Precision measurement and sensing technologies provider Vishay Precision (NYSE: VPG) reported Q2 CY2025 results exceeding the market’s revenue expectations, but sales fell by 2.8% year on year to $75.16 million. Guidance for next quarter’s revenue was better than expected at $77 million at the midpoint, 0.6% above analysts’ estimates. Its non-GAAP profit of $0.17 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Vishay Precision? Find out by accessing our full research report, it’s free.

Vishay Precision (VPG) Q2 CY2025 Highlights:

- Revenue: $75.16 million vs analyst estimates of $72.93 million (2.8% year-on-year decline, 3.1% beat)

- Adjusted EPS: $0.17 vs analyst estimates of $0.04 (significant beat)

- Adjusted EBITDA: $7.89 million vs analyst estimates of $5.25 million (10.5% margin, 50.3% beat)

- Revenue Guidance for Q3 CY2025 is $77 million at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 3.6%, down from 7.6% in the same quarter last year

- Free Cash Flow Margin: 6.3%, similar to the same quarter last year

- Market Capitalization: $345.6 million

Ziv Shoshani, Chief Executive Officer of VPG, commented, “We were pleased with the positive sequential trends in the quarter, which reflected a moderately improved business climate. Second quarter sales grew 4.8% sequentially, and total orders of $79.9 million grew 7.5% sequentially, our third consecutive quarter of order growth. This resulted in a book-to-bill of 1.06, as our Measurement Systems and Sensors reporting segments recorded book-to-bill ratios of 1.20 and 1.12, respectively.”

Company Overview

Emerging from Vishay Intertechnology in 2010, Vishay Precision (NYSE: VPG) operates as a global provider of precision measurement and sensing technologies.

Revenue Growth

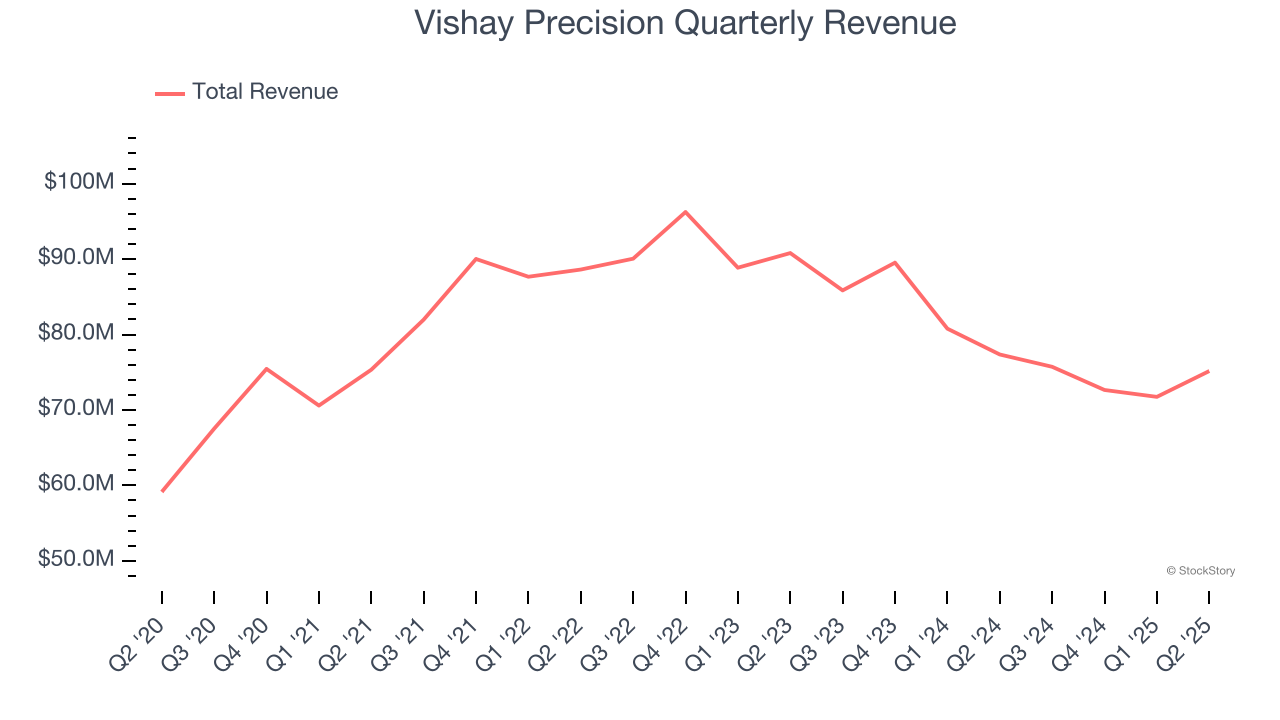

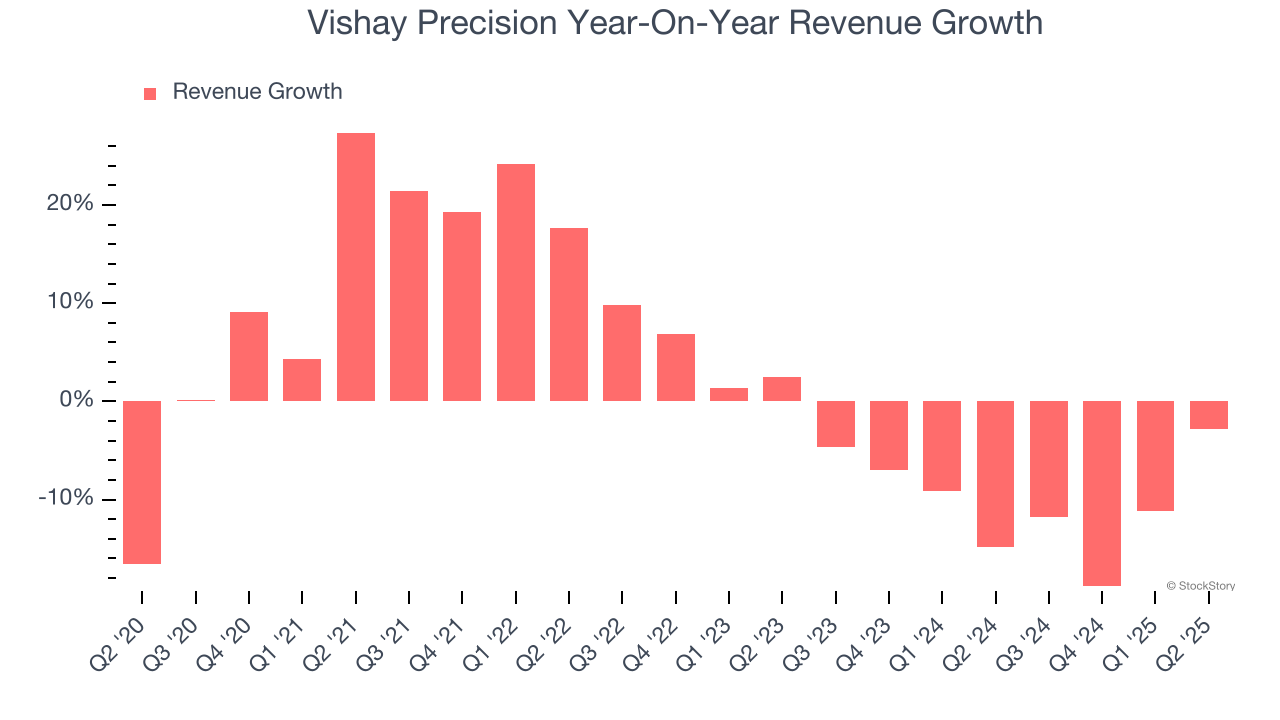

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Vishay Precision’s 2.3% annualized revenue growth over the last five years was sluggish. This fell short of our benchmarks and is a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Vishay Precision’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 10.2% annually. Vishay Precision isn’t alone in its struggles as the Electronic Components industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Vishay Precision’s revenue fell by 2.8% year on year to $75.16 million but beat Wall Street’s estimates by 3.1%. Company management is currently guiding for a 1.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.9% over the next 12 months. Although this projection suggests its newer products and services will spur better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

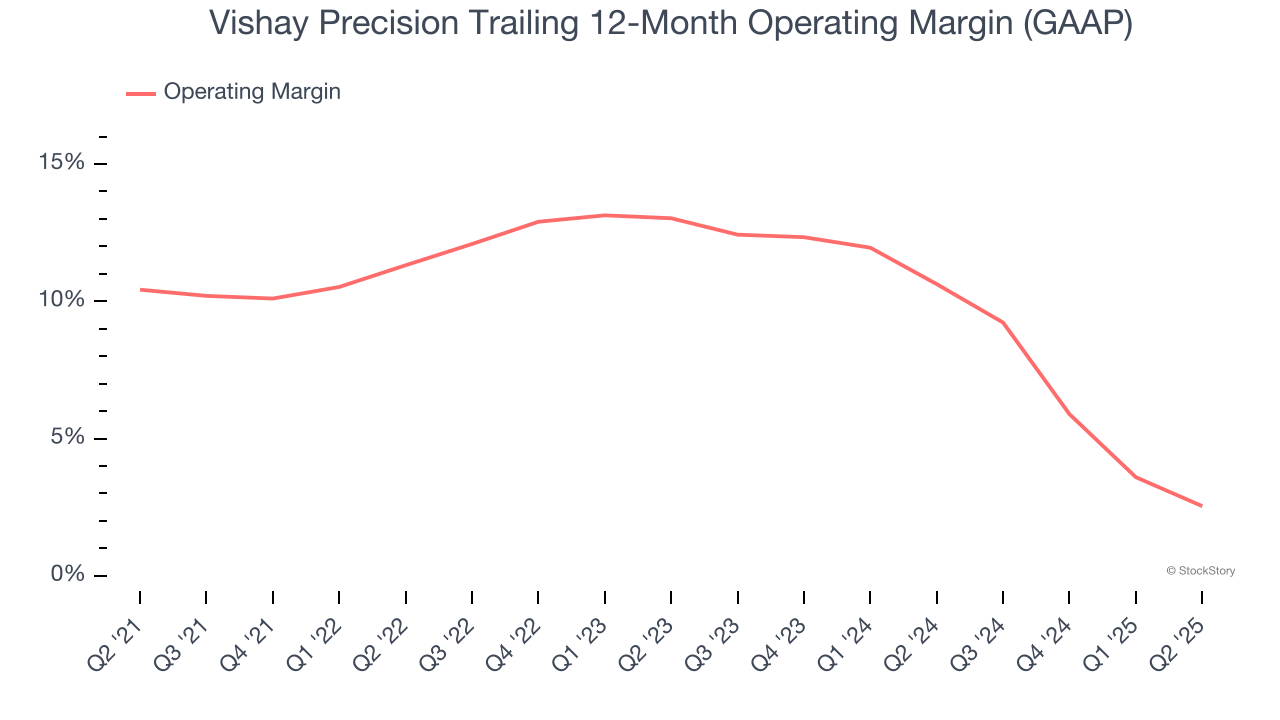

Vishay Precision has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 9.8%, higher than the broader industrials sector.

Looking at the trend in its profitability, Vishay Precision’s operating margin decreased by 7.9 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Vishay Precision generated an operating margin profit margin of 3.6%, down 4 percentage points year on year. Since Vishay Precision’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

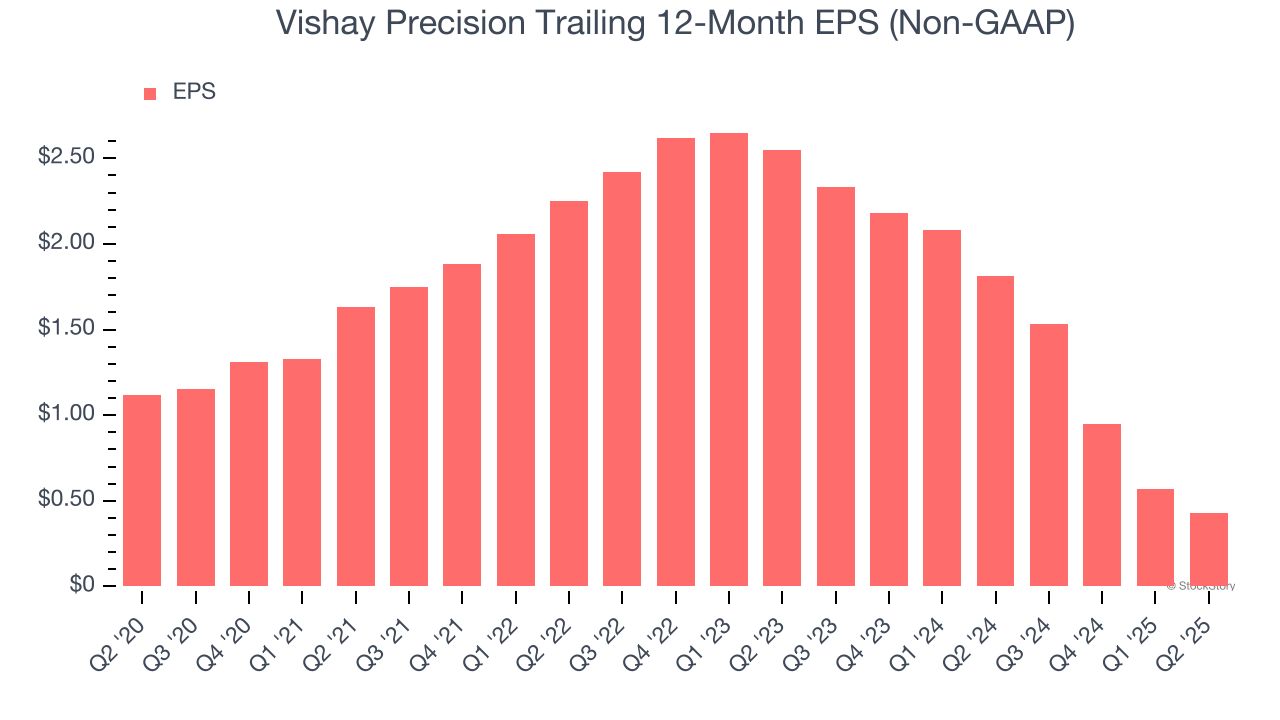

Sadly for Vishay Precision, its EPS declined by 17.4% annually over the last five years while its revenue grew by 2.3%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into the nuances of Vishay Precision’s earnings can give us a better understanding of its performance. As we mentioned earlier, Vishay Precision’s operating margin declined by 7.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Vishay Precision, its two-year annual EPS declines of 58.9% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q2, Vishay Precision reported adjusted EPS at $0.17, down from $0.31 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Vishay Precision’s full-year EPS of $0.43 to grow 137%.

Key Takeaways from Vishay Precision’s Q2 Results

We were impressed by how significantly Vishay Precision blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 1.2% to $26.39 immediately after reporting.

Sure, Vishay Precision had a solid quarter, but if we look at the bigger picture, is this stock a buy? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.