In 2025, a handful of small-cap growth stocks saw massive rebounds as consumer spending held up and select tech-enabled retailers outperformed. U.S. e‑commerce holiday sales are expected to rise 7% to 9% this year, reflecting resilient demand. Within this environment, discount and resale platforms have thrived.

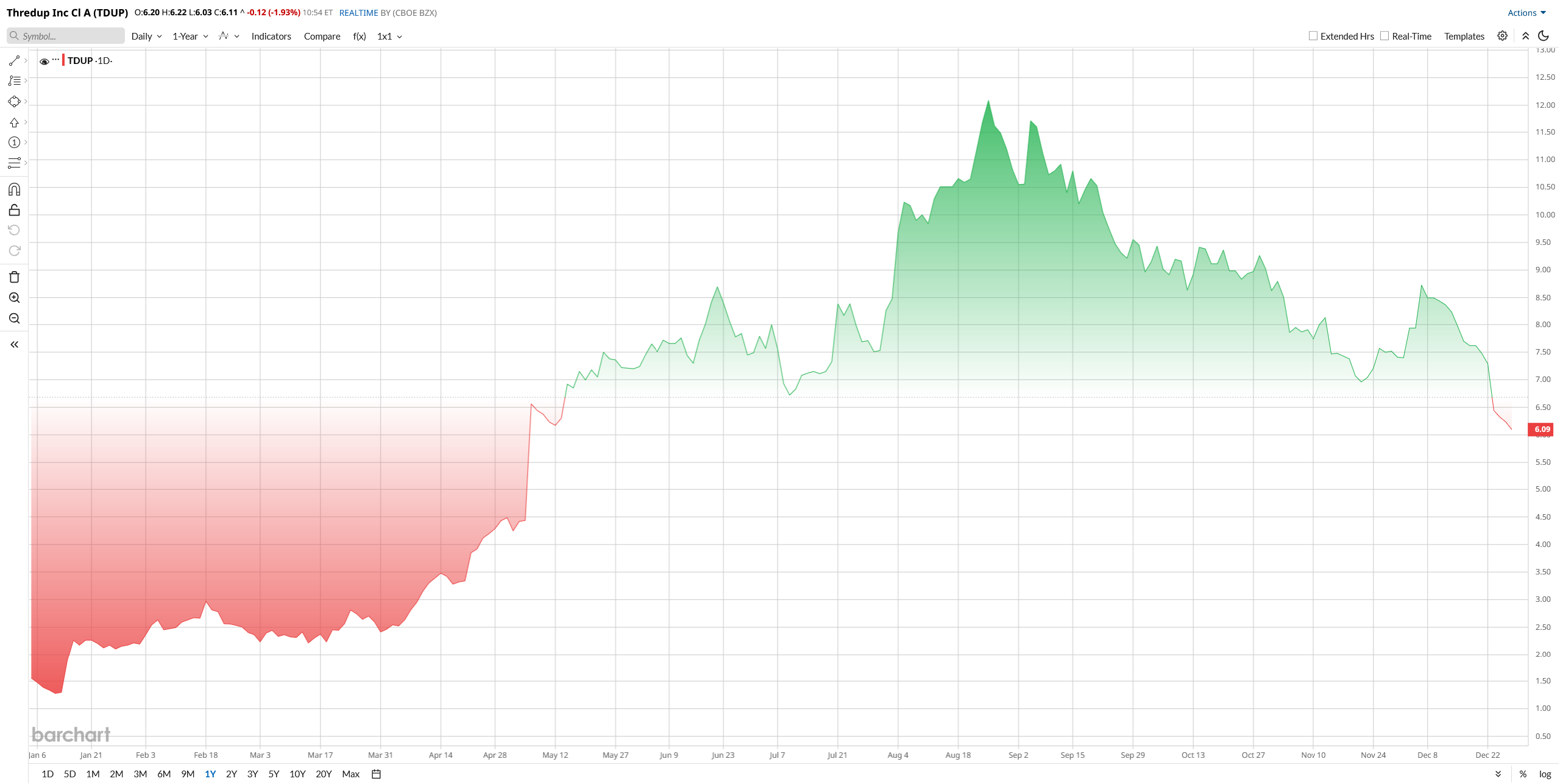

One of the most surprising winners in 2025 has been ThredUp (TDUP), a secondhand apparel platform that has quietly transformed itself from a cash-burning niche retailer into a fast-improving resale infrastructure business. Shares of ThredUp have surged roughly 340% this year as investors reassessed its improving revenue trends, expanding margins, and path toward profitability.

With accelerating growth, rising shopper activity, and expectations for its first profitable quarter, ThredUp is now back on the radar as a potential long-term compounder. The big question heading into 2026 is whether this rally still has room to run or if most of the upside is already priced in. Below, I take a closer look at what’s driving the turnaround and whether TDUP stock can keep delivering for growth-focused investors.

About ThredUp Stock

Founded in 2009, ThredUp is among the world’s largest online marketplaces for secondhand women’s and children’s apparel. It operates a tech-enabled consignment model: consumers send in used clothes to the company’s warehouses, and ThredUp sells the items, often at 50% to 90% off retail. The platform also powers “Resale-as-a-Service” for brands, allowing retailers to run their own thrift channels. This unique circular-business approach, combined with ThredUp’s AI-driven curation tools, sets it apart from traditional retailers.

Valued at $780 million by market cap, ThredUp’s stock has been on an astonishing ride. From about $1.4 per share in early January 2025, it traded around $6.2 by late December, a gain of 339% year-to-date (YTD). This surge far outpaces most peers. The stock’s performance reflects renewed investor confidence in ThredUp’s underlying business after years of underperformance.

But while the stock’s momentum is undeniable, valuation paints a more nuanced picture. On a sales basis, ThredUp appears cheap relative to Internet retail peers. The stock trades at only 2.6× trailing price/sales and an EV/sales of 2.7×, well below the 4× median for consumer companies. However, profitability metrics tell a different story. Its forward EV/EBITDA multiple is sky-high at 48.5×, reflecting lofty growth expectations and the current unprofitable status.

Consumer Trends and Governance Support Sentiment

ThredUp’s recent developments have helped reinforce an increasingly bullish tone among investors. In early November, the company released a holiday spending report indicating that consumers plan to allocate close to 40% of their seasonal apparel budgets to secondhand clothing, up from roughly 30% a year earlier. The data reinforced the view that resale is becoming a mainstream shopping behavior rather than a niche trend.

Around the same time, ThredUp strengthened its governance profile by adding seasoned finance executive Kelly Bodnar Battles to its board as audit committee chair, signaling a sharper focus on financial discipline as the business scales.

Operationally, momentum has been building. In the third quarter of 2025, ThredUp reported revenue of $82.2 million, up 34% year-over-year (YoY), driven by record order volumes and strong new-buyer acquisition. Gross margins remained elevated near 79%, while losses narrowed meaningfully. Adjusted EBITDA turned positive, free cash flow improved, and the company ended the quarter with over $56 million in cash.

Management also raised its outlook, guiding fourth-quarter revenue to $76 to 78 million and full-year 2025 revenue to $307 to 309 million, modestly above prior expectations.

Analysts' Opinion and Outlook on TDUP Stock

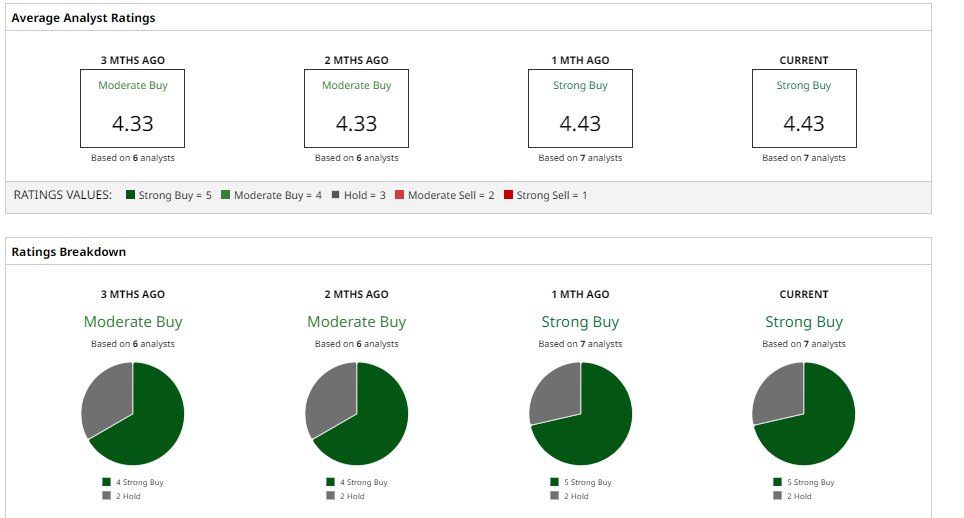

TDUP stock has received a significantly improved perception on Wall Street with a consensus “Strong Buy” rating. Analysts have reinstated or given their bullish ratings since the company is growing at a faster rate and is enjoying better profitability. Numerous analysts are forecasting price targets of around $12 and are implying that prices can increase by 100% from current levels.

This optimism, however, comes with increased expectations. The management anticipates low-to-mid single-digit growth in revenues in the year 2026, which will mark a slower growth in expansion compared to the sharp increase of 2025. Investors will observe whether the customer acquisition increases, upgrades of platforms, and operational efficiencies can boost results even higher than the conservative assumptions. In the long term, the management models anticipate adjusted EBITDA margins of approximately 20–25, which would require continued scale benefits and cost restraint.

The stakes are high. The successful surge of ThredUp has put valuation playing fields on high stakes, and there can be only a few mistakes. Prolonged implementation might merit existing multiplication and encourage further growth, yet a decline would have investors reevaluate the high hopes attached to the stock.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart