Footwear company Crocs (NASDAQ: CROX) reported Q4 CY2024 results topping the market’s revenue expectations, with sales up 3.1% year on year to $989.8 million. On the other hand, next quarter’s revenue guidance of $905.8 million was less impressive, coming in 2.3% below analysts’ estimates. Its non-GAAP profit of $2.52 per share was 11.3% above analysts’ consensus estimates.

Is now the time to buy Crocs? Find out by accessing our full research report, it’s free.

Crocs (CROX) Q4 CY2024 Highlights:

- Revenue: $989.8 million vs analyst estimates of $962.6 million (3.1% year-on-year growth, 2.8% beat)

- Adjusted EPS: $2.52 vs analyst estimates of $2.26 (11.3% beat)

- Adjusted EBITDA: $250.9 million vs analyst estimates of $202.1 million (25.4% margin, 24.2% beat)

- Revenue Guidance for Q1 CY2025 is $905.8 million at the midpoint, below analyst estimates of $926.7 million

- Adjusted EPS guidance for the upcoming financial year 2025 is $12.93 at the midpoint, beating analyst estimates by 2.7%

- Operating Margin: 20.2%, down from 21.8% in the same quarter last year

- Free Cash Flow Margin: 30.7%, down from 33.4% in the same quarter last year

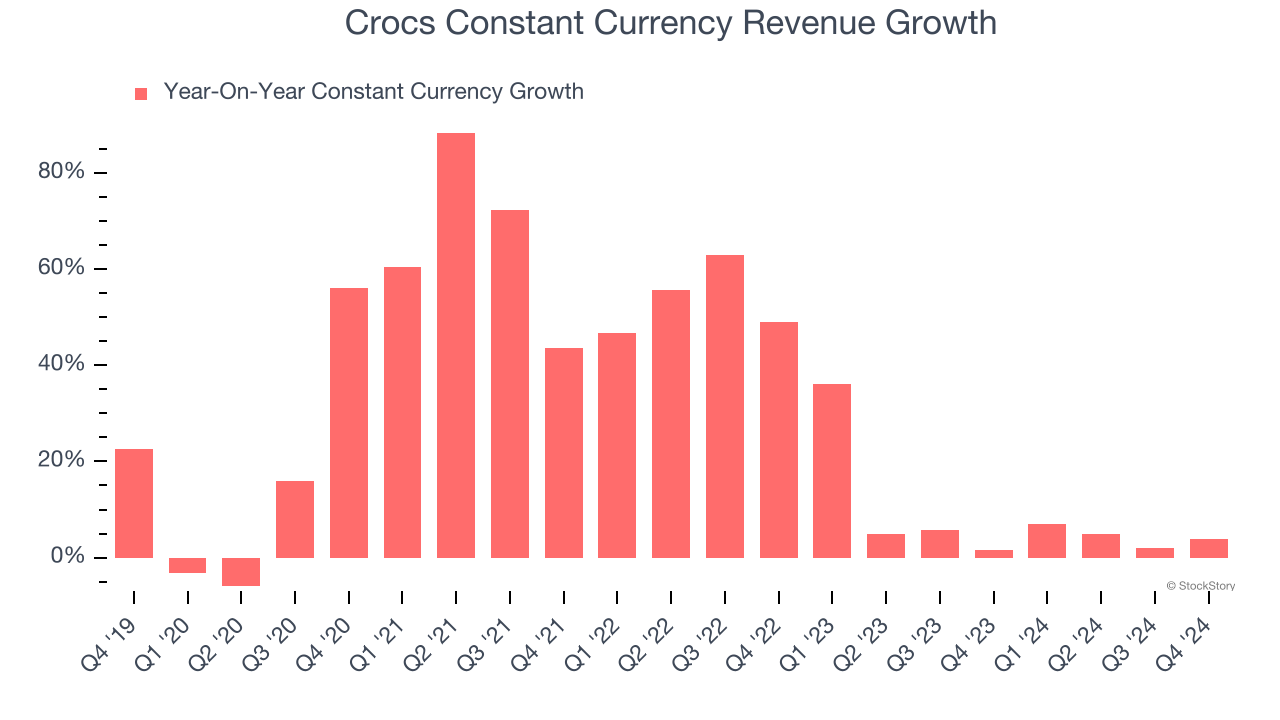

- Constant Currency Revenue rose 3.8% year on year (1.5% in the same quarter last year)

- Market Capitalization: $5.18 billion

"We delivered another record year for Crocs, Inc. highlighted by revenue growth of 4% to $4.1 billion and adjusted earnings-per-share growth of 9%. We generated exceptional operating cash flow of approximately $990 million, which enabled us to return value to shareholders through more than $550 million in share repurchases, while fortifying our balance sheet through the pay down of approximately $320 million of debt," said Andrew Rees, Chief Executive Officer.

Company Overview

Founded in 2002, Crocs (NASDAQ: CROX) sells casual footwear and is known for its iconic clog shoe.

Footwear

Before the advent of the internet, styles changed, but consumers mainly bought shoes by visiting local brick-and-mortar shoe, department, and specialty stores. Today, not only do styles change more frequently as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some footwear companies have made concerted efforts to adapt while those who are slower to move may fall behind.

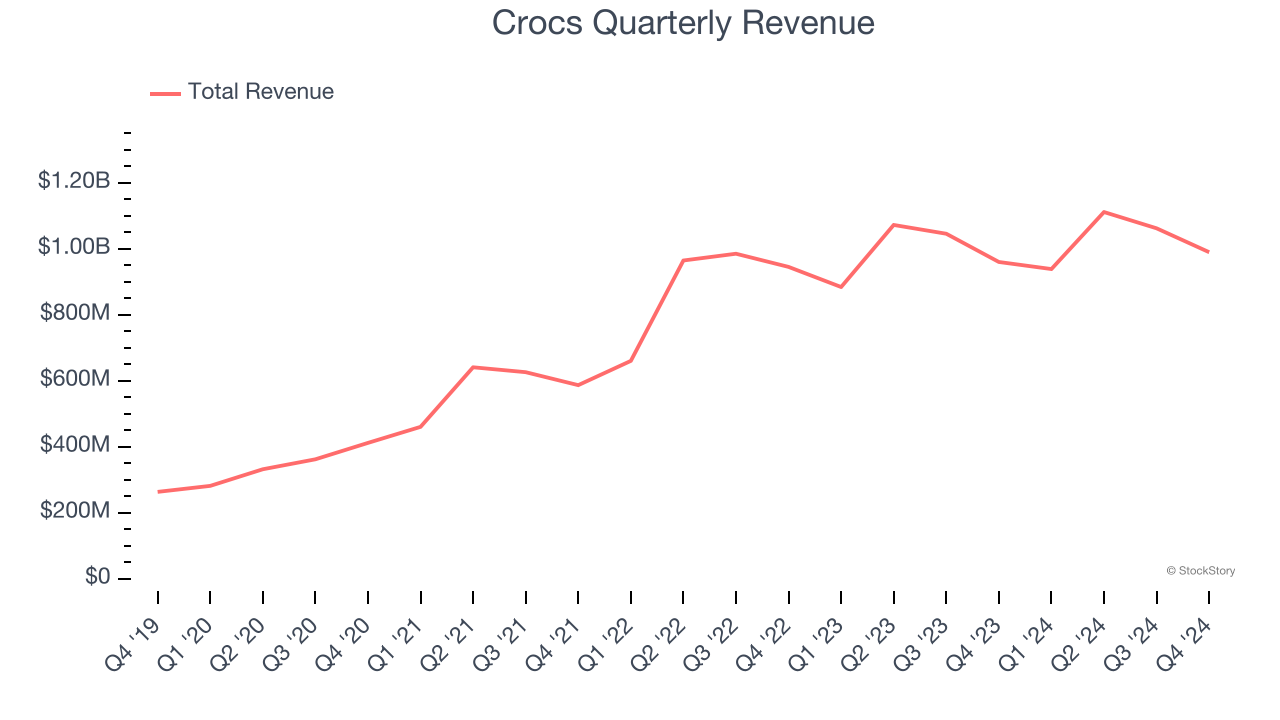

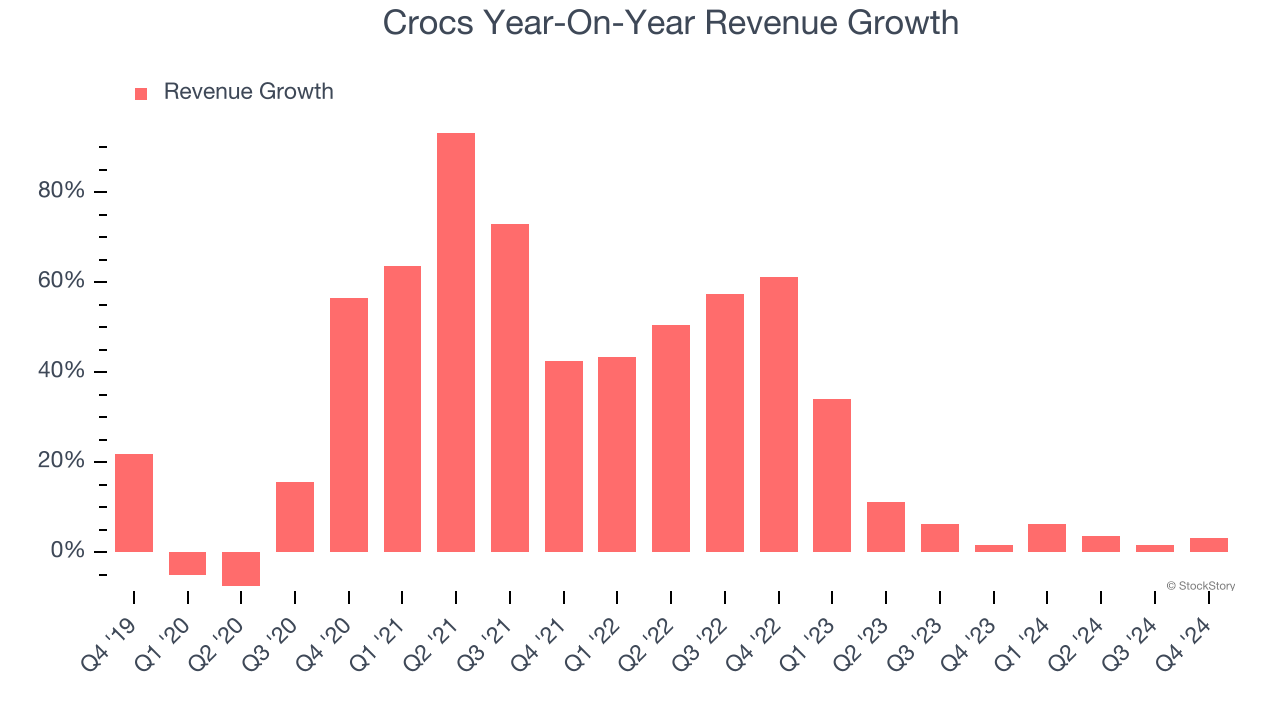

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Luckily, Crocs’s sales grew at an exceptional 27.2% compounded annual growth rate over the last five years. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Crocs’s recent history shows its demand slowed significantly as its annualized revenue growth of 7.4% over the last two years is well below its five-year trend.

We can dig further into the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 8.2% year-on-year growth. Because this number aligns with its normal revenue growth, we can see Crocs’s foreign exchange rates have been steady.

This quarter, Crocs reported modest year-on-year revenue growth of 3.1% but beat Wall Street’s estimates by 2.8%. Company management is currently guiding for a 3.5% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.5% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

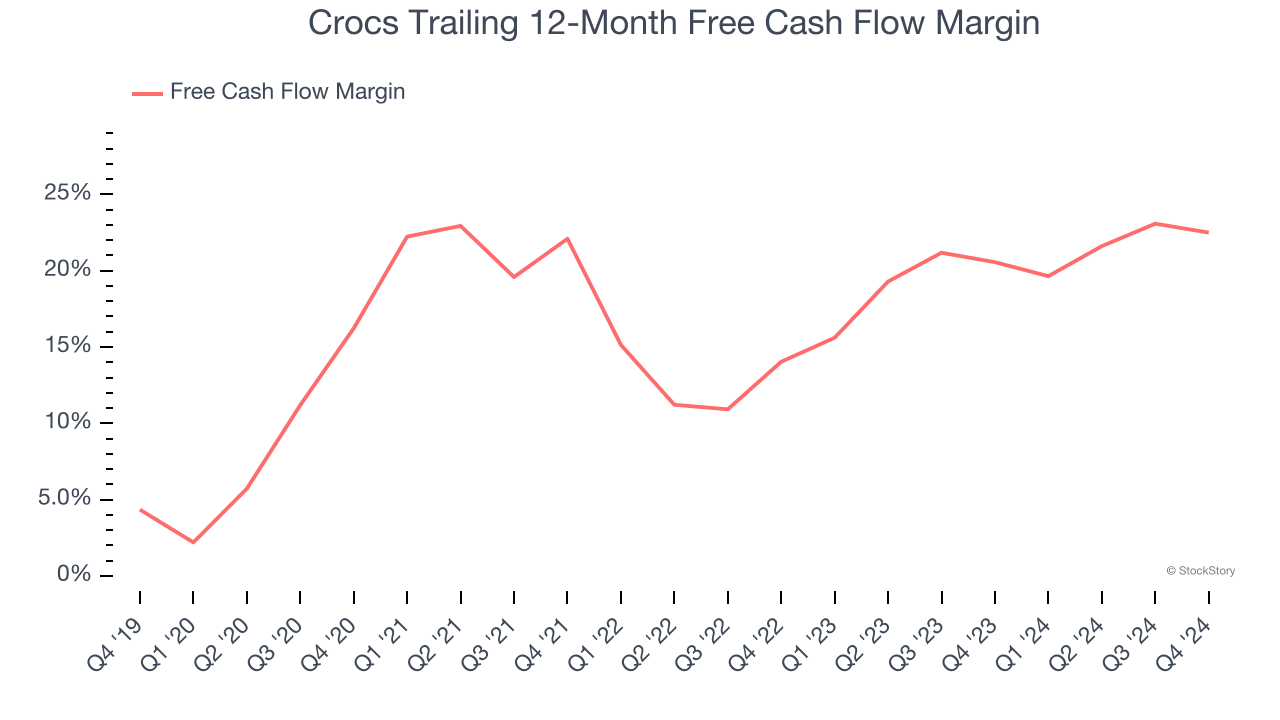

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Crocs has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 21.6% over the last two years, quite impressive for a consumer discretionary business.

Crocs’s free cash flow clocked in at $303.4 million in Q4, equivalent to a 30.7% margin. The company’s cash profitability regressed as it was 2.7 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

Over the next year, analysts predict Crocs’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 22.5% for the last 12 months will decrease to 19.7%.

Key Takeaways from Crocs’s Q4 Results

We were impressed by how significantly Crocs blew past analysts’ constant currency revenue expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. While the company's revenue guidance for next quarter missed, its full-year EPS guidance for the full year exceeded Wall Street’s estimates. Overall, this quarter wasn't perfect but was quite solid. The stock traded up 17.1% to $103.99 immediately after reporting.

Crocs put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.