Daytona Beach, Florida-based Brown & Brown, Inc. (BRO) markets and sells insurance products and services. Valued at $26.8 billion by market cap, the company also provides risk management, employee benefit administration, and managed health care services.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and BRO perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the insurance brokers industry. BRO's market position is strong, driven by its long history, reputation, and diversified insurance portfolio. Its decentralized culture promotes ownership and customer satisfaction, and it offers a broad range of products and services that cater to diverse customers and mitigate market risks.

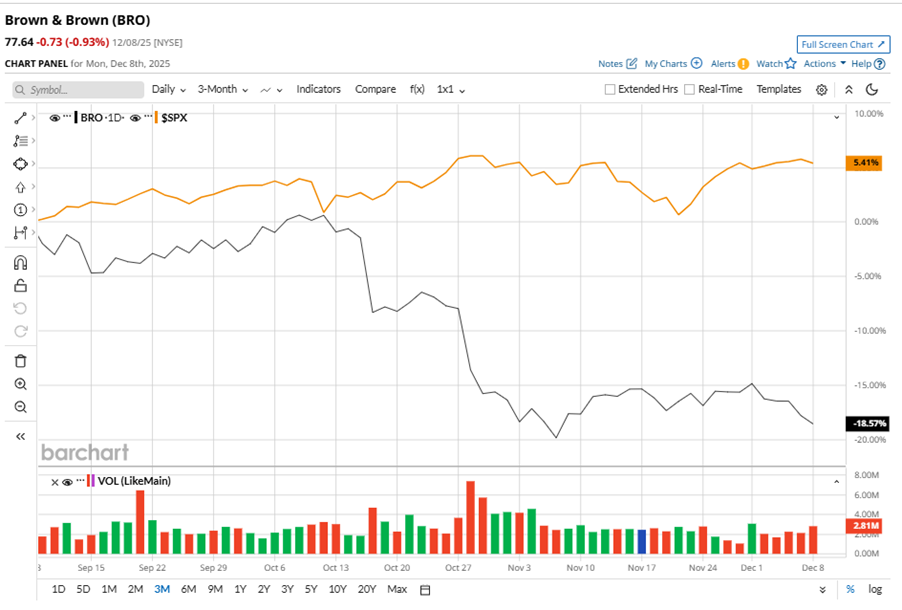

Despite its notable strength, BRO slipped 38.2% from its 52-week high of $125.68, achieved on Apr. 1. Over the past three months, BRO stock has declined 18.6%, underperforming the S&P 500 Index’s ($SPX) 5.4% gains during the same time frame.

In the longer term, shares of BRO fell 29.8% on a six-month basis and dipped 28.9% over the past 52 weeks, considerably underperforming SPX’s six-month gains of 14.1% and 12.4% returns over the last year.

To confirm the bearish trend, BRO has been trading below its 200-day moving average since early June, with slight fluctuations. The stock has been trading below its 50-day moving average since early April, with slight fluctuations.

BRO's underperformance is due to margin pressure and slower organic growth, which has negatively impacted investor sentiment.

On Oct. 27, BRO reported its Q3 results, and its shares closed down more than 6% in the following trading session. Its adjusted EPS of $1.05 surpassed Wall Street expectations of $0.90. The company’s revenue was $1.6 billion, topping Wall Street forecasts of $1.5 billion.

In the competitive arena of insurance brokers, Arthur J. Gallagher & Co. (AJG) has taken the lead over BRO, with a 27.7% downtick on a six-month basis and 19.8% losses over the past 52 weeks.

Wall Street analysts are cautious on BRO’s prospects. The stock has a consensus “Hold” rating from the 18 analysts covering it, and the mean price target of $97.43 suggests a potential upside of 25.5% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Even If There Is an AI Bubble, Wall Street Says You Should Keep Buying This Magnificent 7 Stock

- Nvidia Just Gave Its CUDA Platform a Major Revamp. Will That Move the Needle for NVDA Stock?

- Dear Carvana Stock Fans, Mark Your Calendars for December 22

- After a Red-Hot Rally on S&P 500 Inclusion, Carvana Stock Needs a ‘Cool’ Option Collar. How to Trade CVNA Here.