Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Sunrun (NASDAQ: RUN) and the best and worst performers in the renewable energy industry.

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

The 17 renewable energy stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 5.8% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 1.9% on average since the latest earnings results.

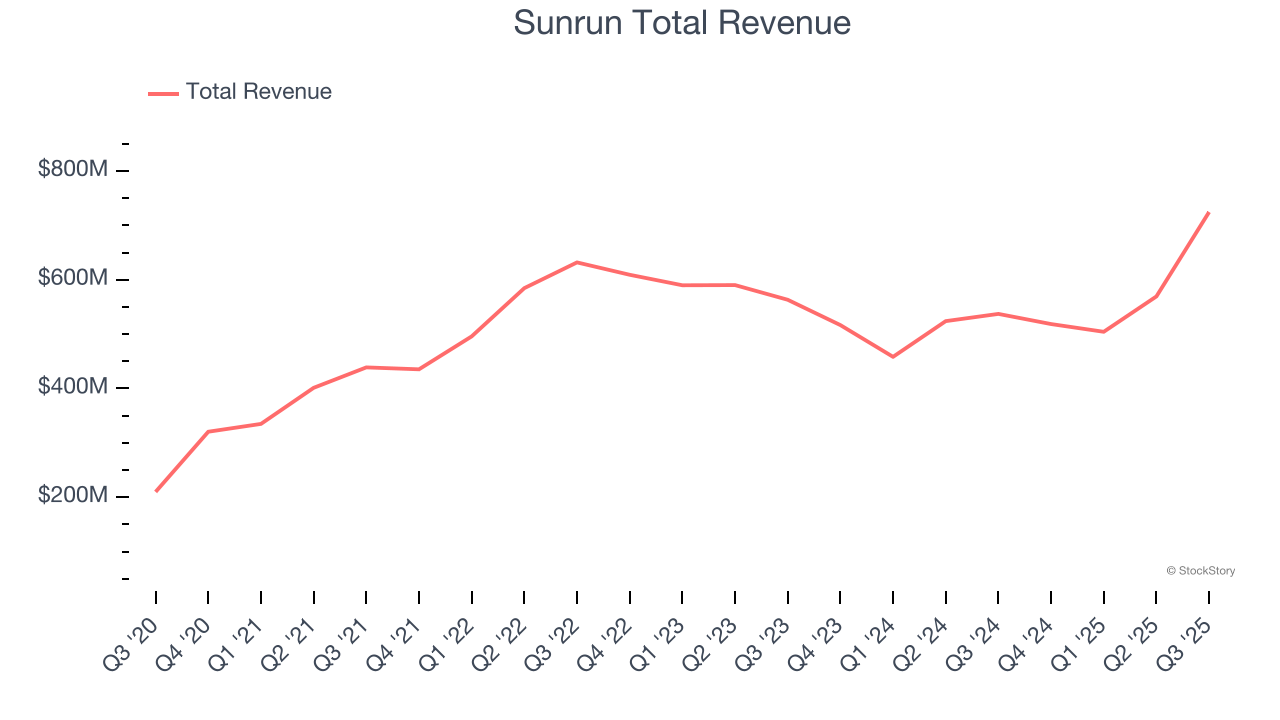

Sunrun (NASDAQ: RUN)

Helping homeowners use solar energy to power their homes, Sunrun (NASDAQ: RUN) provides residential solar electricity, specializing in panel installation and leasing services.

Sunrun reported revenues of $724.6 million, up 34.9% year on year. This print exceeded analysts’ expectations by 22.4%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ customer base estimates and a solid beat of analysts’ EBITDA estimates.

“Our strategic focus on providing Americans a way to achieve energy independence is yielding strong results. We are generating cash while growing our customer base at a healthy rate. We are continuing to lead the industry with superior energy offerings for our customers, allowing them to power through grid outages and protect their households from rising energy costs, while we are also building critical energy infrastructure the country needs as energy demand grows at a rapid rate,” said Mary Powell, Sunrun’s Chief Executive Officer.

Unsurprisingly, the stock is down 12.8% since reporting and currently trades at $17.82.

Is now the time to buy Sunrun? Access our full analysis of the earnings results here, it’s free.

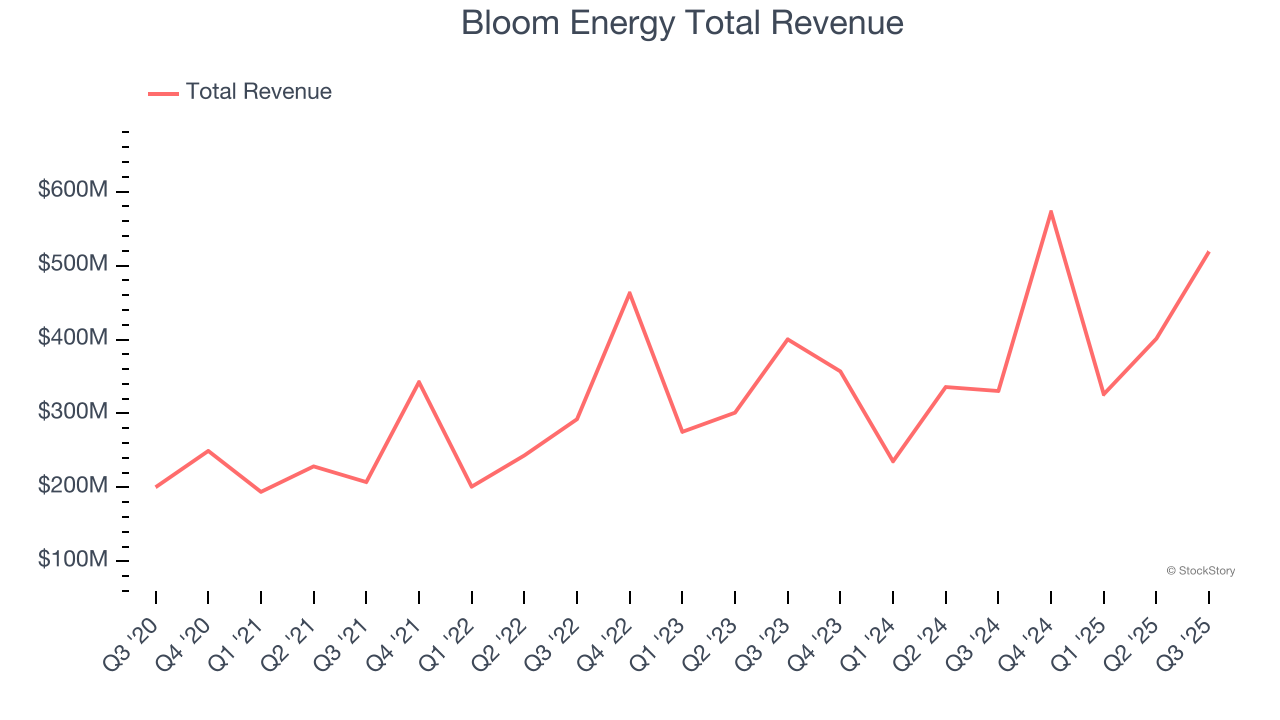

Best Q3: Bloom Energy (NYSE: BE)

Working in stealth mode for eight years, Bloom Energy (NYSE: BE) designs, manufactures, and markets solid oxide fuel cell systems for on-site power generation.

Bloom Energy reported revenues of $519 million, up 57.1% year on year, outperforming analysts’ expectations by 22.8%. The business had an incredible quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 34.3% since reporting. It currently trades at $152.17.

Is now the time to buy Bloom Energy? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Generac (NYSE: GNRC)

With its name deriving from a combination of “generating” and “AC”, Generac (NYSE: GNRC) offers generators and other power products for residential, industrial, and commercial use.

Generac reported revenues of $1.11 billion, down 5% year on year, falling short of analysts’ expectations by 6.6%. It was a disappointing quarter as it posted a miss of analysts’ Residential revenue estimates and a significant miss of analysts’ revenue estimates.

As expected, the stock is down 8.1% since the results and currently trades at $174.75.

Read our full analysis of Generac’s results here.

Shoals (NASDAQ: SHLS)

Started in Huntsville, Alabama, Shoals (NASDAQ: SHLS) designs and manufactures products that make solar energy systems work more efficiently.

Shoals reported revenues of $135.8 million, up 32.9% year on year. This print surpassed analysts’ expectations by 3.6%. It was a strong quarter as it also produced a solid beat of analysts’ revenue estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is down 12.5% since reporting and currently trades at $9.05.

Read our full, actionable report on Shoals here, it’s free.

Enphase (NASDAQ: ENPH)

The first company to successfully commercialize the solar micro-inverter, Enphase (NASDAQ: ENPH) manufactures software-driven home energy products.

Enphase reported revenues of $410.4 million, up 7.8% year on year. This number topped analysts’ expectations by 12%. Overall, it was a strong quarter as it also put up a beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is down 2.1% since reporting and currently trades at $36.04.

Read our full, actionable report on Enphase here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.