With a market cap of $279.3 billion, Philip Morris International Inc. (PM) is a leading global tobacco and nicotine company headquartered in Stamford, Connecticut. Best known for its Marlboro brand internationally, the company is shifting its focus from traditional cigarettes to smoke-free alternatives, led by its IQOS heated tobacco system.

Shares of the tobacco giant have outperformed the broader market over the past 52 weeks. PM stock has surged 37.7% over this time frame, while the broader S&P 500 Index ($SPX) has gained 14.3%. Moreover, shares of Philip Morris are up 11.9% on a YTD basis, compared to SPX’s 1.4% increase.

Narrowing the focus, PM stock has outpaced the State Street Consumer Staples Select Sector SPDR Fund’s (XLP) 4.7% surge over the past 52 weeks and 7.5% rally in 2026.

On Dec. 22, Philip Morris International shares gained 1.8% after the company announced a $1.47 per share quarterly dividend.

For FY2025, which ended in December, analysts expect PM’s EPS to grow 14.3% year over year to $7.51. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

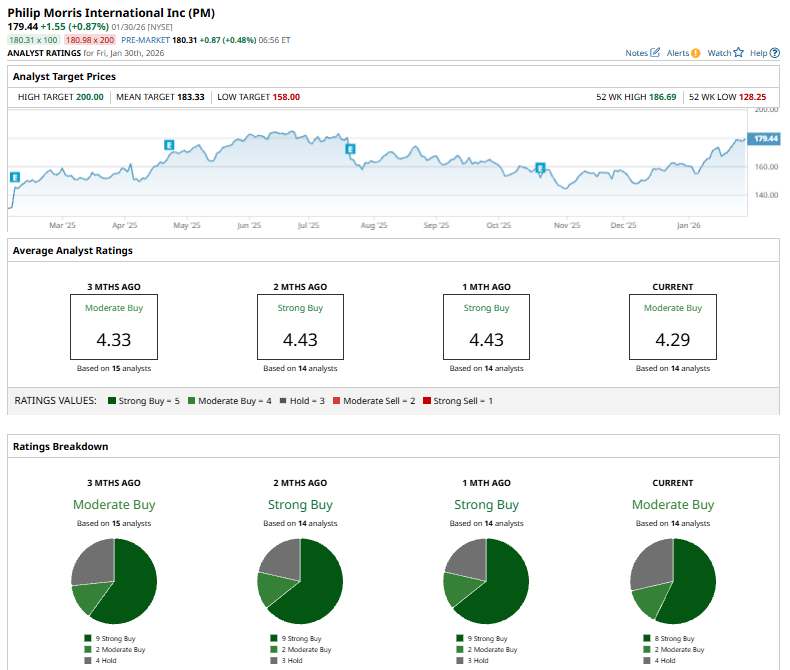

Among the 14 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, two “Moderate Buys,” and four “Holds.”

This consensus is bearish than last month when the stock had an overall “Strong Buy” rating.

On Jan. 20, Jefferies analyst Edward Mundy downgraded Philip Morris International from “Buy” to “Hold” and cut the price target to $180 from $220.

Its mean price target of $183.33 suggests an upside of 2.2%. The Street-high price target of $200 implies a potential upside of 11.5% from the current price.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart