With a market cap of $85.9 billion, American Tower Corporation (AMT) is one of the world’s largest REITs and a leading independent owner, operator, and developer of multitenant communications real estate. It manages a global portfolio of nearly 149,000 communications sites and a highly interconnected footprint of U.S. data center facilities.

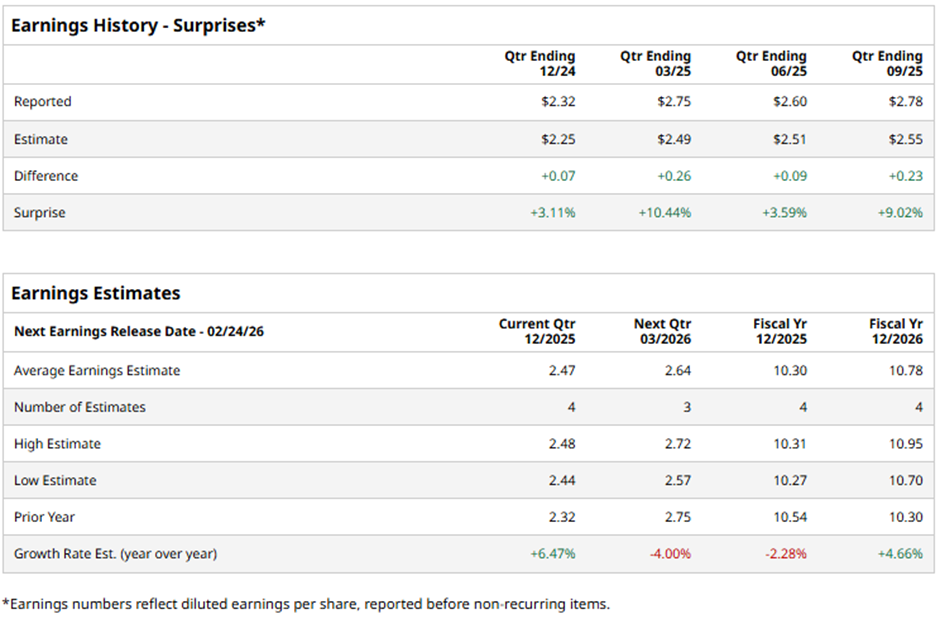

The Boston, Massachusetts-based company is expected to release its fiscal Q4 2025 results soon. Ahead of this event, analysts project AMT to report an AFFO of $2.47 per share, a 6.5% rise from $2.32 per share in the year-ago quarter. It holds a solid track record of consistently surpassing Wall Street's bottom-line estimates in the last four quarterly reports.

For fiscal 2025, analysts forecast the wireless infrastructure provider to report an AFFO of $10.30 per share, down 2.3% from $10.54 per share in fiscal 2024. However, AFFO is expected to grow 4.7 year-over-year to $10.78 per share in fiscal 2026.

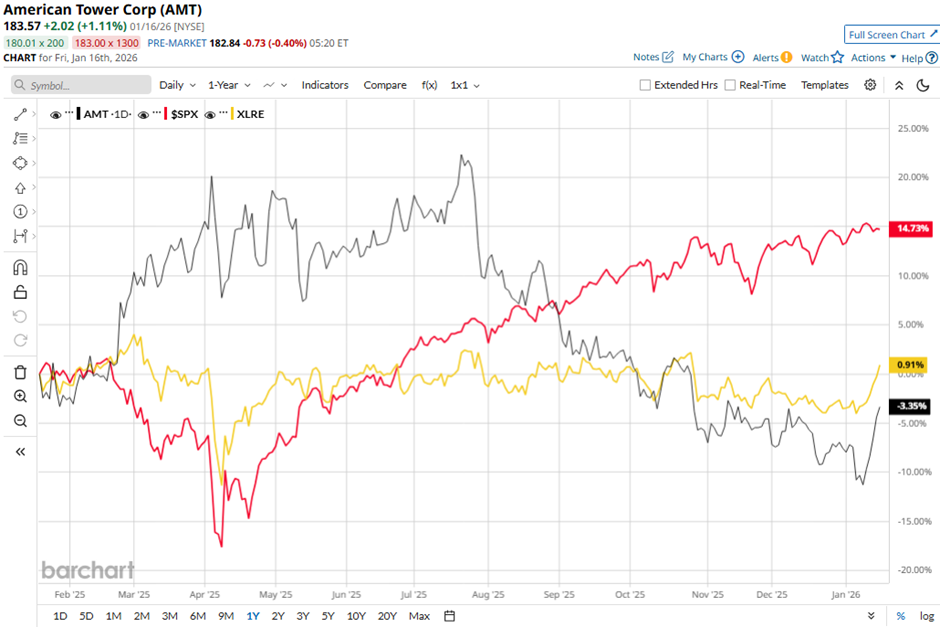

Shares of American Tower have declined 3.4% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 16.9% gain and the State Street Real Estate Select Sector SPDR ETF's (XLRE) 2.7% rise over the same time frame.

Despite reporting better-than-expected Q3 2025 AFFO of $2.78 per share and revenues of $2.72 billion, American Tower’s shares fell 3.7% on Oct. 28 as investors focused on flat U.S. and Canada property revenue and only a 6% overall property segment increase. While the company raised 2025 property revenue guidance to $10.21 billion - $10.29 billion, management disclosed $30 million in revenue reserves related to ongoing legal disputes in Latin America and with DISH.

Analysts' consensus view on AMT stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 22 analysts covering the stock, 14 suggest a "Strong Buy," one gives a "Moderate Buy," and seven recommend a "Hold." The average analyst price target for American Tower is $219.25, indicating a potential upside of 19.4% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart