The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Revolve (NYSE: RVLV) and the rest of the online retail stocks fared in Q2.

Consumers ever rising demand for convenience, selection, and speed are secular engines underpinning ecommerce adoption. For years prior to Covid, ecommerce penetration as a percentage of overall retail would grow 1-2% annually, but in 2020 adoption accelerated by 5%, reaching 25%, as increased emphasis on convenience drove consumers to structurally buy more online. The surge in buying caused many online retailers to rapidly grow their logistics infrastructures, preparing them for further growth in the years ahead as consumer shopping habits continue to shift online.

The 6 online retail stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 3.4% while next quarter’s revenue guidance was 0.5% below.

Thankfully, share prices of the companies have been resilient as they are up 6.9% on average since the latest earnings results.

Revolve (NYSE: RVLV)

Launched in 2003 by software engineers Michael Mente and Mike Karanikolas, Revolve (NASDAQ: RVLV) is a fashion retailer leveraging social media and a community of fashion influencers to drive its merchandising strategy.

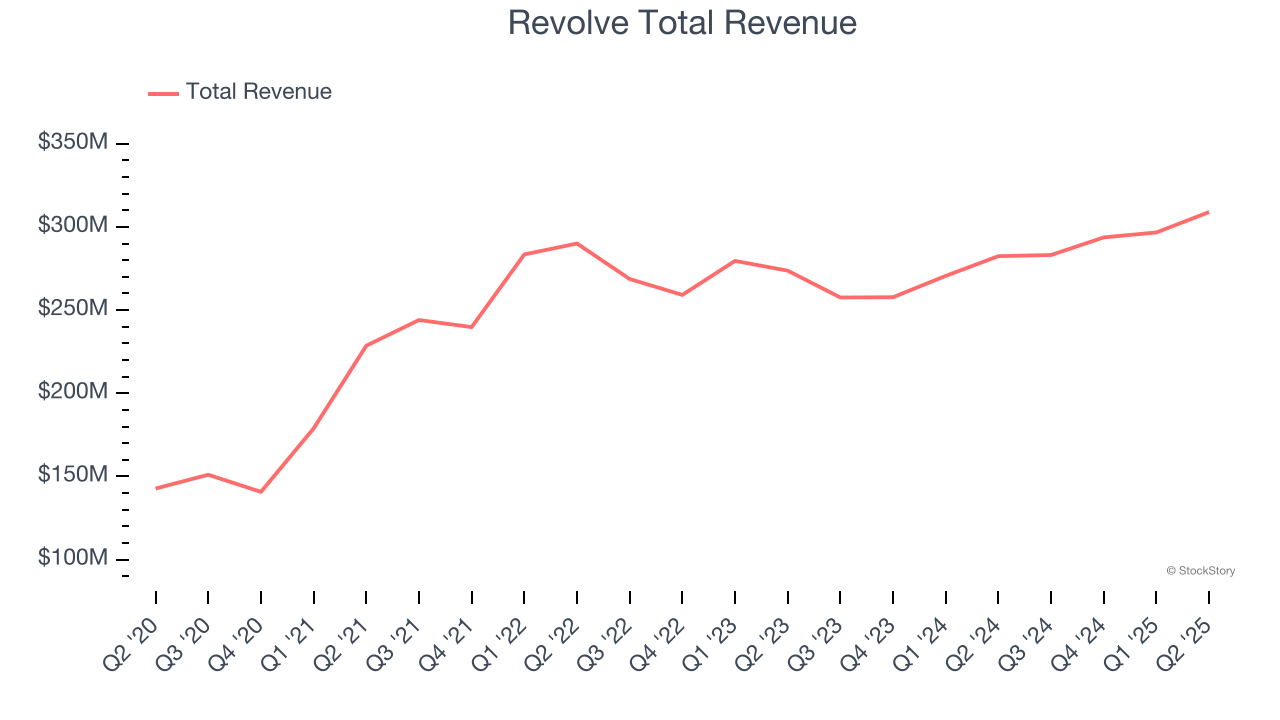

Revolve reported revenues of $309 million, up 9.4% year on year. This print exceeded analysts’ expectations by 3.7%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and a narrow beat of analysts’ number of active customers estimates.

"Our ability to deliver profitable growth and market share gains in the second quarter, while at the same time continuing to invest in exciting long-term growth drivers, is a true reflection of the platform we have built, our operating excellence, and the team's ability to execute," said co-founder and co-CEO Michael Mente.

Interestingly, the stock is up 10.3% since reporting and currently trades at $22.78.

Is now the time to buy Revolve? Access our full analysis of the earnings results here, it’s free.

Best Q2: Carvana (NYSE: CVNA)

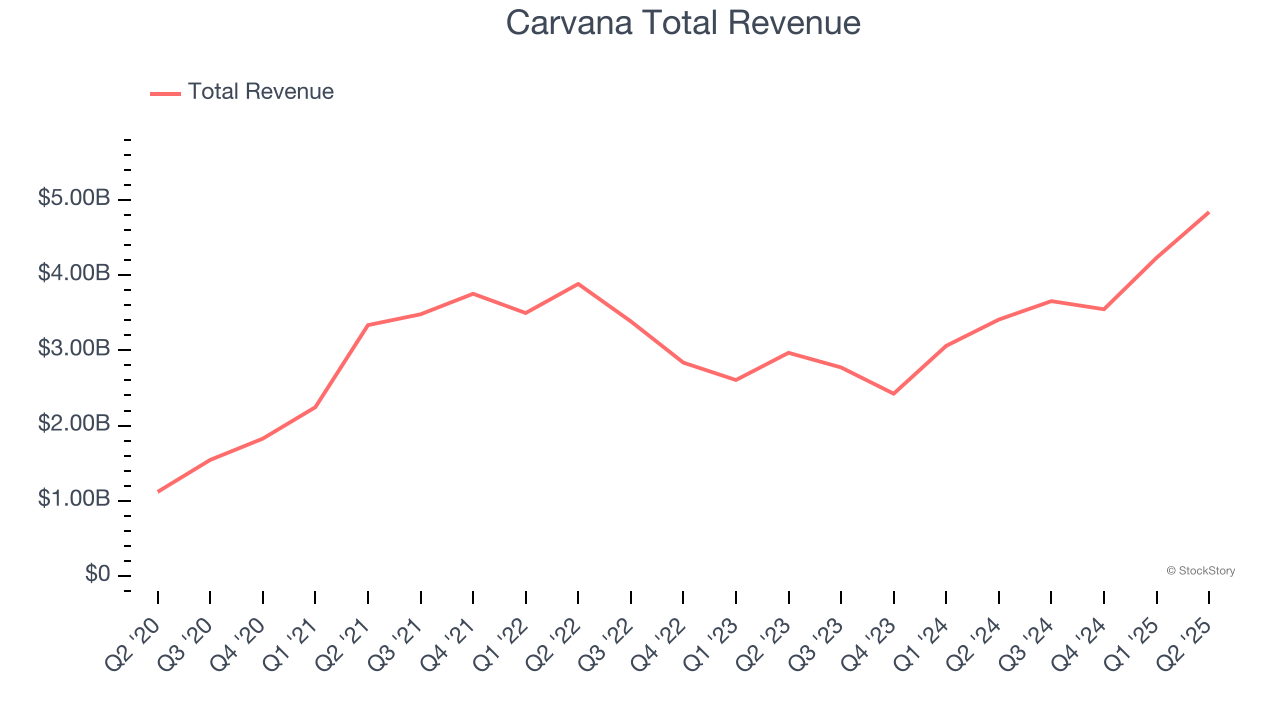

Known for its glass tower car vending machines, Carvana (NYSE: CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

Carvana reported revenues of $4.84 billion, up 41.9% year on year, outperforming analysts’ expectations by 5.7%. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates.

Carvana achieved the biggest analyst estimates beat and fastest revenue growth among its peers. The company reported 143,280 units sold, up 41.2% year on year. The market seems happy with the results as the stock is up 8.2% since reporting. It currently trades at $361.

Is now the time to buy Carvana? Access our full analysis of the earnings results here, it’s free.

Slowest Q2: Wayfair (NYSE: W)

Founded in 2002 by Niraj Shah, Wayfair (NYSE: W) is a leading online retailer of mass-market home goods in the US, UK, Canada, and Germany.

Wayfair reported revenues of $3.27 billion, up 5% year on year, exceeding analysts’ expectations by 4.8%. Still, it was a mixed quarter as it posted a significant miss of analysts’ number of active customers estimates.

Wayfair delivered the slowest revenue growth in the group. The company reported 21 million active buyers, down 4.5% year on year. Interestingly, the stock is up 34.3% since the results and currently trades at $87.60.

Read our full analysis of Wayfair’s results here.

Coupang (NYSE: CPNG)

Founded in 2010 by Harvard Business School student Bom Kim, Coupang (NYSE: CPNG) is an e-commerce giant often referred to as the "Amazon of South Korea".

Coupang reported revenues of $8.52 billion, up 16.4% year on year. This number topped analysts’ expectations by 2.1%. Overall, it was a very strong quarter as it also put up a solid beat of analysts’ EBITDA estimates.

The company reported 24.1 million active buyers, up 9.4% year on year. The stock is up 8.6% since reporting and currently trades at $32.50.

Read our full, actionable report on Coupang here, it’s free.

Amazon (NASDAQ: AMZN)

Founded by Jeff Bezos after quitting his stock-picking job at D.E. Shaw, Amazon (NASDAQ: AMZN) is the world’s largest online retailer and provider of cloud computing services.

Amazon reported revenues of $167.7 billion, up 13.3% year on year. This result surpassed analysts’ expectations by 3.4%. It was a strong quarter as it also logged an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ operating income estimates.

The stock is down 2.5% since reporting and currently trades at $228.28.

Read our full, actionable report on Amazon here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.