Environmental engineering firm Tetra Tech (NASDAQ: TTEK) reported Q4 CY2025 results topping the market’s revenue expectations, but sales fell by 13.4% year on year to $1.04 billion. Guidance for next quarter’s revenue was better than expected at $1 billion at the midpoint, 1% above analysts’ estimates. Its GAAP profit of $0.40 per share was 26% above analysts’ consensus estimates.

Is now the time to buy Tetra Tech? Find out by accessing our full research report, it’s free.

Tetra Tech (TTEK) Q4 CY2025 Highlights:

- Revenue: $1.04 billion vs analyst estimates of $974.9 million (13.4% year-on-year decline, 6.4% beat)

- EPS (GAAP): $0.40 vs analyst estimates of $0.32 (26% beat)

- Adjusted Operating Income: $133.5 million vs analyst estimates of $120.8 million (12.9% margin, 10.6% beat)

- The company lifted its revenue guidance for the full year to $4.23 billion at the midpoint from $4.15 billion, a 1.8% increase

- EPS (GAAP) guidance for Q1 CY2026 is $0.32 at the midpoint, missing analyst estimates by 5.5%

- Operating Margin: 13.6%, up from 1.9% in the same quarter last year

- Market Capitalization: $9.75 billion

Dan Batrack, Chairman and CEO, commented, “Tetra Tech began fiscal 2026 with a strong first quarter as net revenue was up 8% and EPS up 17%. Subsequent to the first quarter, we announced two strategic acquisitions, further expanding our front-end consulting business for our defense clients. As expected, our margin increased by 80 basis points, with our higher margin front-end advisory and technical consulting business growing at a double-digit rate. With the promotion of Roger Argus to CEO effective after our annual shareholders meeting, I see continued progress toward achieving our 2030 vision and direction and the associated financial targets.”

Company Overview

With a 50-year legacy of "Leading with Science" and operations on all seven continents, Tetra Tech (NASDAQ: TTEK) provides high-end consulting and engineering services focused on water management, environmental solutions, and sustainable infrastructure for government and commercial clients worldwide.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $4.46 billion in revenue over the past 12 months, Tetra Tech is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

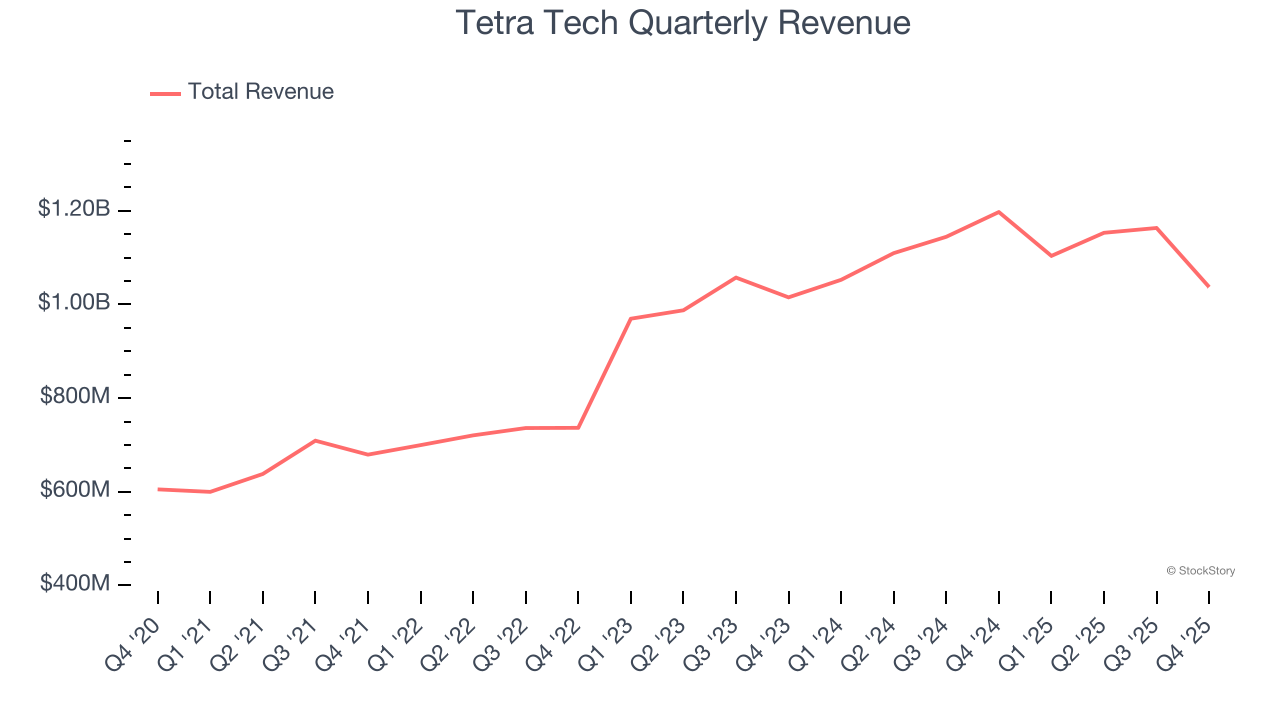

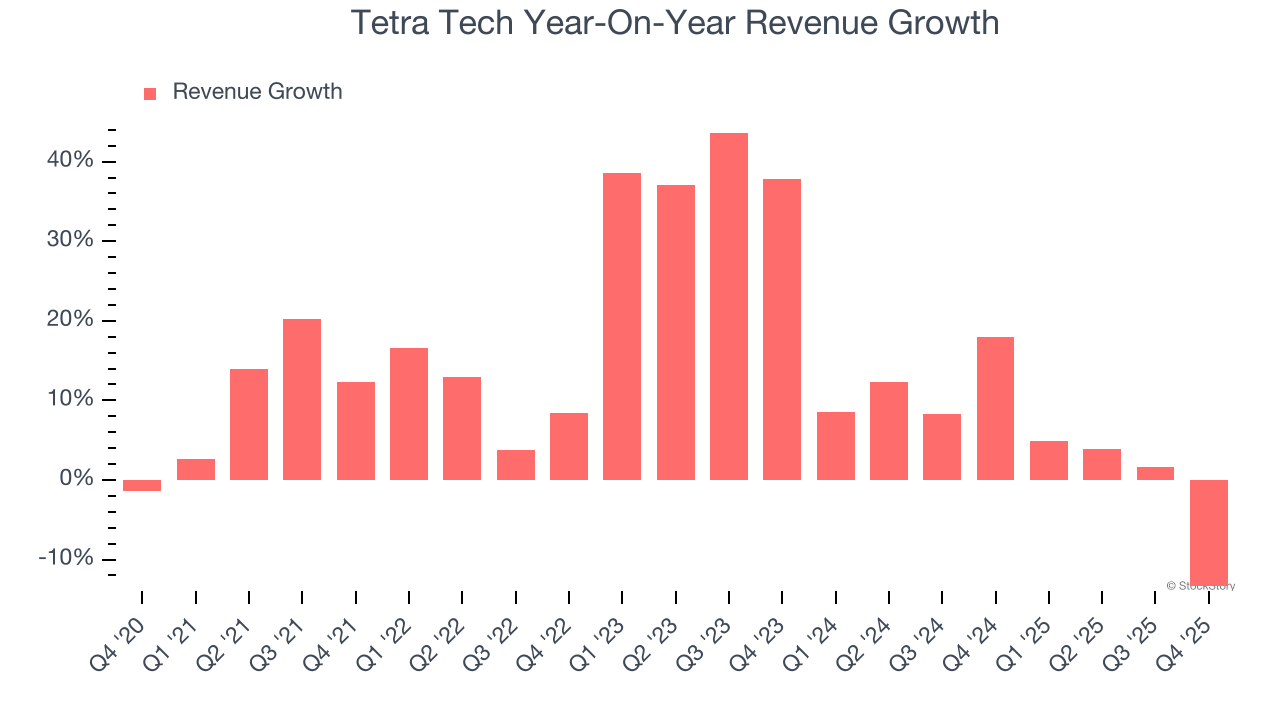

As you can see below, Tetra Tech grew its sales at an exceptional 13.8% compounded annual growth rate over the last five years. This is an encouraging starting point for our analysis because it shows Tetra Tech’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Tetra Tech’s annualized revenue growth of 5.2% over the last two years is below its five-year trend, but we still think the results were respectable.

This quarter, Tetra Tech’s revenue fell by 13.4% year on year to $1.04 billion but beat Wall Street’s estimates by 6.4%. Company management is currently guiding for a 9.4% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 5.1% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Adjusted Operating Margin

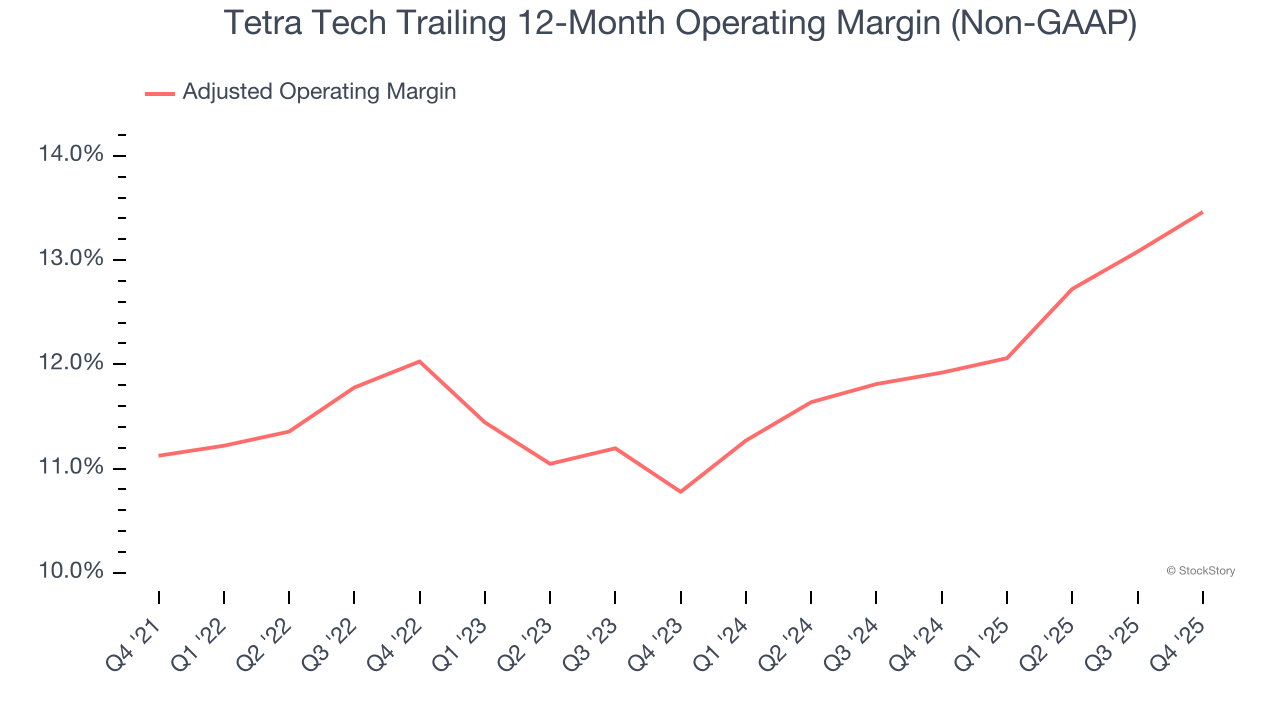

Tetra Tech has done a decent job managing its cost base over the last five years. The company has produced an average adjusted operating margin of 11.9%, higher than the broader business services sector.

Analyzing the trend in its profitability, Tetra Tech’s adjusted operating margin rose by 2.3 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, Tetra Tech generated an adjusted operating margin profit margin of 12.9%, up 1.4 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

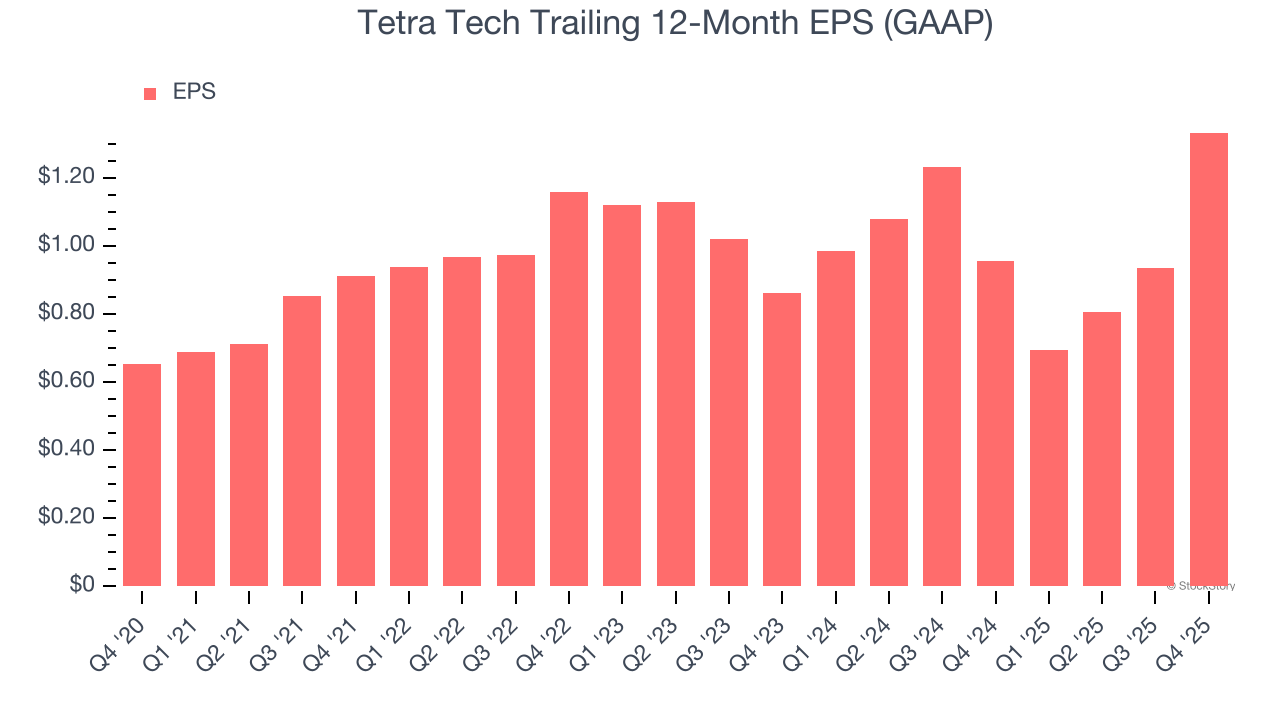

Tetra Tech’s astounding 15.3% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Tetra Tech’s two-year annual EPS growth of 24.3% was fantastic and topped its 5.2% two-year revenue growth.

We can take a deeper look into Tetra Tech’s earnings quality to better understand the drivers of its performance. Tetra Tech’s adjusted operating margin has expanded over the last two years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Tetra Tech reported EPS of $0.40, up from $0 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Tetra Tech’s full-year EPS of $1.33 to grow 13.7%.

Key Takeaways from Tetra Tech’s Q4 Results

It was good to see Tetra Tech beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its EPS guidance for next quarter missed. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 2% to $37.80 immediately after reporting.

Indeed, Tetra Tech had a rock-solid quarterly earnings result, but is this stock a good investment here? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).