Graphite One (TSXV: GPH | OTC: GPHOF) at current prices is a value-investment opportunity too good to ignore. Frankly, it's a ground-floor opportunity. Now, that term gets used a lot in describing smallcap stocks with potential. However, the reasons justifying the bullish sentiment aren't always front and center. For GPHOF, they are. And the better news is that the company doesn't need to do all the talking. Instead, GPHOF management can steer investors to the U.S. Governments USGS report indicating that smallcap exploration company Graphite One is sitting on the largest graphite deposit ever found. Not just in the United States but in the world.

That's enough reason for investors to be speculatively bullish on GPHOF's prospects. But beyond the blue-sky valuations worthy of sitting atop the asset, it validates the longer-term GPHOF mission. For smallcap explorations, that too can be worth its weight in gold, or in this case, graphite. So far, investors agree, sending GPHOF stock higher by over 36% YTD at $1.08. By the way, while an impressive run, it's about 53% off its 52-week high of $1.65. Ironic is that GPHOF is better positioned today than when it scored that level and has more supporting documentation, including the powerful USGS statements, to show that its move higher is more than deserved; it's the likely precursor of higher highs.

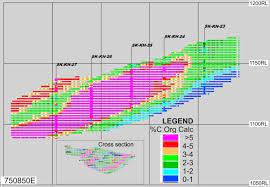

Additional news last week strengthened that case when GPHOF updated resource estimates at its Alaska-based Graphite Creek property. In a published video, GPHOF reported that its ongoing drill and survey programs showed an increase of 15.5% in Measured and Indicated tonnage, with 37.6 million tonnes at 5.14% graphite and an Inferred Resource of 243.7 million tonnes at 5.07% graphite. In simpler terms, the across-the-board estimate increase adds to an already compelling value proposition. And whether on its own or through potential development partnerships, it reinforces the likelihood that the path of GPHOF stock is higher. Appreciably so.

Fortifying Intrinsic Value While Exposing inherent Potential

And more support for the thesis could be forthcoming. Additional planned drill programs this year intend to delineate the scope and size of the resource. Remember, proven assets under the ground strengthen a company's balance sheet. Valuations of most junior metals miners prove that point. Vizsla Silver (NYSE: VZLA) and Arizona Metals Corp (OTC Other: AZMCF) have market caps in the millions based not on what they unearthed but on what they have the potential to do. Newmont (NYSE: NEM) and Couer Mining (NYSE: CDE), also considered "junior," have billion-dollar-plus market caps. Again, much of that valuation is on blue sky potential. GPHOF is indeed worthy of the same appreciation.

While its roughly $122 million market cap is impressive, considering it sits atop a massive pocket of graphite, there could be considerable value yet to be priced. It's fair to say there is. Still, that's not all bad news. Valuation disconnects do more than expose opportunities; they create actionable ones. And with GPHOF continually strengthening precedent with confirmatory drill and survey programs, its next update could justify and, more importantly, support a substantial move higher for its stock.

Remember, not just a few, but every company in the E.V. sector needs what GPHOF is indicated to have plenty of- graphite. The United States is currently 100% import-dependent for natural graphite. That means the interest could be significant as Graphite One continues to complete plans to initiate a complete U.S.-based, advanced graphite supply chain solution anchored by its Graphite Creek resource. And the further GPHOF is along, the more likely its stock price to rise accordingly. In other words, time makes the company more valuable.

And its plan to capitalize is in place. Graphite One is to build an advanced graphite material and battery anode manufacturing plant in Washington State to support project development. The location will have a separate recycling facility to reclaim graphite and other battery materials. The entire build will contribute to GPHOF's intent to be a complete life-cycle contributor to a global circular economy. A final feasibility study will guide the direction of the comprehensive project.

Soaring Global Graphite Demand

Believing GPHOF can be a significant contributor is not an overzealous presumption. Despite its smallcap size, GPHOF is positioning well to feed the demand of one of the most valued commodities to an industry still in relative infancy. Remember, while the E.V. sector is booming, it still has yet to reach all the way down to the mainstream consumer. But it will, especially with E.V. companies like Tesla (NASDAQ; TSLA), Ford (NYSE: F), General Motors (NYSE: G.M.), Mullen Automotive (NASDAQ: MULN), and others focused on bringing MSRP's of vehicles down to the $20,000 level.

The impact of that inclusion can be enormous. The World Bank has estimated graphite production will need to increase by 500% over the next 30 years to meet the demand for battery metals if it continues growing at its current pace. But the current speed is accelerating, so much so that CNBC has predicted that as many as 125 million electric vehicles will be on the road as soon as 2030. Therefore, imagine what that number could look like by 2050 and beyond – and how much graphite will be needed to sustain it.

Remember, it's no secret that the U.S. strongly supports expanding electric vehicle technologies, introducing legislation to incentivize their development and secure essential production components. An over $500 billion infrastructure bill passed in 2022 intends to facilitate building over 500,000 charging stations, with a goal of making at least half of the vehicles on the road electric by 2030. That's not all powering the GPHOF value proposition.

The White House signed an executive order in 2021 to strengthen the nation's reserve of battery metals after the United States Geological Survey categorized graphite as one of the 35 minerals and metals considered critical to the United States. Furthermore, the U.S. Department of Defense stated in 2021 that there would be an 83,000 metric ton shortfall of graphite supply in a potential conflict scenario. Moreover, the U.S. government has identified graphite as an essential asset to national security and the technology economy, cementing the demand for decades.

Developing Its Graphite Creek Asset

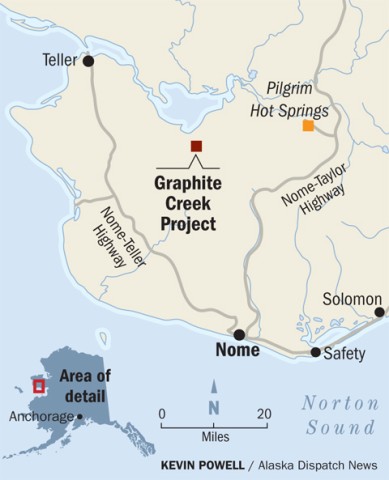

For now, the value driver is addressing E.V. sector demand. Graphite One is doing that by developing its 100%-owned Graphite Creek project in Alaska. Located about 60 kilometers north of Nome, Alaska, the property covers 23,680 acres and boasts 135 State of Alaska mining claims and 41 State-selected mining claims. Value expected to be inherent to GPHOF is that Graphite One's preliminary economic assessment of the area indicates a potential 40-year mining life for the Graphite Creek deposit, supporting an annual production of 41,840 metric tons of coated spherical graphite and 13,500 metric tons of graphite powder. There's more to like.

The material found at Graphite Creek has been noted to naturally exhibit the morphological characteristics of an already-processed material, an important aspect that could bring significant efficiencies when producing the Coated Spherical Graphite required by Li-Ion and E.V. batteries. These unique characteristics have led the company to brand Graphite Creek's graphite by the acronym "STAX" or "Spherical Thin Aggregate Expanded." Preliminary research on STAX Graphite has indicated that it could be helpful for applications beyond E.V.s, such as high-purity nuclear-grade graphite, fire-suppressant graphite foam, and industrial diamonds for next-gen semiconductor substrates.

And keep in mind that its potential is amplified even further, knowing that the United States graphite supply has been 100% dependent on imports since 1990, with China supplying most of the materials. The government imported 58,000 metric tons of natural graphite in 2020, almost identical to Graphite One's potential annual output. Therefore, Graphite One and its Alaskan Graphite Creek project are in a position to capitalize on being the most significant domestic holder or producer of graphite. And not just investors are excited about what Graphite One could be on the verge of accomplishing.

A Partner In Building U.S. Stockpiles?

The U.S. government could be a satisfied customer, too, even a potential funding partner. They have emphasized strengthening the development and production of battery metals and minerals to incentivize cleaner energy sources and correct an over-reliance on foreign sources for these critical materials. Last year, they double-down by reiterating its vision to expand the domestic mining, production, processing, and recycling of essential minerals and materials. This means that in addition to Graphite One's 100% ownership of a domestic property rich in graphite, they may also have a deep-pocketed partner eager to support their efforts.

The company's strong working relationship with the Alaska U.S. Delegation, the State of Alaska and other relevant State Agencies, and the local Alaska Native Entities are also valuable. Alaska Governor Mike Dunleavy nominated Graphite One as a High-Priority Infrastructure Project in 2019, stating, "Graphite Creek is the largest deposit of graphite in the Nation, and would be a superior domestic supply of this critical mineral, which is necessary for modern batteries, renewable energy technology, and many other high-tech uses." This nomination allowed the company to present its project to the Federal Permitting Improvement Steering Council (FPISC), in which its operations were found to qualify under both the "renewable energy" and "manufacturing" sectors.

Most importantly, Graphite One is provided a green light to continue the development of their Graphite Creek property in Alaska, supported by promising pre-feasibility studies showing potential to exploit one of the most substantial graphite deposits in the nation.

Reasons To Run Higher In 2023

All told, GPHOF is more than on the right track to exploit its intrinsic value and become a leading graphite supplier in the United States. As important, if not more, they can be one of the first and largest suppliers in the domestic market, a presumption supported by in-house and independent surveys of its properties showing that they can more than reach that status; they can potentially contribute at a scale that nearly matches the nation's current annual demand for graphite.

If so, and a strong case is made for their ability to do so, GPHOF share prices, despite their impressive YTD move higher, can support higher valuations. Proven assets in the ground alone can already support that case. But knowing global demand, government interest, and unrelenting E.V. sector need, valuing on that basis alone isn't a fair measure. Appraising the totality of GPHOF's mission to monetize its assets is. And using that model, Graphite One presents more than an attractive opportunity; it's compelling.

Disclaimers: Shore Thing Media, LLC. (STM, LLC.) is responsible for the production and distribution of this content. STM, Llc. is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by STM, Llc. is not intended to be, nor does it constitute, investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report and publication. In no event shall STM, Llc. be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by STM, Llc., including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. STM, Llc. strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, STM, Llc., its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. STM, LLC has been compensated up to two-thousand-five-hundred dollars cash via wire transfer by a third party to produce and syndicate digital content for Graphite One, Inc. for a period of one month. As part of that content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website by visiting primetimeprofiles.com/disclaimer.

Media Contact

Company Name: STM, LLC.

Contact Person: Michael Thomas

Email: contact@primetimeprofiles.com

Phone: 917-773-0072

Country: United States

Website: https://primetimeprofiles.com/