Popular electric vehicle (EV) company Rivian Automotive (RIVN) has to recall nearly 20,000 units (19,641 units, to be precise) of its previously serviced R1S and R1T EVs in the U.S. due to an issue with the toe links. The U.S. National Highway Traffic Safety Administration (NHTSA) stated that the company will replace the incorrectly assembled rear toe-link bolts at no charge.

Although there has been only one incident related to a toe-link issue, the NHTSA issued the recall because there is a risk associated with servicing toe links using earlier service procedures. Given this situation, where the company must bear the costs of nearly 20,000 vehicle recalls and its 2025 production and delivery numbers declined compared to the prior year, investors might want to take a measured view of RIVN stock now.

About Rivian Stock

Headquartered in Irvine, California, Rivian specializes in designing, developing, and manufacturing premium EVs for adventure and sustainability. Its primary production facility in Normal, Illinois, produces flagship models such as the R1T electric pickup truck and R1S SUV, along with advanced battery packs and components, using cutting-edge robotics and stamping technology. The company has a market capitalization of $23.5 billion.

Rivian emphasizes vertical integration by producing its own motors, batteries, and software in-house, while partnering with key suppliers for raw materials. It also invests heavily in R&D for next-gen features. The company also builds commercial fleets, notably for Amazon (AMZN), and plans to open a second U.S. plant in Georgia to expand capacity and drive EV innovation.

RIVN stock has held up well on Wall Street, benefiting from tailwinds such as optimism surrounding the impending launch of its R2 vehicle. Another major reason for the stock’s solid performance is the company's partnership with Volkswagen (VWAGY). In a joint venture deal valued at $5.8 billion, Rivian already received $1 billion equity tranche in June 2025.

Over the past 52 weeks, RIVN stock has gained 38%, and over the past six months, 47%. It had reached a 52-week high of $22.69 on Dec. 22, but RIVN is down 15% from that level as of this writing. Over the past month, Rivian is up by 4%.

RIVN stock is trading at a stretched valuation. Its price-to-sales ratio is 3.76 times, significantly higher than the industry average.

Rivian’s Topline Grows, But It Is Still Incurring Losses

On Nov. 4, Rivian reported its third-quarter results for fiscal 2025. Revenue climbed 78% year-over-year (YOY) to $1.56 billion, surpassing the $1.49 billion that Wall Street analysts had expected.

Rivian’s automotive revenue increased by 47% from the prior-year period to $1.14 billion. This was primarily due to higher deliveries as consumers accelerated purchases before the expiration of tax credits and due to rising average selling prices. However, the company reported an adjusted loss per share of $0.65, down from a $0.99 loss a year earlier and below the $0.71 per-share loss analysts expected.

Wall Street analysts have a mixed view of Rivian’s bottom-line trajectory. For the fourth quarter, loss per share is expected to increase by 31% YOY to $0.83. On the other hand, for the full fiscal 2025, the company’s loss per share is projected to drop by 30% annually to $3.20.

What Do Analysts Think About Rivian Stock?

This month, analysts at Piper Sandler maintained a “Neutral” rating on RIVN stock and raised its price target from $14 to $20. Piper Sandler analysts have contrasting views on the company’s outlook. North American sales are expected to drop by 1.2% in 2026 due to affordability concerns. On the other hand, analysts expect the company’s European sales to return to growth. In China, sales are expected to drop by 3% due to macroeconomic weakness and expiring subsidies.

Last month, analysts at Baird upgraded the stock to “Outperform” and raised the price target from $14 to $25, citing the lower-priced R2 vehicle and a new product cycle as factors that could impact the stock. Baird analysts also highlighted the company's Autonomy and AI Day, during which it outlined its autonomous strategy and showcased custom chips.

In the same month, Morgan Stanley analysts downgraded RIVN stock from “Equalweight” to “Underweight,” and set a price target of $12. Morgan Stanley is concerned about the company’s R2 release, as the EV market backdrop faces significant headwinds, including the loss of the $7,500 tax credit and slowing EV adoption.

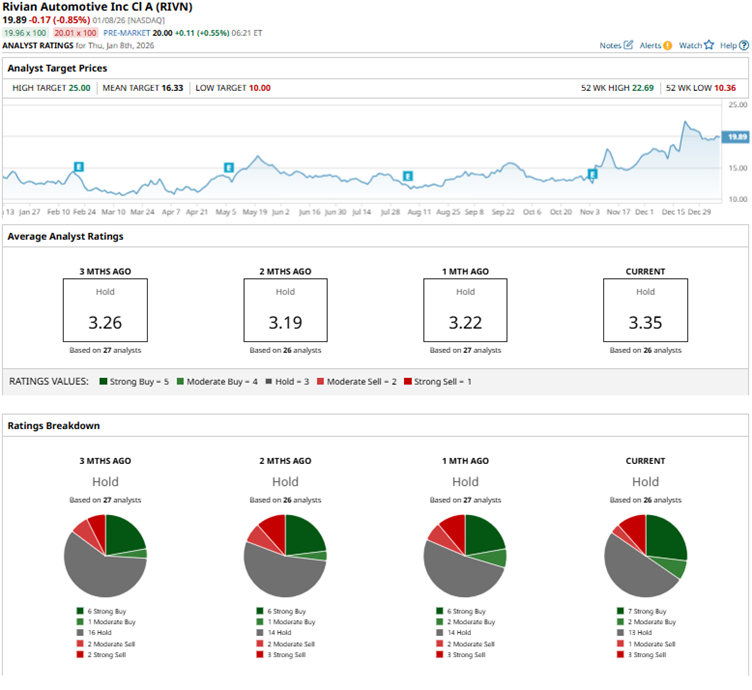

Wall Street analysts are taking a measured stance on RIVN stock with a consensus “Hold” rating. Of the 26 analysts rating the stock, seven analysts have a “Strong Buy” rating, two analysts have a “Moderate Buy” rating, 13 analysts rate the stock with a “Hold” rating, one analyst suggests a “Moderate Sell,” and three analysts offer a “Strong Sell” rating. The consensus price target of $16.58 represents 14% potential downside from current levels. However, the Street-high price target of $25 indicates 30% potential upside from current levels.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart