While the S&P 500 is up 14% since June 2024, Match Group (currently trading at $32.74 per share) has lagged behind, posting a return of 5.5%. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is MTCH a buy right now? Or is its underperformance reflective of its business quality?

Why Does MTCH Stock Spark Debate?

Originally started as a dial-up service before widespread internet adoption, Match (NASDAQ: MTCH) was an early innovator in online dating and today has a portfolio of apps including Tinder, Hinge, Archer, and OkCupid.

Two Positive Attributes:

1. Eye-Popping Growth in Customer Spending

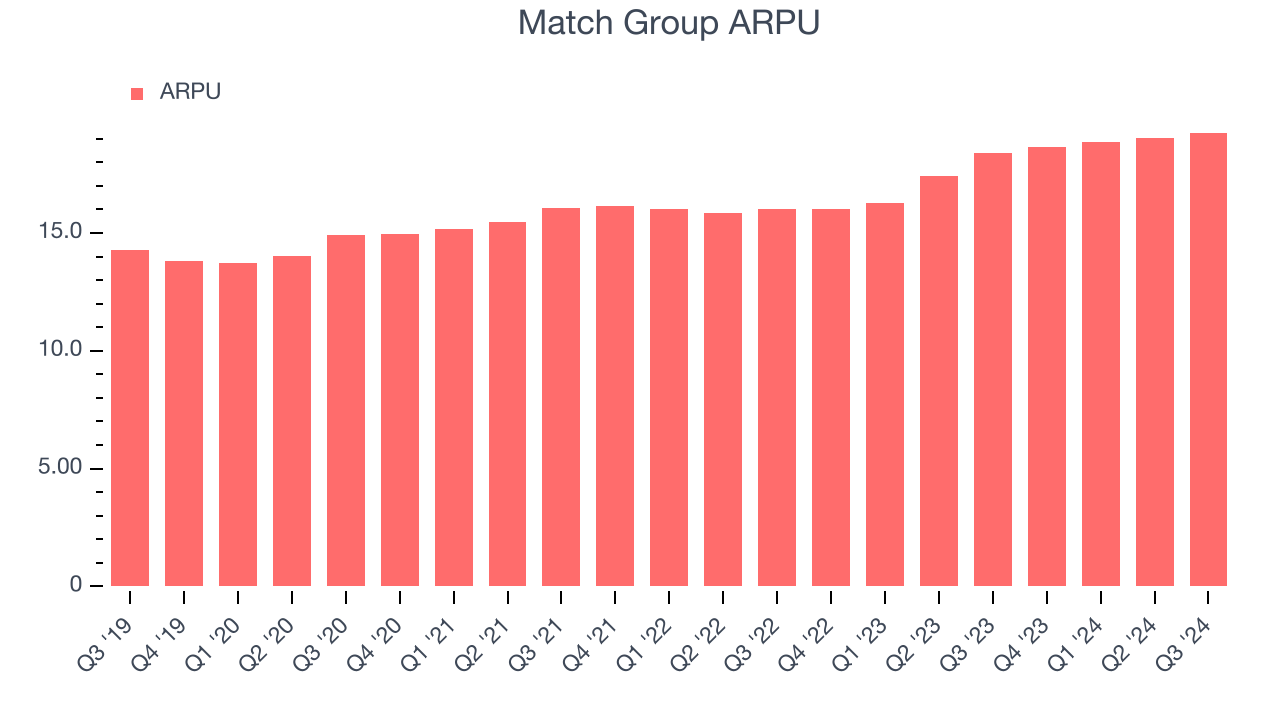

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Match Group because it measures how much the average user spends. ARPU is also a key indicator of how valuable its users are (and can be over time).

Match Group’s ARPU growth has been excellent over the last two years, averaging 9%. Although its payers shrank during this time, the company’s ability to successfully increase monetization demonstrates its platform’s value for existing users.

2. EBITDA Margin Reveals a Well-Run Organization

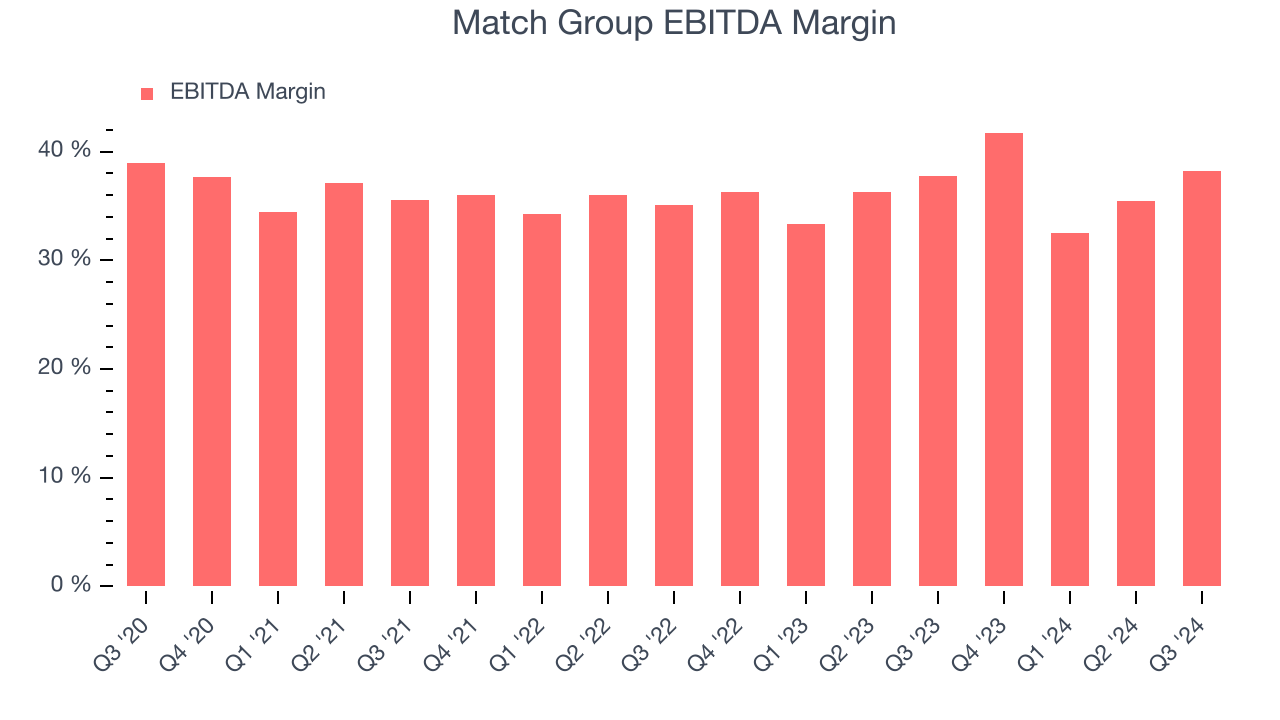

Operating income is often evaluated to assess a company’s underlying profitability. In a similar vein, EBITDA is used to analyze consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a clearer view of the business’s profit potential.

Match Group has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 36.5%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

One Reason to be Careful:

Declining Payers Reflect Product Weakness

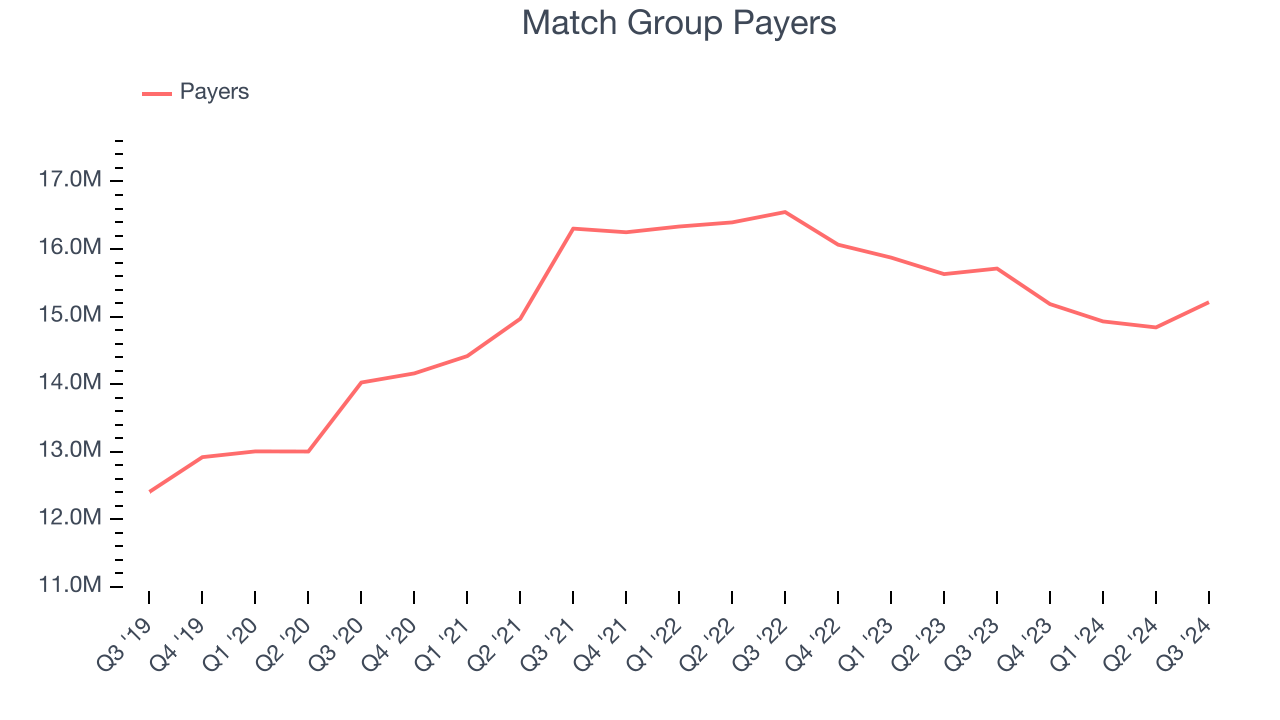

As a subscription-based app, Match Group generates revenue growth by expanding both its subscriber base and the amount each subscriber spends over time.

Match Group struggled to engage its payers over the last two years as they have declined by 4.2% annually to 15.21 million in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Match Group wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

Final Judgment

Match Group has huge potential even though it has some open questions. With its shares trailing the market in recent months, the stock trades at 6.7x forward EV-to-EBITDA (or $32.74 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Match Group

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.