Data and analytics software provider Teradata (NYSE: TDC) reported Q2 CY2025 results topping the market’s revenue expectations, but sales fell by 6.4% year on year to $408 million. On the other hand, next quarter’s revenue guidance of $404.8 million was less impressive, coming in 0.9% below analysts’ estimates. Its non-GAAP profit of $0.47 per share was 16.9% above analysts’ consensus estimates.

Is now the time to buy Teradata? Find out by accessing our full research report, it’s free.

Teradata (TDC) Q2 CY2025 Highlights:

- Revenue: $408 million vs analyst estimates of $402 million (6.4% year-on-year decline, 1.5% beat)

- Adjusted EPS: $0.47 vs analyst estimates of $0.40 (16.9% beat)

- Adjusted Operating Income: $67 million vs analyst estimates of $64.35 million (16.4% margin, 4.1% beat)

- Revenue Guidance for Q3 CY2025 is $404.8 million at the midpoint, below analyst estimates of $408.3 million

- Management slightly raised its full-year Adjusted EPS guidance to $2.21 at the midpoint

- Operating Margin: 5.9%, down from 15.1% in the same quarter last year

- Free Cash Flow Margin: 9.6%, up from 1.7% in the previous quarter

- Annual Recurring Revenue: $1.49 billion at quarter end, up 1.6% year on year

- Market Capitalization: $1.95 billion

Company Overview

Part of point-of-sale and ATM company NCR from 1991 to 2007, Teradata (NYSE: TDC) offers a software-as-service platform that helps organizations manage and analyze their data across multiple storages.

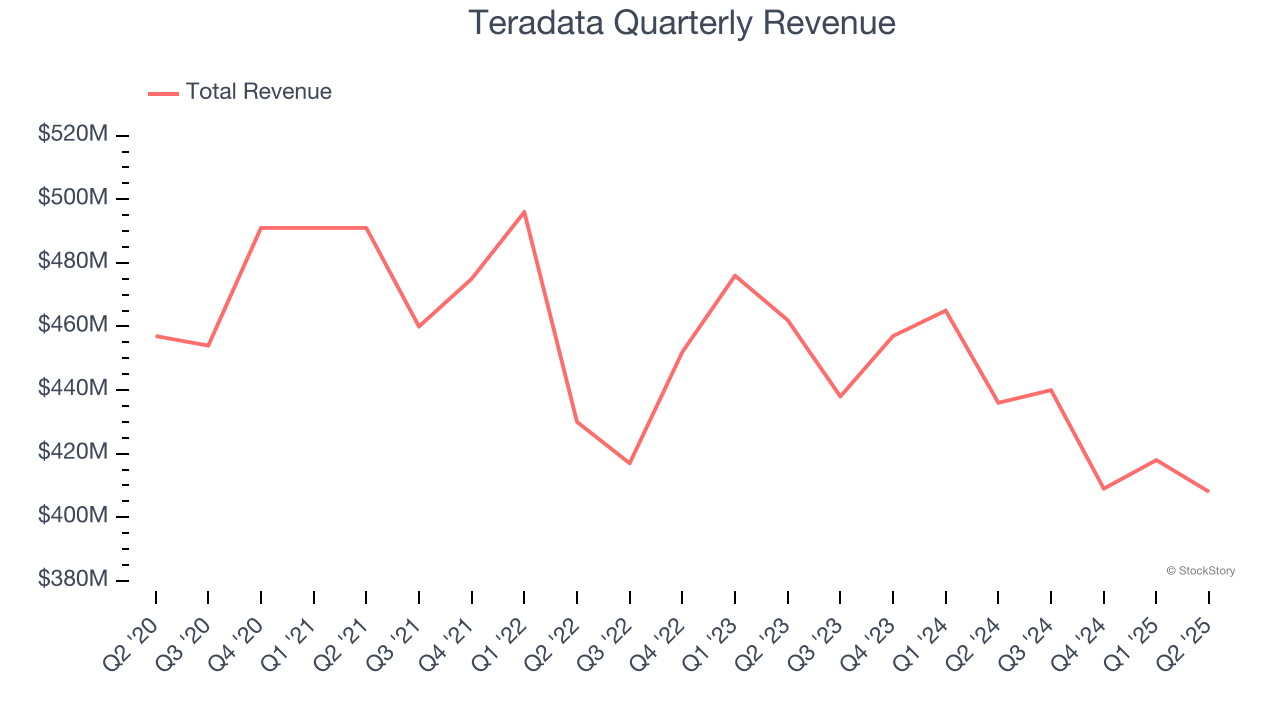

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Teradata’s demand was weak over the last three years as its sales fell at a 3.4% annual rate. This wasn’t a great result and is a sign of poor business quality.

This quarter, Teradata’s revenue fell by 6.4% year on year to $408 million but beat Wall Street’s estimates by 1.5%. Company management is currently guiding for a 8% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 2.5% over the next 12 months, similar to its three-year rate. This projection is underwhelming and implies its newer products and services will not catalyze better top-line performance yet.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

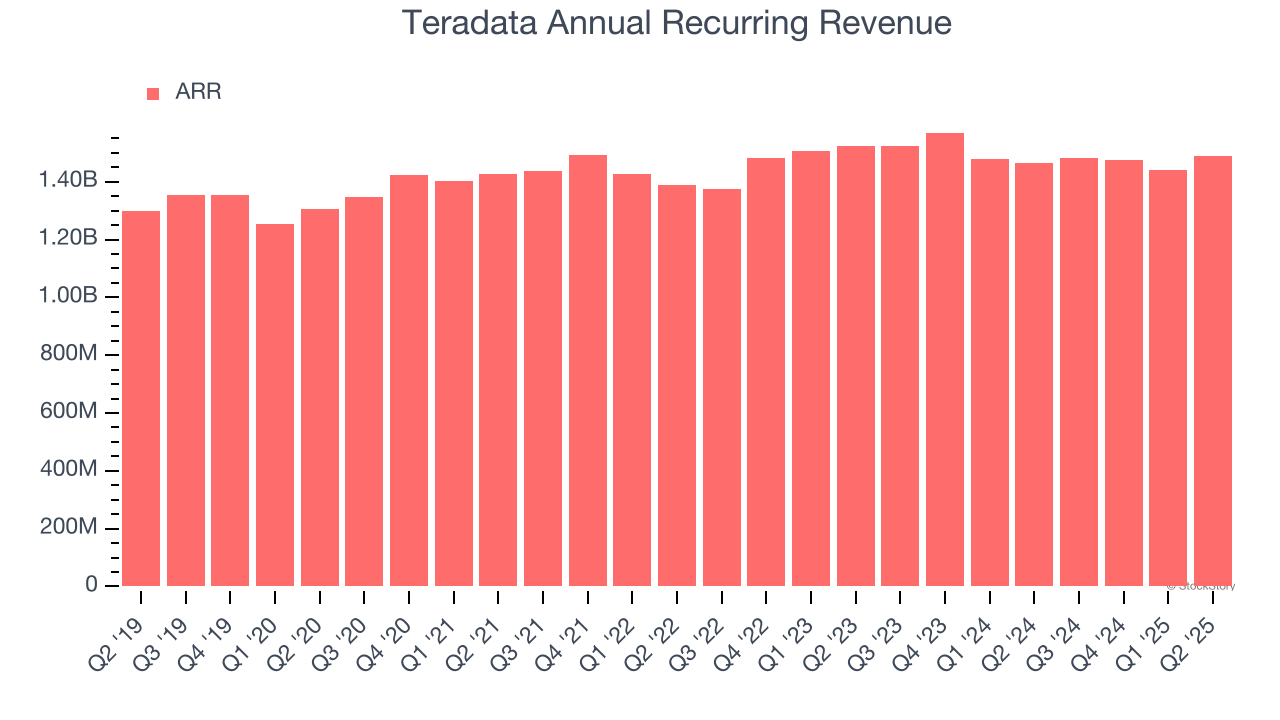

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Teradata’s ARR came in at $1.49 billion in Q2, and it averaged 2.4% year-on-year declines over the last four quarters. However, this alternate topline metric outperformed its total sales, which likely means that the recurring portions of the business are growing faster than less predictable, choppier ones such as implementation fees. That could be a good sign for future revenue growth.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Teradata is efficient at acquiring new customers, and its CAC payback period checked in at 38.6 months this quarter. The company’s relatively fast recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from Teradata’s Q2 Results

We enjoyed seeing Teradata beat analysts’ annual recurring revenue expectations this quarter. We were also glad its full-year EPS guidance exceeded Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed and its revenue guidance for next quarter fell slightly short of Wall Street’s estimates. Overall, this quarter was mixed, but expectations seemed low going into the print. The stock traded up 4.3% to $21.10 immediately after reporting.

Big picture, is Teradata a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.