Kyndryl has gotten torched over the last six months - since June 2025, its stock price has dropped 33.9% to $27.26 per share. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Kyndryl, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Is Kyndryl Not Exciting?

Even though the stock has become cheaper, we're cautious about Kyndryl. Here are three reasons why KD doesn't excite us and a stock we'd rather own.

1. Revenue Spiraling Downwards

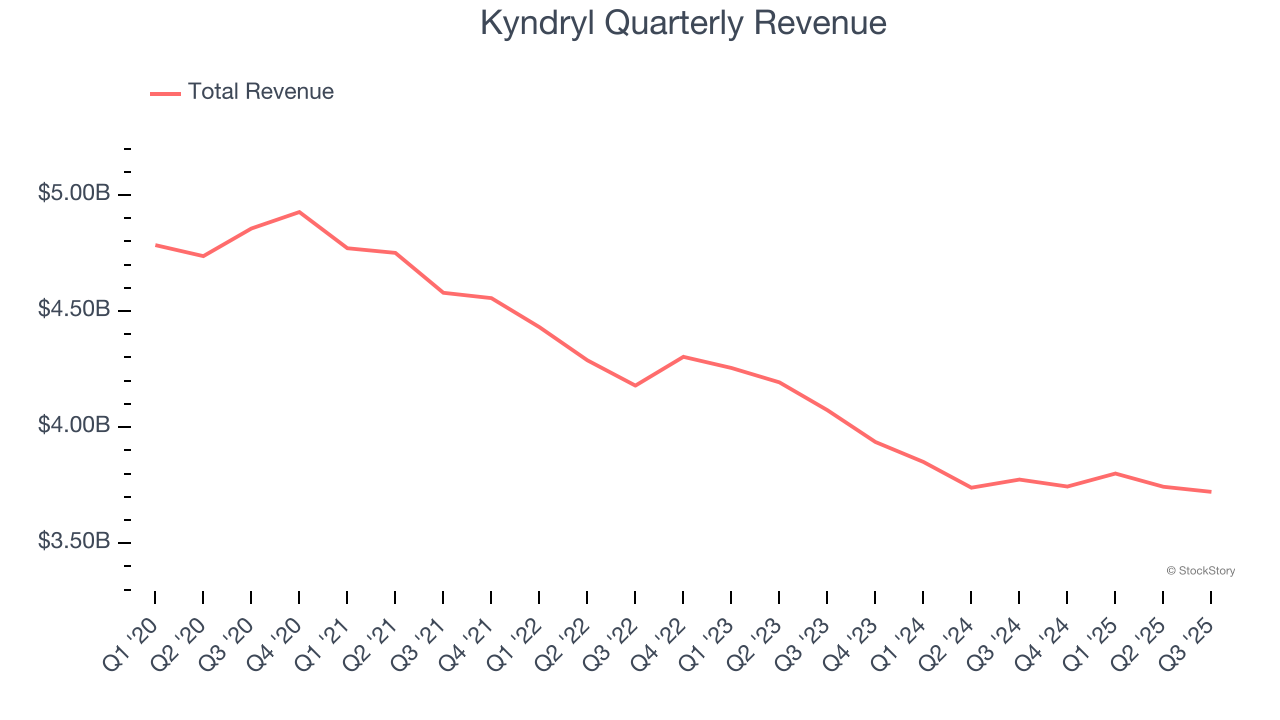

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Kyndryl’s demand was weak and its revenue declined by 4.8% per year. This wasn’t a great result and signals it’s a lower quality business.

2. Breakeven Free Cash Flow Limits Reinvestment Potential

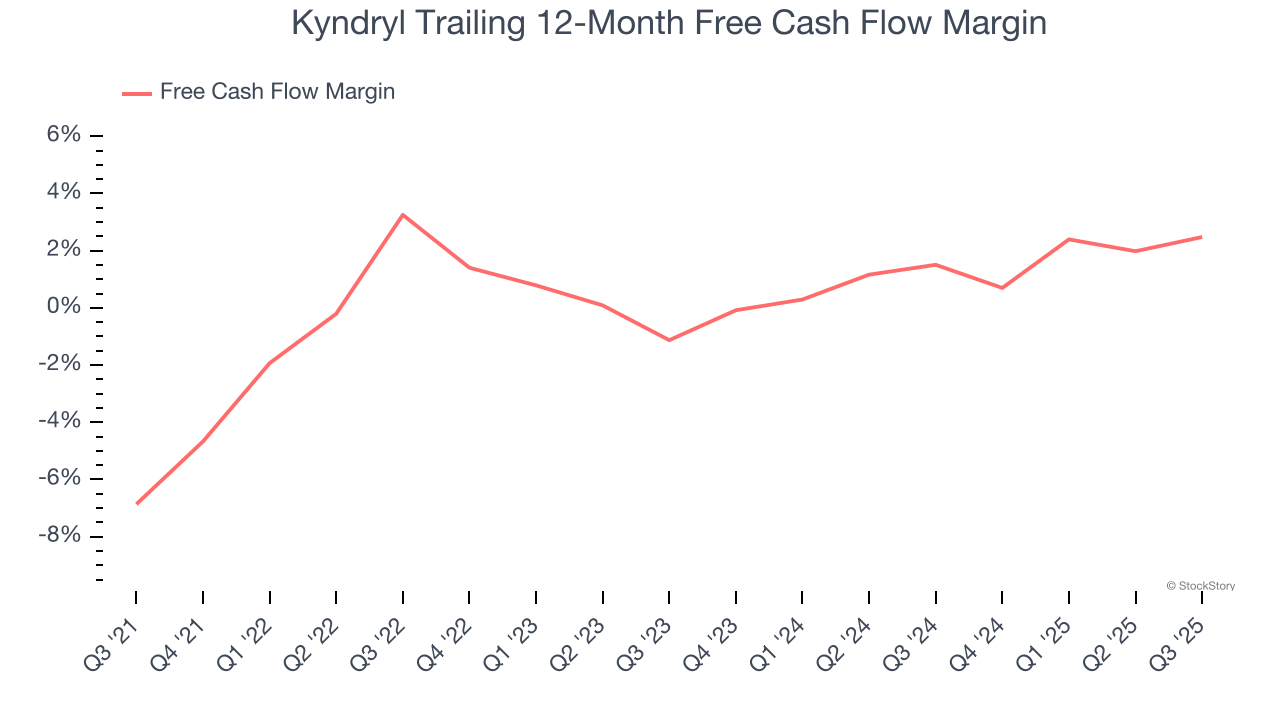

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Kyndryl broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

3. Previous Growth Initiatives Have Lost Money

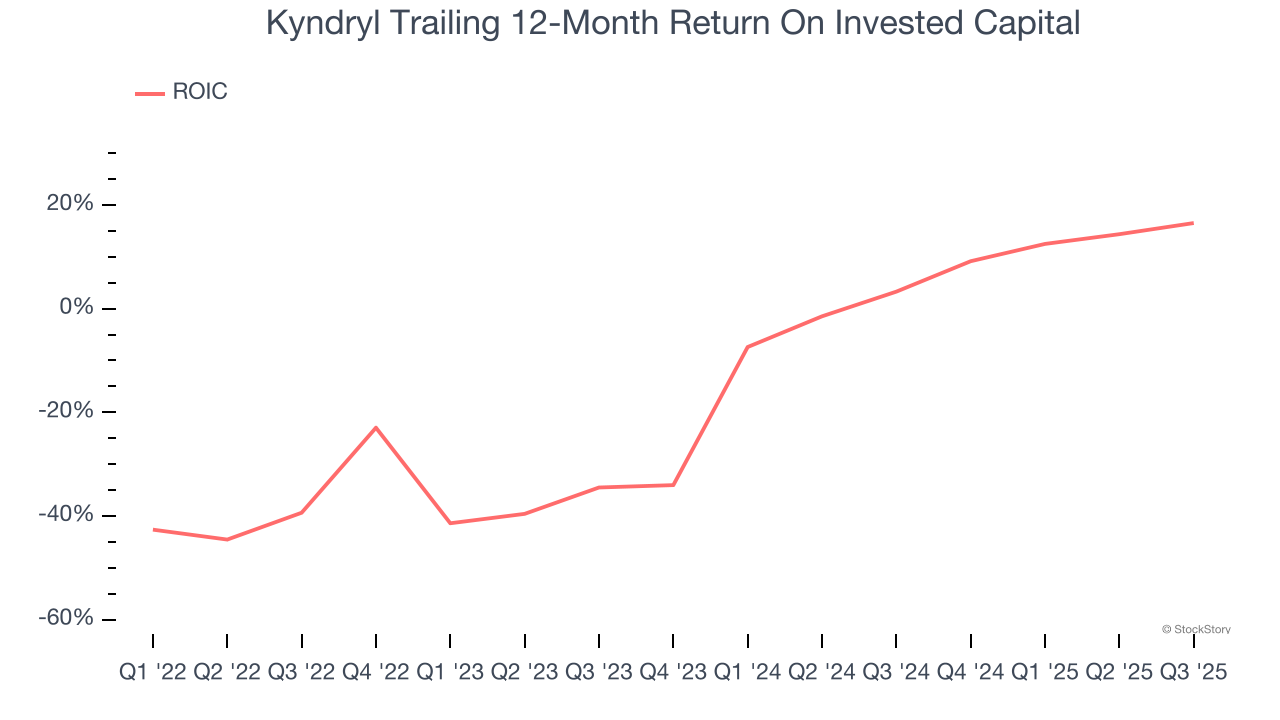

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Kyndryl’s five-year average ROIC was negative 13.5%, meaning management lost money while trying to expand the business. Its returns were among the worst in the business services sector.

Final Judgment

Kyndryl isn’t a terrible business, but it isn’t one of our picks. After the recent drawdown, the stock trades at 8.2× forward P/E (or $27.26 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.