Palantir Technologies (PLTR) remains one of the market’s most polarizing growth stories, drawing sharp contrasts between investors impressed by its execution and skeptics focused on its premium valuation.

Truist Securities analyst Arvind Ramnani clearly sides with the bulls, arguing that Palantir’s scale, operating discipline, and central role in artificial intelligence (AI) justify investor confidence despite near-term valuation concerns. Its shares have risen nearly tenfold over the past two years, yet Ramnani believes the upside is far from exhausted.

He initiated coverage with a “Buy” rating, highlighting the company’s expanding opportunity to drive generative AI adoption across both government agencies and enterprise customers.

Ramnani pointed to Palantir’s revenue trajectory as a key differentiator. The company has meaningfully outpaced most software peers, with U.S. government revenue rising 50% year-over-year (YOY) for two consecutive quarters and commercial growth accelerating to 73%. He also emphasized improving profitability, noting Palantir’s progression toward a sustainable “Rule of 80+” profile, balancing 50%+ operating margins with strong top line growth.

While the U.S. has been anchoring Palantir’s expansion, international markets are also emerging as an important long-term growth driver. The company is positioning itself to capture additional commercial and government contracts abroad, broadening its opportunity set and reinforcing the durability of its growth outlook.

The backdrop lays the foundation for a deeper evaluation of the stock.

About Palantir Stock

Headquartered in Denver, Colorado, Palantir develops advanced platforms supporting counterterrorism and enterprise data operations. With a market cap of nearly $400.1 billion, its Gotham, Foundry, and Apollo platforms enable pattern recognition, secure deployment, data integration, and enterprise-scale AI activation across industries.

Palantir’s shares have delivered strong and consistent gains, skyrocketing 159.2% over the past 52 weeks and 26.6% in the last six months. The performance comfortably outpaced the tech-heavy Nasdaq Composite ($NASX), which rose 20.54% over the past 52 weeks and 15% during the same six-month period.

Valuation remains the central friction point. PLTR stock is currently trading at 226.21 times forward adjusted earnings and 98.29 times sales, both far above industry norms. Investors appear willing to pay that premium, betting on continued revenue acceleration, expanding margins, and long-term operating leverage.

Palantir Surpasses Q3 Earnings

On Nov. 3, 2025, Palantir reported fiscal 2025 Q3 results that exceeded Wall Street expectations. Revenue climbed 62.8% YOY to $1.18 billion, exceeding the $1.09 billion Street forecast. Adjusted EPS came in at $0.21, beating analyst estimates of $0.17.

The U.S. business continued to anchor performance. Domestic revenue rose 77% YOY to $883 million, while U.S. commercial revenue surged 121% to $397 million. Management credited the quarter’s strength to the accelerating adoption of its Artificial Intelligence Platform (AIP).

Commercial momentum translated into robust deal activity. Palantir closed 204 contracts worth at least $1 million, including 91 deals above $5 million, and 53 exceeding $10 million. Total contract value reached a record $2.76 billion, marking a 151% YOY increase, while customer count expanded 45%.

Markets initially responded favorably, pushing shares up 3.4% on the day of the announcement. The enthusiasm faded quickly, however, as valuation concerns resurfaced. Michael Burry’s disclosure that he purchased put options on five million shares further amplified pressure, driving the stock down nearly 7.9% in the following session.

Looking ahead, management expects fourth-quarter 2025 revenue between $1.327 billion and $1.331 billion. For the full-year 2025, Palantir has raised revenue guidance to a range of $4.396 billion to $4.400 billion.

Analysts mirror the optimism in their forecasts. They expect Q4 fiscal 2025 EPS of $0.17, representing 1,800% YOY growth. For the full fiscal year 2025, earnings are projected to jump 550% to $0.52, followed by an additional 51.9% increase to $0.79 in fiscal year 2026.

What Do Analysts Expect for Palantir Stock?

Truist Securities has placed a confident “Buy” rating on PLTR and established a $223 price target, signaling strong conviction in the company’s growth trajectory and AI-driven opportunities.

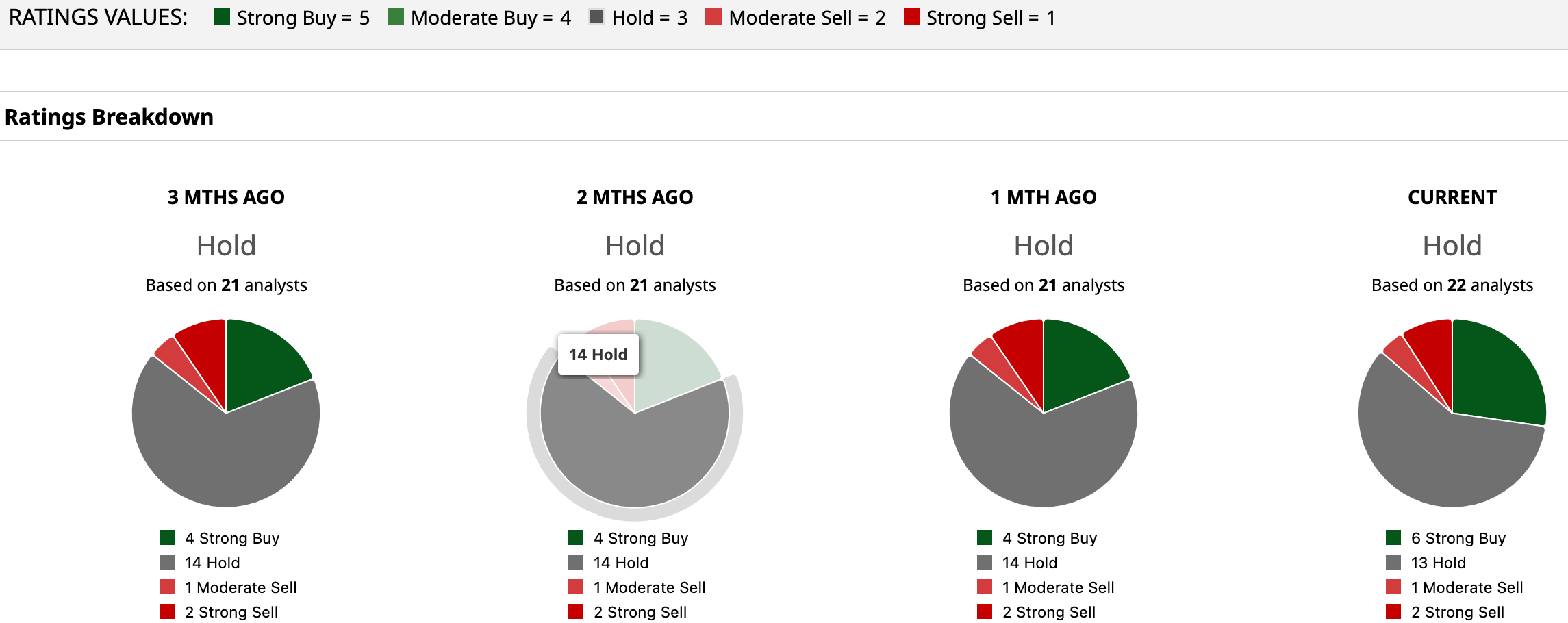

Despite Truist’s bullish stance, Wall Street exhibits a more cautious outlook, assigning PLTR stock an overall “Hold” rating. Among the 21 analysts covering the stock, five rate it a “Strong Buy,” 13 recommend “Hold,” one suggests a “Moderate Sell,” and two flag it as a “Strong Sell.” The diversity of opinions reflects the tension between Palantir’s exceptional growth and its elevated valuation.

Looking at price targets, PLTR’s mean price target of $192.67 represents potential upside of 9%. More strikingly, the Street-high target of $255 points to a gain of 44.18% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is the Pullback in Alibaba Stock a Buying Opportunity?

- One of Wall Street’s Most Iconic Companies Is Warning of a ‘Blue-Collar Crisis’ in 2026. What That Means, and Why It Matters for You.

- Is White-Hot Oklo Stock a Buy Following New Meta Energy Deal?

- Trump Just Called Out Raytheon but RTX Stock Is Holding Steady. How Should You Play the Defense Giant Here?