What a time it’s been for Royal Caribbean. In the past six months alone, the company’s stock price has increased by a massive 61.6%, reaching $244 per share. This run-up might have investors contemplating their next move.

Is there a buying opportunity in Royal Caribbean, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.Despite the momentum, we're cautious about Royal Caribbean. Here are three reasons why RCL doesn't excite us and a stock we'd rather own.

Why Is Royal Caribbean Not Exciting?

Established in 1968, Royal Caribbean Cruises (NYSE: RCL) is a global cruise vacation company renowned for its innovative and exciting cruise experiences.

1. EPS Barely Growing

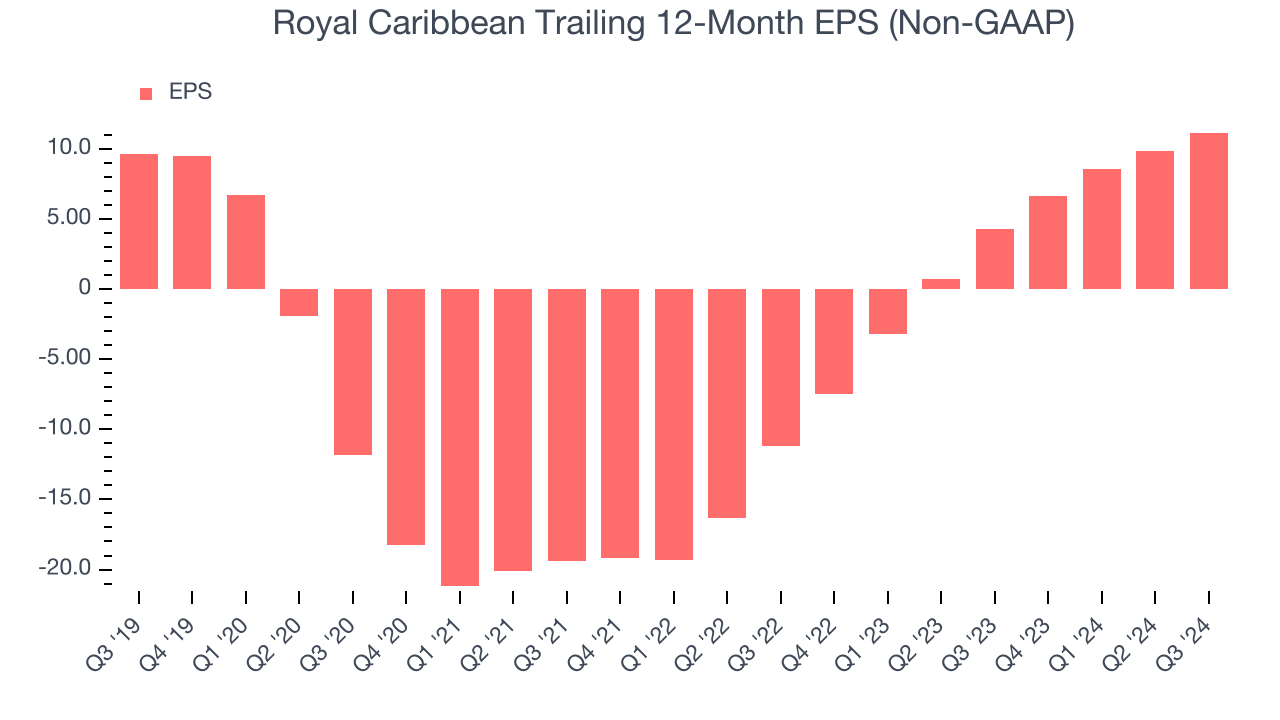

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Royal Caribbean’s EPS grew at an unimpressive 3% compounded annual growth rate over the last five years, lower than its 8.3% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

2. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

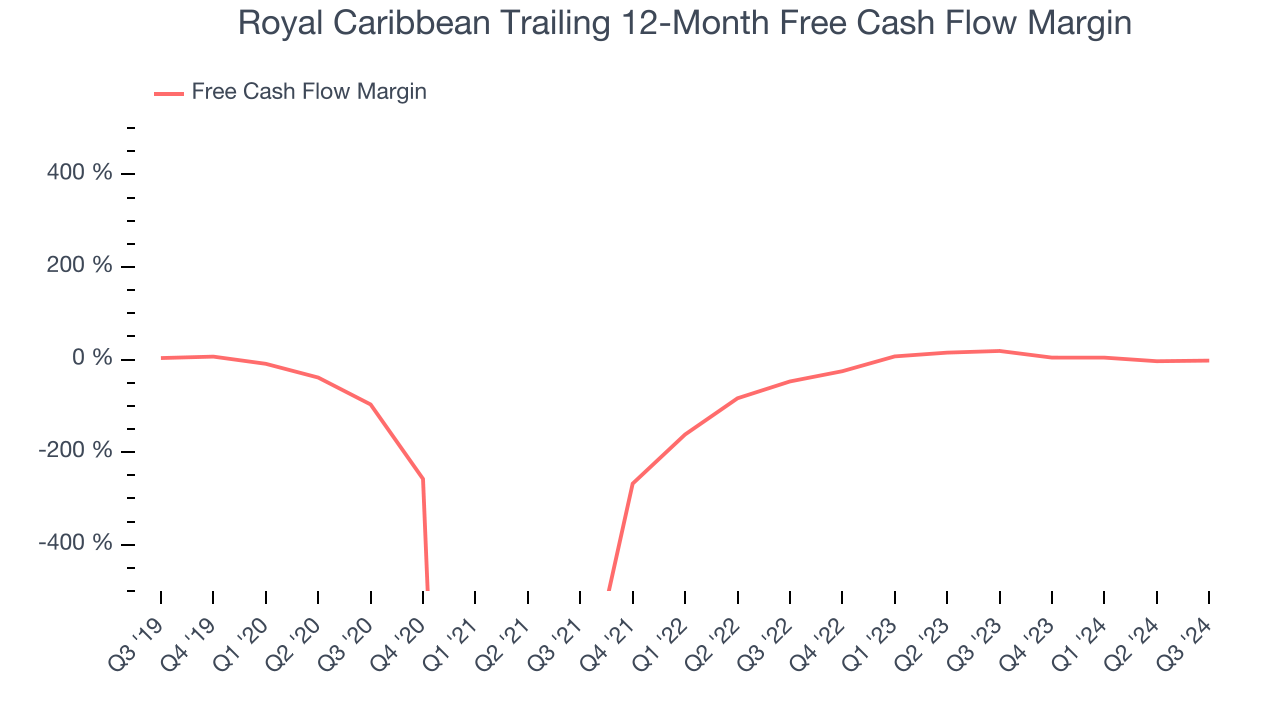

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Royal Caribbean has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7.1%, subpar for a consumer discretionary business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Royal Caribbean to make large cash investments in working capital and capital expenditures.

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Royal Caribbean’s five-year average ROIC was negative 2.9%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

Final Judgment

Royal Caribbean isn’t a terrible business, but it doesn’t pass our bar. Following the recent surge, the stock trades at 18.3x forward price-to-earnings (or $244 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward Wabtec, a leading provider of locomotive services benefiting from an upgrade cycle.

Stocks We Like More Than Royal Caribbean

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.