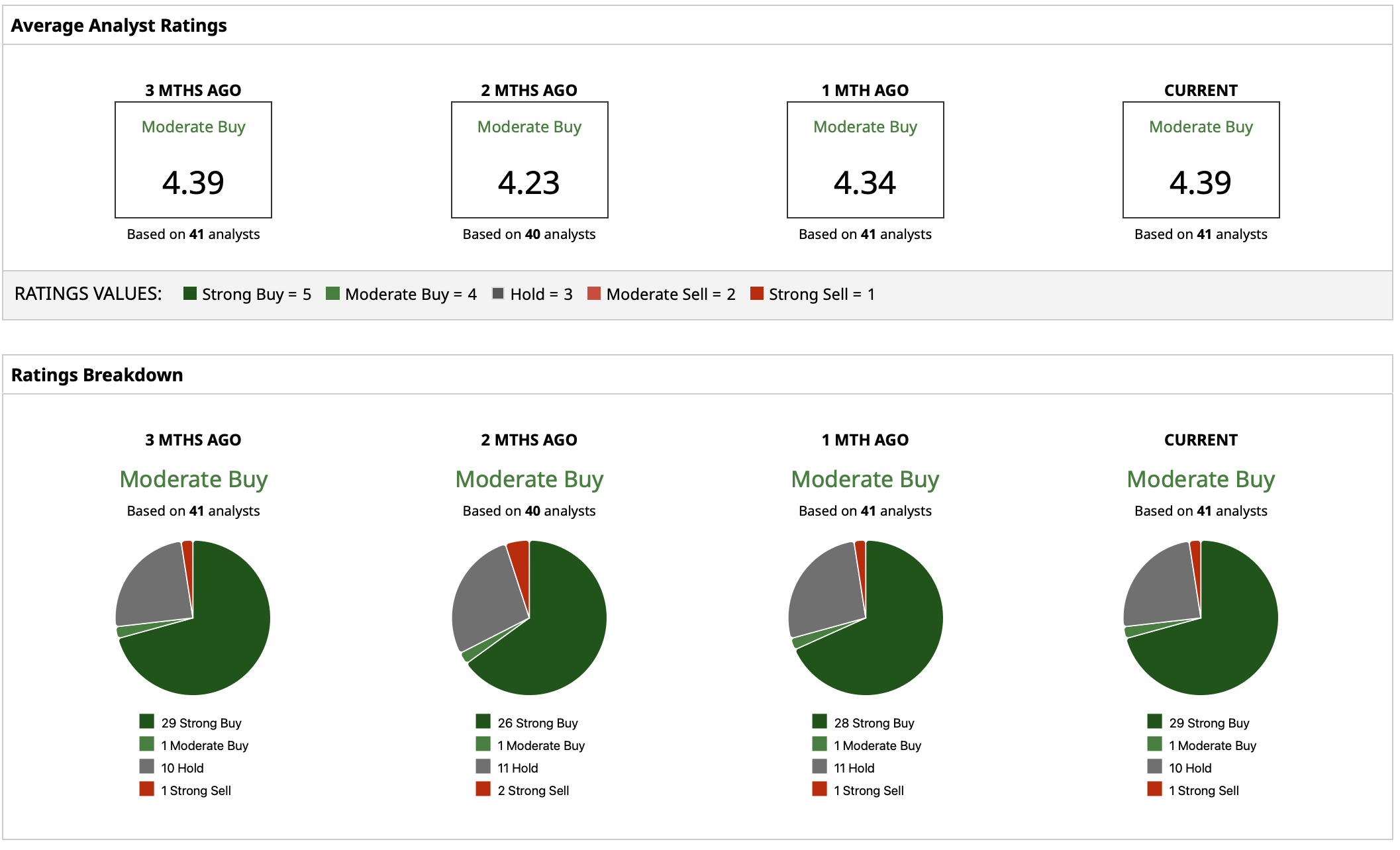

Analysts on Wall Street are overall positive about Oracle despite the current volatility in the ORCL stock price. Oracle is covered by 41 analysts with a “Moderate Buy” consensus rating.

The median target price for ORCL stock is $304.03, which indicates a potential gain of 59% from current levels. What's more, implying a potential gain of 109%, the high target of $400 indicates that there is continued faith in the idea that Oracle's AI-based cloud backlog will create a positive revenue stream over time. Finally, the low target of $175 implies 8% potential downside from here.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- After Rigetti Announced a Quantum Computing Delay, How Should You Play RGTI Stock in January 2026?

- Wells Fargo Says You Should Buy the Dip in Broadcom Stock

- Taiwan Semi Crushed Q4 Earnings. That Makes This 1 AI Chip Stock a Top Buy.

- As Trump Hits AMD MI325X Chips with a 25% Tariff, How Should You Play AMD Stock?