If there ever were a modern gold rush, it would not be miners with pickaxes but servers running Nvidia (NVDA) chips. In 2023, the company stormed past a $1 trillion market cap. By 2024, it was already sitting on $3 trillion. And now, just months after breaking the $4 trillion barrier, Nvidia has done the unthinkable again. The chipmaker has become the first company in history to touch the $5 trillion mark.

Nvidia remains the beating heart of artificial intelligence (AI) infrastructure, even as global headwinds try to slow it down. Restrictions on business in China threaten nearly $30 billion in annual sales, while customer concentration raises eyebrows since two customers made up 39% of Q2 revenue.

The industry itself still debates AI’s return on investment, yet Nvidia keeps signing multibillion-dollar deals, locking arms with giants like OpenAI. And when the company revealed a backlog with visibility into $500 billion in cumulative revenue for its Blackwell and Rubin products in 2025 and 2026, even Wall Street analysts were left blinking in surprise.

The next big moment is now coming on Wednesday, Nov. 19, when Nvidia releases its Q3 fiscal 2026 earnings after the market close. The announcement already lit a fire under the stock, which climbed almost 3% on October 29, reaching an all-time high of $212.19.

Investors now wait with bated breath, watching how fast Nvidia can ship its Blackwell chips, preserve its margins, and keep the AI revolution humming.

About Nvidia Stock

Headquartered in Santa Clara, California, Nvidia began by redefining the way computers see and process information. Its genius move was turning GPUs, originally designed for video games, into the powerhouse engines behind AI.

Those same chips now train the brains of AI systems like ChatGPT and run advanced image generators that have reshaped digital creativity. Today, with a market cap hovering near $4.9 trillion, Nvidia stands as the emblem of the AI age, powering data centers, autonomous systems, and virtual worlds.

Over the past 52 weeks, NVDA shares have surged 39.5%. The rally has not cooled in recent months either. In the last three months, the stock climbed another 9.5%.

NVDA trades at 49 times forward adjusted earnings and 38.52 times sales, towering over industry averages and signaling that investors are willing to pay a premium for what they see as unmatched growth and market leadership.

Nvidia Surpasses Q2 Earnings

On Aug. 27, Nvidia unveiled its fiscal 2026 second-quarter results, surpassing Wall Street expectations. Revenue soared 55.6% year-over-year (YOY) to $46.74 billion, comfortably surpassing the $46.06 billion analysts had projected.

The crown jewel of Nvidia’s operations, its data center division, brought in $41.1 billion, up 56.4%. The gaming business, once the foundation of Nvidia’s empire, added $4.3 billion, up 48.9% from a year earlier. The company’s GPUs, once prized for frame rates, now power select OpenAI models running directly on personal computers.

Even the smaller robotics segment made its mark, bringing in $586 million, a 69% annual increase, though still a small piece of the overall pie. Adjusted net income rose 52.1% to $25.8 billion. Meanwhile, adjusted EPS climbed 54.4% to $1.05, topping the $1.01 Street forecast.

Moreover, liquidity stayed robust, with cash, cash equivalents, and marketable securities climbing to $56.8 billion by quarter’s end, up from $43.2 billion on Jan. 26. Total current assets also rose sharply to $102.2 billion, compared with $80.1 billion previously.

Looking ahead, Nvidia’s management expects Q3 fiscal 2026 revenue to hit $54 billion, give or take 2%. Analysts are just as bullish. They forecast Q3 EPS growth of 50% year over year to $1.17. For the full fiscal year, EPS is expected to rise 44% to $4.22, with fiscal 2027 earnings projected to climb another 41.2% to $5.96.

What Do Analysts Expect for Nvidia Stock?

Wall Street is singing in near-perfect harmony on NVDA.

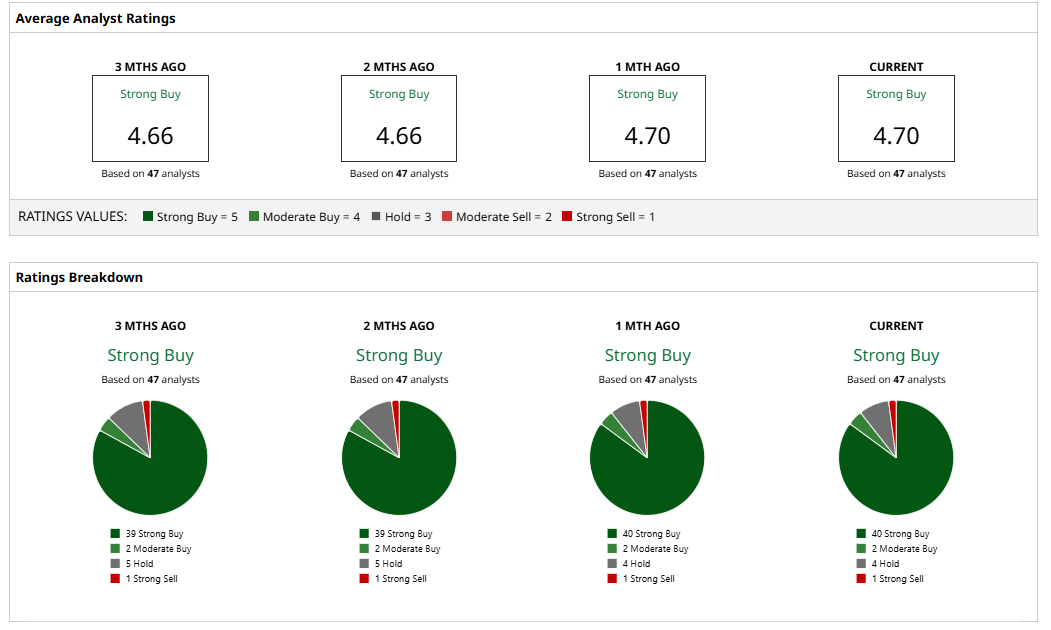

The consensus rating for NVDA stands at a “Strong Buy.” Out of 47 analysts covering NVDA, 40 recommend “Strong Buy,” two suggest “Moderate Buy,” four advise “Hold,” and one recommends “Strong Sell.”

NVDA’s average price target of $233.05 represents potential upside of 19%. Meanwhile, the Street-high target of $350 reflects potential gain of 80% from current levels, painting a picture of confidence that borders on conviction.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart