Nasdaq, Inc. (NDAQ) is a leading financial services and technology company that operates stock exchanges and provides market data, analytics, financial technology tools, and listing services across global capital markets. The firm runs the NASDAQ Stock Market along with other U.S. exchanges. Headquartered in New York, Nasdaq has a market cap of $51.7 billion.

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and Nasdaq fits the label perfectly, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the financial data & stock exchanges Industry. Its strengths lie in its leading stock exchange platform, diverse revenue streams from trading, listings, and technology services.

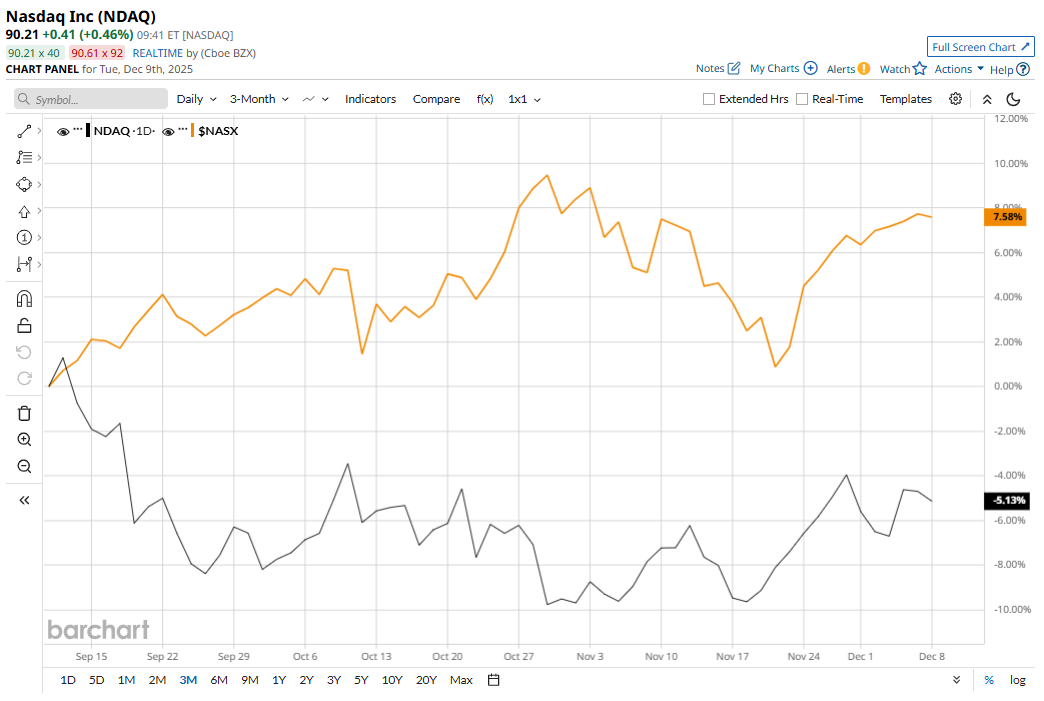

NDAQ has dropped 8.2% from its 52-week high of $97.63 on Aug. 11. Shares have declined 5.6% over the past three months, lagging behind the Nasdaq Composite ($NASX), which has returned 8% over the same time frame.

Year-to-date (YTD), shares have climbed 15.9%, but are still underperforming NASX’s 21.9% gain. Over the past 52 weeks, the stock has surged 12.4%, below the NASX’s 18.6% increase.

The stock has traded above the 200-day moving average since early May. However, it has been trading below the 50-day moving average since mid-September but has moved above the line since late-November.

The stock is rising in 2025 primarily due to strong financial performance driven by its strategic shift toward high-growth financial technology and solutions segments. In Q3 2025, Nasdaq delivered a stable performance with net revenues of $1.3 billion, representing a 15% year-over-year increase. Non-GAAP EPS reached $0.88, up 19% from the prior-year quarter, beating consensus estimates.

NDAQ has lagged behind its rival, Cboe Global Markets, Inc.’s (CBOE) 27.1% gain over the past 52 weeks and 31.2% rise in 2025.

The stock has a consensus rating of “Moderate Buy” from the 19 analysts covering it, and its mean price target of $106 implies an upside potential of 18%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Down 8% in December, Investors Should Wait Until Late January to Buy Harley-Davidson

- Protect Your Babies and Your Portfolios with This ‘Strong Buy’ Stock

- Even If There Is an AI Bubble, Wall Street Says You Should Keep Buying This Magnificent 7 Stock

- Nvidia Just Gave Its CUDA Platform a Major Revamp. Will That Move the Needle for NVDA Stock?