Ecosystem features tokenized yields from delta-hedged strategies generated by native protocol, Arcana

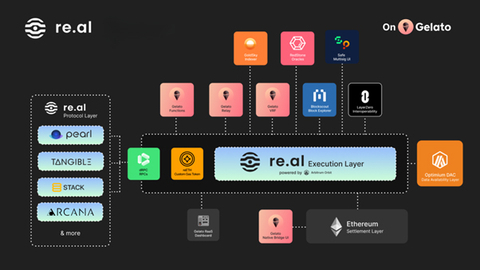

With over $40M USD TVL locked in its protocols at launch and 190 tokenized properties on the chain, re.al is launching its mainnet as the world's first RWA (real world asset) Layer 2 chain to return 100% of its revenue to users, including sequencing fees, and protocol revenues. Powered by Arbitrum Orbit and built on Gelato Rollup-as-a-Service (RaaS) Platform, re.al’s new permissionless Layer 2 establishes itself the optimal RWA chain in DeFi, solving the challenges of liquidity, interoperability, and composability of traditional assets on-chain.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240520880751/en/

(Graphic: Business Wire)

re.al has been developed from the ground up as an RWA-powered yield ecosystem, or “yieldchain,” where off-chain “real yields” are utilized on-chain in a novel liquidity flywheel. Products on the chain are designed to separate the tokenized RWA from its native yield, using T-Bill rates or income from property rentals in DeFi native solutions that reward liquidity providers with sustainable returns that may potentially exceed the yields natively generated by the underlying assets.

“re.al allows users to bypass traditional barriers to asset ownership, opening up fresh access in categories like real estate, private credit, treasuries and institutional trade strategies to those who have previously been boxed out,” explains Jag Singh, founder and CEO of re.al. “Our products within the ecosystem are designed to leverage integrated, off-chain yields to build deep, native liquidity on the chain – all in an egalitarian way that shares revenue with our community.”

On re.al, users have the power to create a diversified portfolio of RWAs that includes real estate, treasuries, gold and more, earning sustainable yields and network revenue share. Launching with a rich dApp ecosystem, re.al is providing comprehensive functionality from day one with a vision to expand the ecosystem to hundreds of protocols all benefiting from RWA-specific infrastructure, shared liquidity, and like-minded userbases.

Protocols deploying for launch include:

- Tangible, crypto’s largest tokenizer and marketplace for RWAs, 190 properties tokenized

- Pearl, a concentrated liquidity exchange built to optimize trading of RWAs

- Stack, a borrowing and leverage protocol for RWAs

- Arcana, a protocol to earn yield from tokenized, delta-neutral trade strategies, offering users multiple paths to maximize the value of their assets

“It’s not enough to build another DeFi L2 or even an RWA-focused L2 without an underlying ecosystem liquidity structure designed to support new and innovative yield-generating products,” says Michael Slatkin, CMO of re.al. “The L2 marketplace is too competitive and a long-term solution for native incentives that deliver the sustainable high yields liquidity providers need is a mandatory for teams looking to deploy new chains.”

re.al leverages Arbitrum Nitro modular technology stack, abstracting away traditional blockchain barriers with blazing fast TPS, and instant settlement while inheriting the security of Ethereum. With block times of 100ms and throughput up to 30,000 TPS, re.al stands out as one of the fastest EVM Layer 2 rollups on the market. This positions re.al as the top platform for asset issuers to easily launch RWA projects and for investors to efficiently access capital.

"re.al merges Arbitrum cutting-edge Layer 2 tech with Web3 Services, baked in the chain layer," says Hilmar Orth, Founder of Gelato. "It's a game-changer, unlocking the full potential of mainstream RWA dApps, advancing mainstream blockchain adoption."

re.al is collaborating with Gelato RaaS to integrate a comprehensive suite of industry-standard web3 services and key features into the chain layer, easing the onboarding of capital while prioritizing user experience and compliance. re.al’s Layer 2 will feature infrastructure partners like LayerZero, RedStone Oracles, Blockscout, dRPC, Goldsky and Safe Multisig UI along with Gelato’s suite of Web3 Services to serve its growing dApp ecosystem with core functionality.

The launch of re.al marks a significant step forward for on-chain RWAs, breaking barriers that have previously hindered tokenization adoption. With a dedication to returning revenue to users and a focus on building deep liquidity and a sustainable dApp ecosystem, re.al stands apart from other offerings in the space.

About re.al

re.al is a permissionless Layer 2 platform for tokenized real-world assets (RWAs), leveraging the power of tokenization and DeFi composability. Built with Arbitrum Orbit, re.al provides a secure, scalable, and cost-effective solution for transforming traditional assets on the blockchain. The $RWA token serves as the governance token, introducing a novel value accrual and sustainability model.

About Arbitrum Foundation

The Arbitrum Foundation, founded in March 2023, supports and grows the Arbitrum network and community with secure scaling for Ethereum. Introduced in March 2023, Arbitrum Orbit is a permissionless path for launching customizable dedicated L2 and L3 Orbit chains using Arbitrum technology. Arbitrum Orbit enables features such as custom gas tokens, dedicated throughput, customizable permissions, interoperability, and more by leveraging its secure, scalable, and cost-efficient blockchain scaling technology. More than 25 Orbit chains have been officially announced, and an additional 50+ are in active development to date.

About Gelato

Gelato is an all-in-one Ethereum Rollup as a Service Platform built without limits. Designed to be super-fast, incredibly secure, and infinitely scalable, Gelato Rollups allow anyone to build and deploy their fully serviced Layer 2 chains natively integrated with industry-standard Web3 tools and services launching a production-ready web3 development environment with one click. For more information visit Gelato's: Official Website | Telegram | Twitter

View source version on businesswire.com: https://www.businesswire.com/news/home/20240520880751/en/

Contacts

Will Crockett, Wachsman

tangible@wachsman.com