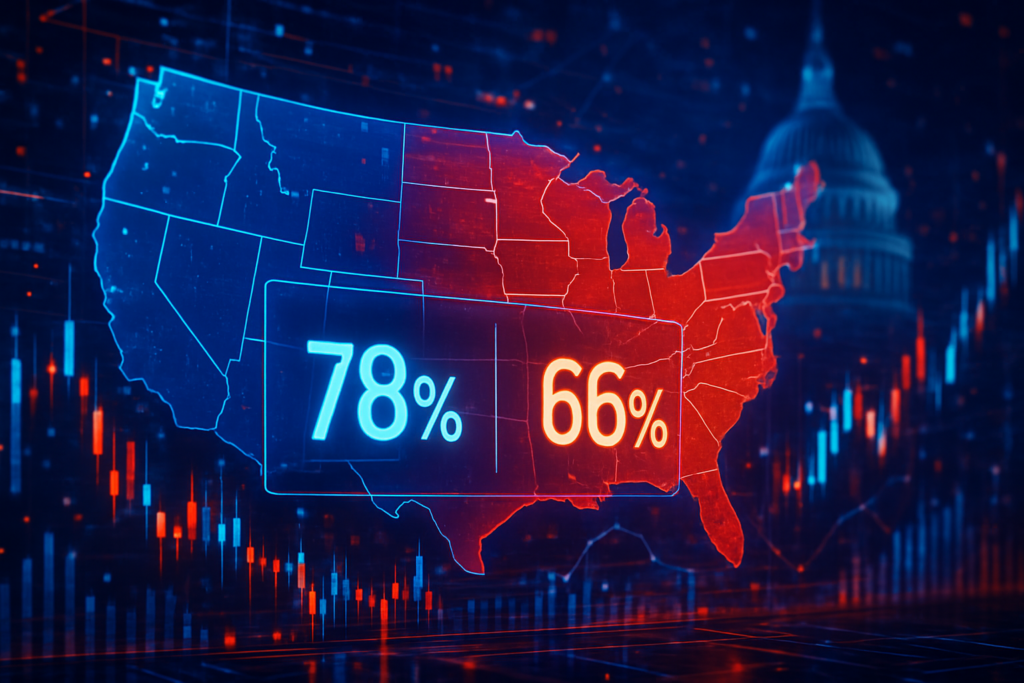

As the calendar turns to February 2026, the United States is bracing for a political showdown that promises to be as much a financial event as a democratic one. The 2026 U.S. Midterm Elections are already generating unprecedented activity in the prediction market space, with traders pouring billions of dollars into contracts determining the future control of the 119th Congress. Currently, the "Balance of Power" markets show a high probability of a divided government, with Democrats holding a commanding 78% chance of flipping the House of Representatives, while Republicans maintain a 66–68% lead to keep the Senate.

This surge in interest is more than just political speculation; it represents the maturation of "Information Finance," or InfoFi. For the first time, prediction markets are not just side-bets for political junkies but are functioning as a primary source of real-time probability data for news networks and institutional investors alike. Weekly notional volume across major platforms recently hit a staggering $6.32 billion, signaling that the 2026 midterms will likely be the highest-volume event in the history of the industry.

The Market: What's Being Predicted

The core of the 2026 prediction frenzy revolves around the control of the two legislative chambers. On Kalshi, the first fully regulated U.S. exchange for such contracts, the "Democratic House Control" contract is trading at 78¢, implying a near-certainty among traders of a "midterm correction." Meanwhile, Polymarket, the decentralized heavyweight that recently secured a massive $2 billion investment from the Intercontinental Exchange, Inc. (NYSE: ICE), shows a more contested but still favorable outlook for a Democratic House.

The Senate remains the primary battleground for Republican defense. On PredictIt—which recently underwent a "Grand Relaunch" under the Aristotle Exchange with higher investment limits—Republican Senate control is priced at 67¢. This divergence between the House and Senate forecasts suggests that traders expect a legislative stalemate starting in 2027. Liquidity has never been higher; individual contracts for the "Balance of Power" have already surpassed $500,000 in volume on Kalshi, while the total open interest across all political markets is approaching record highs.

Why Traders Are Betting

The massive volume is being driven by a combination of retail enthusiasm and sophisticated institutional hedging. Many traders are using these markets to protect their portfolios against potential shifts in tax policy and regulatory oversight that would accompany a change in House leadership. The entry of Interactive Brokers Group, Inc. (NASDAQ: IBKR) through its ForecastEx platform has provided a bridge for institutional players to enter the space, capturing roughly 12% of the institutional market share by early 2026.

Beyond hedging, the "InfoFi" movement has turned political outcomes into a new asset class. Notable "whale" activity has been spotted on Polymarket, where large positions are being taken on specific swing-state Senate races. These traders are often betting against traditional polling, which many in the prediction community view as slower and more prone to bias than a market with "skin in the game." The decentralized nature of Polymarket allows it to tap into global liquidity, providing a broader, perhaps less American-centric, perspective on U.S. political stability, which often contrasts with the more domestic-focused sentiment on Kalshi.

Broader Context and Implications

The 2026 cycle marks a turning point in the regulatory landscape. Newly appointed CFTC Chairman Michael Selig recently launched the "Future-Proof Initiative," which aimed to eliminate the regulatory uncertainty that plagued the industry during the 2024 cycle. By withdrawing old proposals to ban political betting, the federal government has effectively signaled that prediction markets are here to stay. This has paved the way for Robinhood Markets, Inc. (NASDAQ: HOOD) to dominate the retail sector, processing over 3.0 billion event contracts in late 2025 alone.

However, the rise of these markets has not been without friction. While federal regulators are leaning toward acceptance, state-level conflicts are intensifying. Nevada and Massachusetts have both recently challenged the legality of these platforms under state gambling laws. This ongoing tug-of-war between federal preemption and state enforcement remains a key risk factor for the industry. Despite these hurdles, the historical accuracy of these markets—which famously outperformed polls in several 2024 battlegrounds—has given them a level of credibility that is now attracting interest from even the most traditional financial institutions.

What to Watch Next

As we move deeper into the 2026 primary season, several key milestones will likely shift the current odds. The first major data point will be the fundraising totals for the first quarter of 2026, which often serve as a proxy for candidate viability. Additionally, traders are keeping a close eye on a pending court ruling in Nevada that could determine whether decentralized platforms like Polymarket can continue to operate through U.S.-licensed intermediaries without interference from state gaming commissions.

Market participants should also watch for the expected launch of a native prediction platform by Coinbase Global, Inc. (NASDAQ: COIN) later this year. A Coinbase entry would likely bring a fresh wave of crypto-native liquidity to the midterms, potentially challenging the current dominance of Kalshi and Polymarket. Any significant shifts in inflation data or unemployment figures will also immediately reflect in the House control markets, as economic sentiment remains the strongest historical indicator of midterm results.

Bottom Line

The 2026 Midterm Elections are cementing prediction markets as the ultimate "truth machine" for political forecasting. With $6 billion in weekly volume and the backing of major financial entities like ICE and Interactive Brokers, these platforms have moved beyond the fringes and into the heart of the American financial system. The current consensus of a Democratic House flip and a Republican Senate hold reflects a market that is pricing in a return to legislative gridlock.

Ultimately, the success of these markets in 2026 will tell us whether "InfoFi" is a permanent fixture of the global economy or a temporary bubble. If the markets continue to provide more accurate and timely data than traditional polls, they will likely become the standard by which all future political events are measured. For now, the message from the traders is clear: the political pendulum is swinging, and the smart money is already positioned for the impact.

This article is for informational purposes only and does not constitute financial or betting advice. Prediction market participation may be subject to legal restrictions in your jurisdiction.

PredictStreet focuses on covering the latest developments in prediction markets.

Visit the PredictStreet website at https://www.predictstreet.ai/.