There was little good news from Thursday’s market action as the S&P 500 lost 1..66%, the Dow lost 1.65%, and the Nasdaq 100 was down over 2%.

It’s become clear that further interest rate cuts in 2025 are likely off the table as the Federal Reserve tries to ensure inflation doesn’t get any worse than it already is.

While we may never get the official jobs data from the federal government for October, the private data available is not good. For example, in October, job layoff announcements increased by 175% year over year to 153,000. It is the worst monthly figure in the fourth quarter since 2008.

Interestingly, despite the doom and gloom, corporate earnings are good. Barchart contributor Rich Asplund reported yesterday that Bloomberg Intelligence data suggests Q3 2025 earnings for S&P 500 companies were the best since 2021.

It all sets up nicely for today’s commentary about yesterday’s unusual options activity.

On Thursday, there were 1,290 unusually active options, with three boasting Vol/OI (volume-to-open-interest) ratios over 100--none of which I would seriously consider. In fact, of the top 10 based on Vol/OI ratios, Metsera (MTSR) and Core Scientific (CORZ) had eight of them.

One thing that does jump out at me in the top 100 is the large number of deep ITM (in the money) puts. That suggests investors are looking to protect their long positions.

Here are three deep ITM puts (say 20%) for stocks whose companies actually make money.

Have an excellent weekend!

Meta Platforms (META)

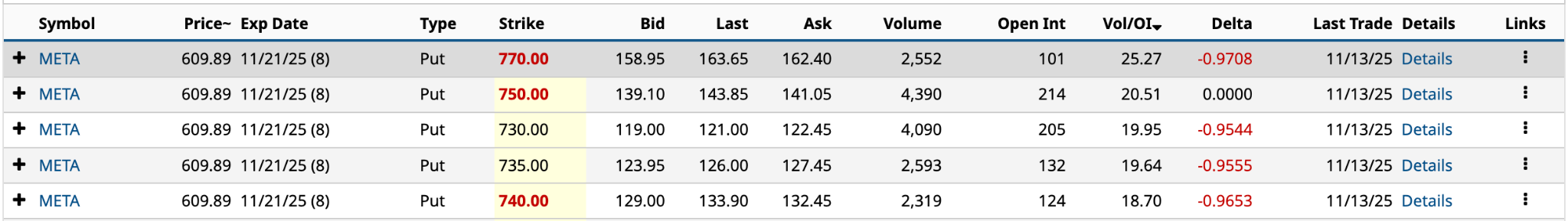

Meta Platforms (META) had five puts in the top 100. They all expire next Friday. Outside the top 10, META had another 10 unusually active put options, most of which were also deep ITM.

While the social media company’s options volume yesterday was only marginally higher than its 30-day average of 607,800, there was some interesting trading among these top five.

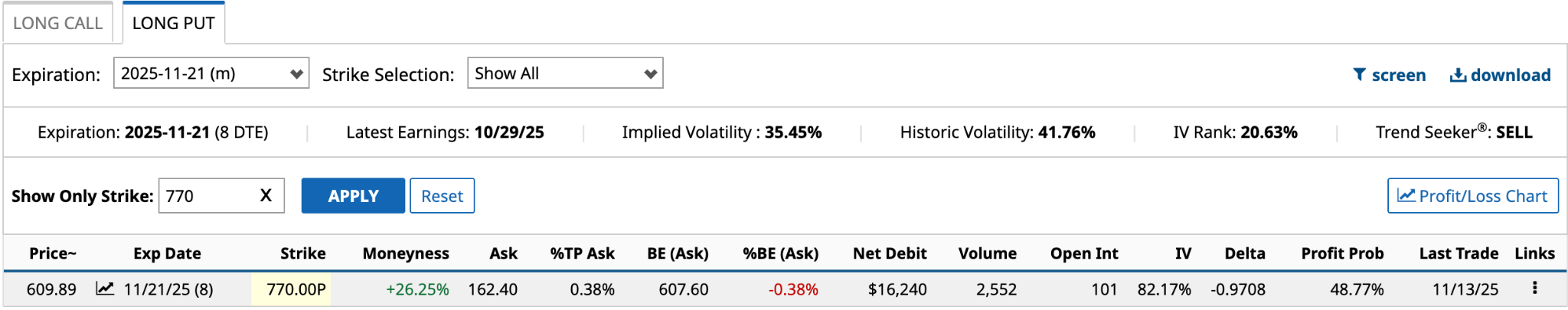

For example, the Nov. 21 $770 put, the highest Vol/OI ratio of the five, and 26.25% ITM had just five trades accounting for 2,552 contracts, ranging from 22 to 178 in trade size. Not one contract less than 10.

As you can see, the breakeven of $607.60 is just 0.38% below yesterday’s closing price.

So, why would somebody spend $16,240 (26.6% of the share price) for just eight days of protection on the downside? Someone who bought the stock near its 5-year low of $88.09 in October 2023 and doesn’t want to sell, triggering capital gains.

Further, the shorter the DTE (days to expiration), the lower the cost of the protective puts. Some of the buyers may have been rolling over the puts from the beginning of November after Meta reported earnings that included “aggressive spending” on AI, sending the shares 11% lower on the news.

The other interesting put of the five is the $750 strike. It had the highest volume of the five yesterday at 4,390. There were seven trades with two over 1,400 and only one under 10. Again, a sign of bigger fish looking to protect the downside. And for the $750 strike, it’s still 22.97% ITM but $2,135 cheaper.

In the first nine months of 2025, Meta generated $29.5 billion in free cash flow, despite more than doubling capital expenditures year over year to $48.3 billion. If there’s a company that could comfortably increase spending by $2 billion in 2025, to $71 billion at the midpoint of its guidance, Meta would be it.

Lululemon (LULU)

Lululemon (LULU) had one put in the top 100. It expires on Jan. 16/2026 in 64 days.

The 64-day DTE is more in line with what traders will use for protective puts and hedging. The athleisure brand’s stock has struggled mightily in 2025, down 56% year-to-date. Right now, the stock’s simply trying to find a floor.

The 64-day DTE is more in line with what traders will use for protective puts and hedging. The athleisure brand’s stock has struggled mightily in 2025, down 56% year-to-date. Right now, the stock’s simply trying to find a floor.

I’m not a technical analyst, but there appear to have been two instances in the past six months when the stock gapped down: June 2025 and September 2025, both after earnings announcements. It reports Q3 2025 earnings on Dec. 4. Will we see a third? I don’t know, but that’s probably why investors would be doing a protective put of this duration.

Having said that, if you’re like me and believe that Lululemon will ultimately return to the $300s once it regains investors' trust, the idea of selling the $350 put deep ITM is an interesting one.

Based on the information from above, the premium is $176.25, or 103.9% of yesterday’s closing price. Of course, deep ITM means you’ll likely have to buy 100 shares at $350 come January. Right now, your net cost for 100 shares is $173.75, 2.4% above its current share price.

Imagine that LULU delivers strong earnings in early December and the share price bounces up to $200 by January. You’re looking at a $26.25 profit [$200 share price - $350 strike price + $176.25 bid price]. That’s a 15.5% return or 88.4% annualized.

What happens instead if the share price falls by $30 by expiration? Your net cost goes from $173.75 to $210.34 [$350 strike - new share price of $139.66 + $176.25 bid price], 24.0% above its current share price. If you didn’t sell the put and just bought the shares for $169.66, your $30 loss would be a negative return of 17.7%, slightly better.

Do you feel lucky?

Constellation Brands (STZ)

Constellation Brands (STZ) had two puts in the top 100.

Like most in the alcohol beverage industry, Constellation has taken it on the chin in the past year. STZ stock is down over 46%, 8% in the past month alone. Like LULU, it’s struggling to find a bottom. Over the past five years, they’ve both declined significantly, even as the S&P 500 has gained 88%.

Can you say falling knife? Unsurprisingly, the Barchart Technical Opinion is Strong Sell. It is currently a Moderate Buy (3.83 out of 5) according to the 24 analysts covering STZ stock. The target price of $170.45 is 31.4% above its current share price.

As you can see by the two puts, the $210 put strike is 61.92% ITM, while the $270 is a whopping 108.19% ITM. The latter would have to more than double in the next 64 days. That isn’t happening.

Between the two strike prices, the average trade size yesterday was 722.5, hardly the stuff of investment clubs or meme stocks. These were big fish. Like LULU, these investors could have been doing protective puts, but there are two sides to each trade, so the other side would have been betting that the floor was near.

In the LULU example, I used a theoretical example where its share price increased by 18% by expiration. Let’s do the same for STZ.

Suppose STZ bounces up 18% to $153.03 by January 16. The $210 put would be a $21.23 profit [$153.03 share price - $210 strike price + $78.20 bid price], and wouldn’t you know it, a profit of $21.23 for the $270 put [$153.03 share price - $270 strike price + $138.20 bid price]. That’s annualized returns of 93.5%.

If the share price remains flat until expiration, both puts would have a net cost of $13,180 for the 100 STZ shares, 1.6% above yesterday's $129.69 closing price. If I were selling rather than buying, I’d go with the $210 put strike.

That said, neither has any chance of reaching their strike prices over the next 64 days.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Michael Burry Warned That the AI Bubble Is About to Burst. If You Agree, Use Options to Bet Against These 2 Stocks.

- These 3 Unusually Active Puts Deep ITM Offer Strategic Plays for Both Bulls and Bears

- Cisco Delivered Strong, But Lower Free Cash Flow and FCF Margins - Has CSCO Stock Peaked?

- These 2 ETFs May Be the Best-Kept Secrets on Wall Street