Wrapping up Q2 earnings, we look at the numbers and key takeaways for the home construction materials stocks, including JELD-WEN (NYSE: JELD) and its peers.

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

The 10 home construction materials stocks we track reported a strong Q2. As a group, revenues missed analysts’ consensus estimates by 0.7% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 6.5% on average since the latest earnings results.

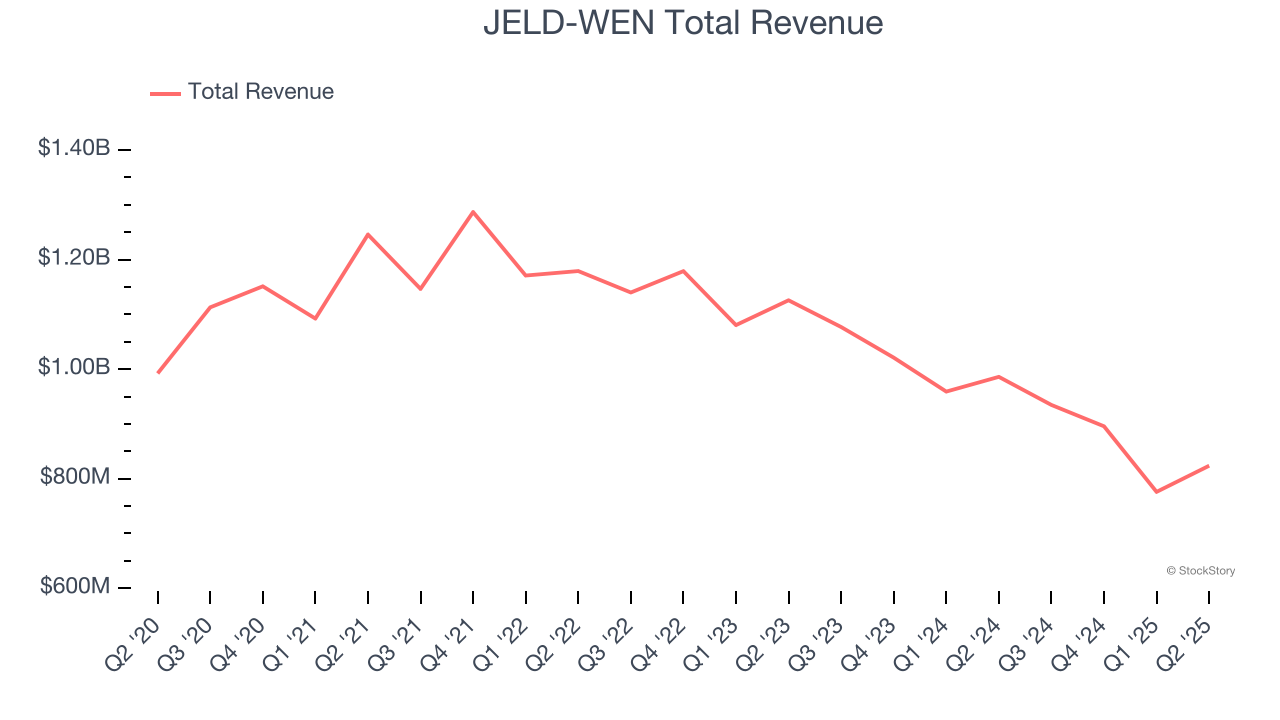

JELD-WEN (NYSE: JELD)

Founded in the 1960s as a general wood-making company, JELD-WEN (NYSE: JELD) manufactures doors, windows, and other related building products.

JELD-WEN reported revenues of $823.7 million, down 16.5% year on year. This print exceeded analysts’ expectations by 1.7%. Overall, it was an exceptional quarter for the company with a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

"While the second quarter brought continued challenges, we managed the uncertainty effectively, delivering cost reductions across the business," said Chief Executive Officer William J. Christensen.

JELD-WEN scored the highest full-year guidance raise but had the slowest revenue growth of the whole group. Unsurprisingly, the stock is up 26.6% since reporting and currently trades at $5.88.

Is now the time to buy JELD-WEN? Access our full analysis of the earnings results here, it’s free.

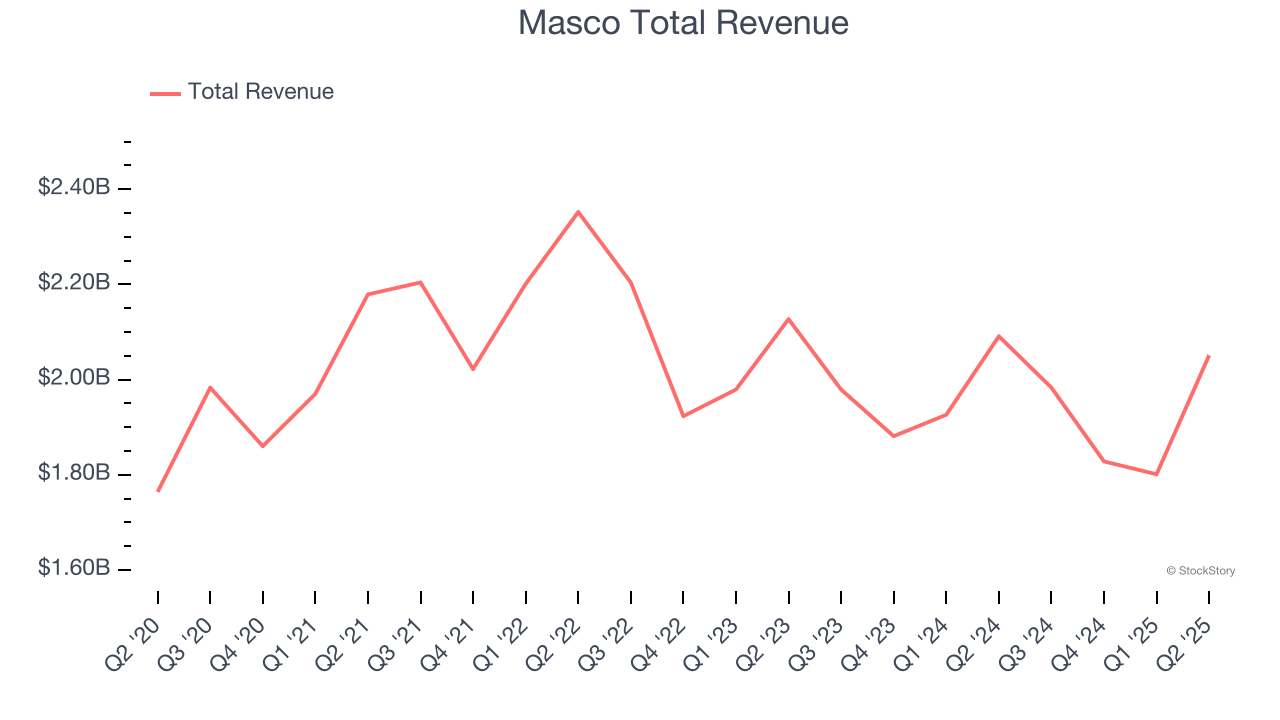

Best Q2: Masco (NYSE: MAS)

Headquartered just outside of Detroit, MI, Masco (NYSE: MAS) designs and manufactures home-building products such as glass shower doors, decorative lighting, bathtubs, and faucets.

Masco reported revenues of $2.05 billion, down 1.9% year on year, outperforming analysts’ expectations by 2.5%. The business had a stunning quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ adjusted operating income estimates.

The market seems happy with the results as the stock is up 11.8% since reporting. It currently trades at $73.52.

Is now the time to buy Masco? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Gibraltar (NASDAQ: ROCK)

Gibraltar (NASDAQ: ROCK) makes renewable energy, agriculture technology and infrastructure products. Its mission statement is to make everyday living more sustainable.

Gibraltar reported revenues of $309.5 million, up 13.1% year on year, falling short of analysts’ expectations by 17.9%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

Gibraltar delivered the fastest revenue growth but had the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 3.5% since the results and currently trades at $62.08.

Read our full analysis of Gibraltar’s results here.

Griffon (NYSE: GFF)

Initially in the defense industry, Griffon (NYSE: GFF) is a now diversified company specializing in home improvement, professional equipment, and building products.

Griffon reported revenues of $613.6 million, down 5.3% year on year. This result lagged analysts' expectations by 5.6%. It was a slower quarter as it also produced full-year revenue guidance missing analysts’ expectations and a miss of analysts’ EBITDA estimates.

The stock is down 11.8% since reporting and currently trades at $72.64.

Read our full, actionable report on Griffon here, it’s free.

Builders FirstSource (NYSE: BLDR)

Headquartered in Irving, TX, Builders FirstSource (NYSE: BLDR) is a construction materials manufacturer that offers a variety of lumber and lumber-related building products.

Builders FirstSource reported revenues of $4.23 billion, down 5% year on year. This print came in 0.7% below analysts' expectations. Overall, it was a slower quarter as it also logged a miss of analysts’ Windows, doors & millwork revenue estimates and full-year revenue guidance missing analysts’ expectations significantly.

The stock is up 9.6% since reporting and currently trades at $138.18.

Read our full, actionable report on Builders FirstSource here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.