Electrical energy control systems manufacturer Powell (NYSE: POWL) fell short of the market’s revenue expectations in Q2 CY2025, with sales flat year on year at $286.3 million. Its GAAP profit of $3.96 per share was 5% above analysts’ consensus estimates.

Is now the time to buy Powell? Find out by accessing our full research report, it’s free.

Powell (POWL) Q2 CY2025 Highlights:

- Revenue: $286.3 million vs analyst estimates of $301.7 million (flat year on year, 5.1% miss)

- EPS (GAAP): $3.96 vs analyst estimates of $3.77 (5% beat)

- Adjusted EBITDA: $61.87 million vs analyst estimates of $58.4 million (21.6% margin, 5.9% beat)

- Operating Margin: 21%, up from 19.9% in the same quarter last year

- Free Cash Flow Margin: 1.8%, down from 4.3% in the same quarter last year

- Backlog: $1.4 billion at quarter end

- Market Capitalization: $2.85 billion

Brett A. Cope, Powell’s Chairman and Chief Executive Officer, stated, “I am very proud of the Powell team as we delivered another strong quarter of results. We continue to execute our project backlog at a high level, achieving a gross margin of 30.7% in the current quarter, an improvement of 230 basis points compared to the prior year. Our strong brand of trusted execution supports another quarter of robust order activity highlighted by a book-to-bill ratio(3) of 1.3x and sequential backlog growth of 7%. While new order activity was strong across most of our key markets, notable awards in the quarter included a $60 million award in the Electric Utility market - the largest utility order in Powell’s history - and a testament to our long-term focus of growth within this market. We were also awarded over $80 million combined from two separate awards for custom offshore modules for oil and gas production; and we received a $30 million order for a large Traction Power project based in the United States.”

Company Overview

Originally a metal-working shop supporting local petrochemical facilities, Powell (NYSE: POWL) has grown from a small Houston manufacturer to a global provider of electrical systems.

Revenue Growth

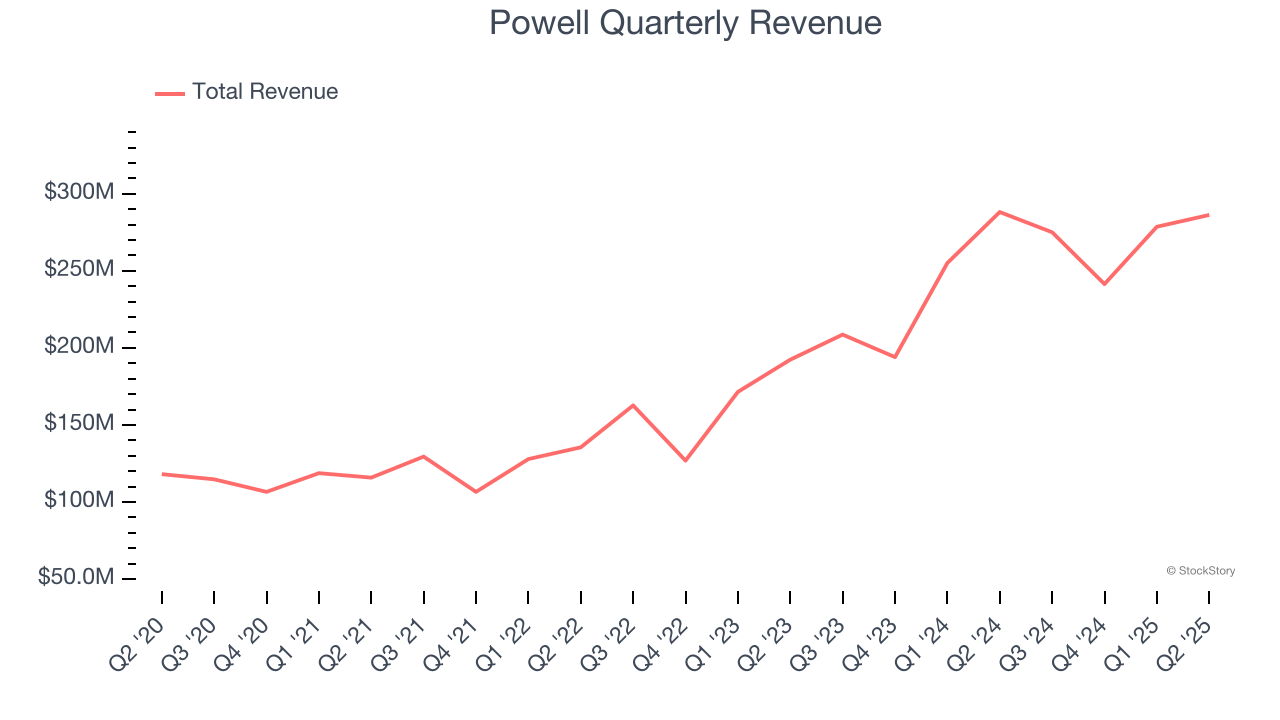

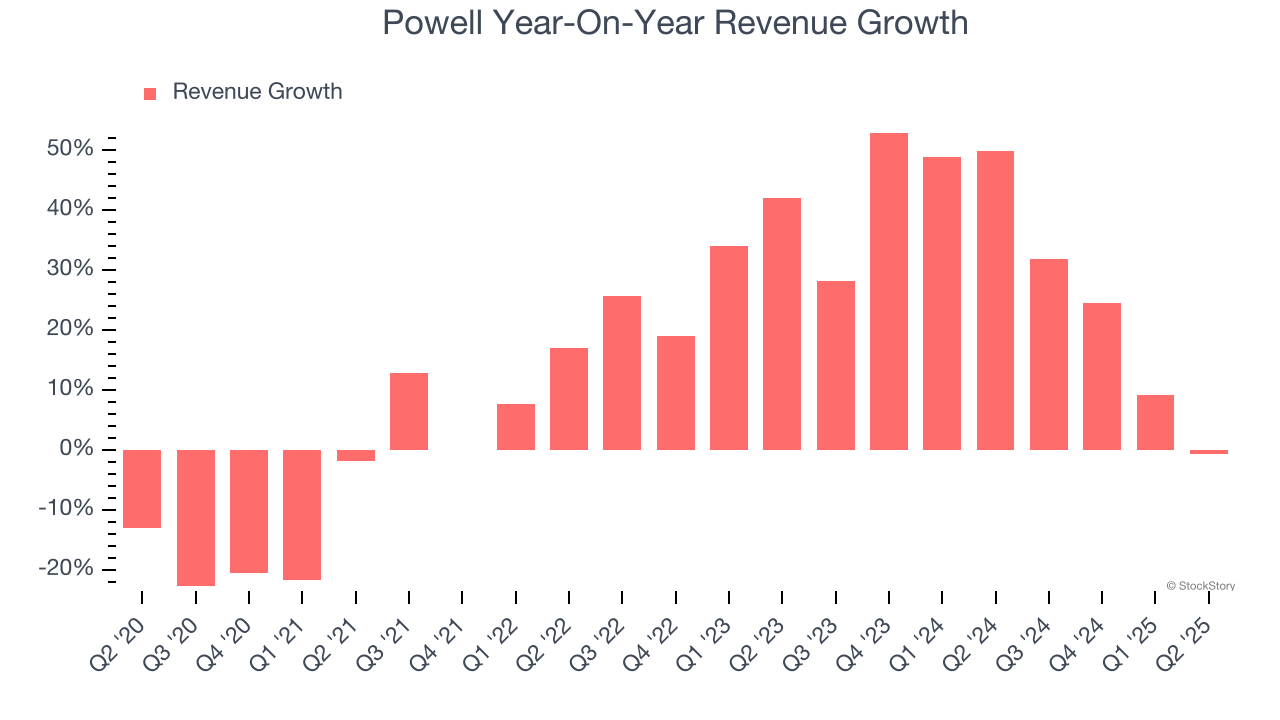

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Powell grew its sales at an exceptional 14.4% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Powell’s annualized revenue growth of 28.7% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated. Powell’s recent performance shows it’s one of the better Electrical Systems businesses as many of its peers faced declining sales because of cyclical headwinds.

This quarter, Powell missed Wall Street’s estimates and reported a rather uninspiring 0.7% year-on-year revenue decline, generating $286.3 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 7.1% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

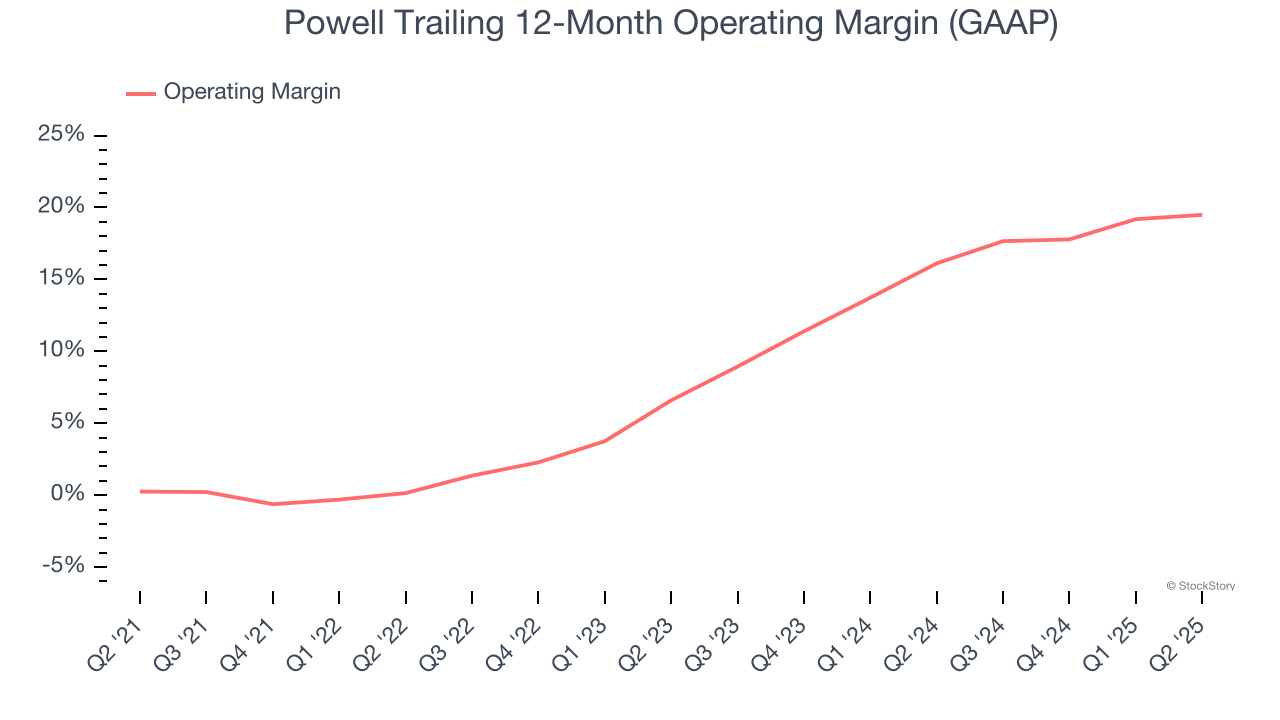

Powell has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 11.2%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Powell’s operating margin rose by 19.2 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q2, Powell generated an operating margin profit margin of 21%, up 1.1 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

Earnings Per Share

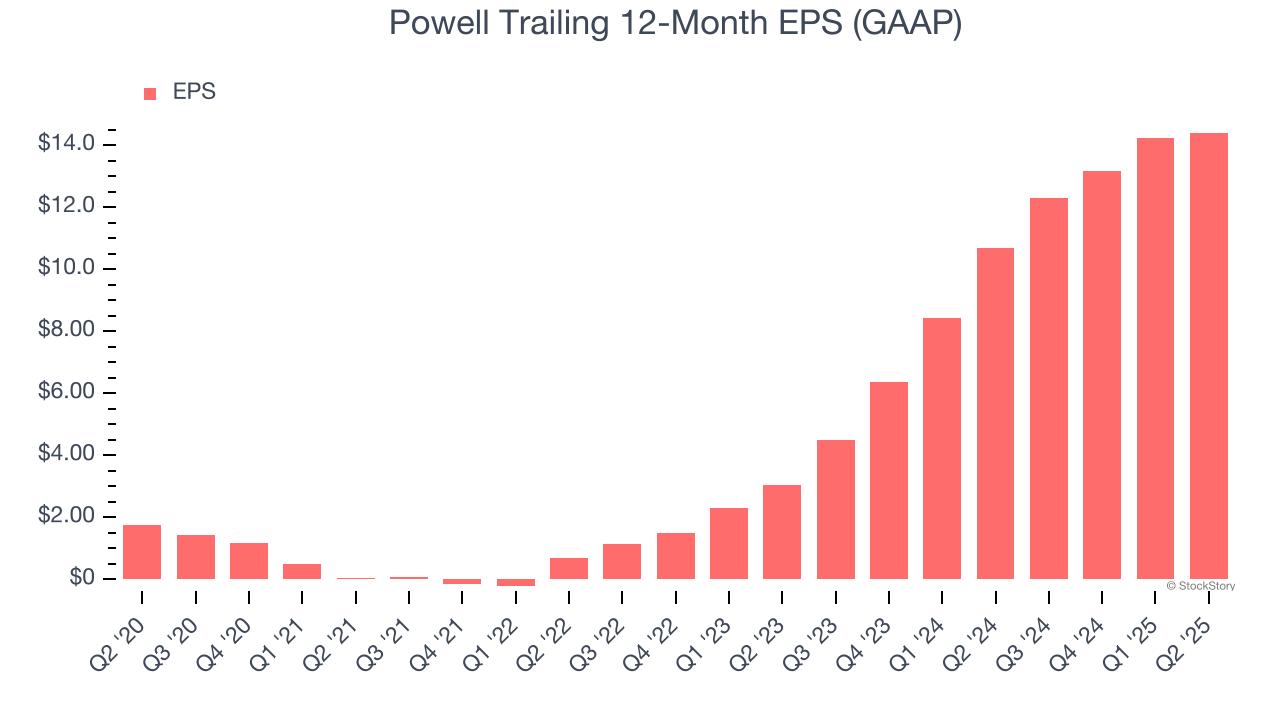

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Powell’s EPS grew at an astounding 52.6% compounded annual growth rate over the last five years, higher than its 14.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Powell’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Powell’s operating margin expanded by 19.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Powell, its two-year annual EPS growth of 117% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q2, Powell reported EPS at $3.96, up from $3.79 in the same quarter last year. This print beat analysts’ estimates by 5%. Over the next 12 months, Wall Street expects Powell’s full-year EPS of $14.40 to stay about the same.

Key Takeaways from Powell’s Q2 Results

We enjoyed seeing Powell beat analysts’ EPS and EBITDA expectations this quarter. On the other hand, its revenue missed. Overall, this was a weaker quarter. The stock traded down 12.4% to $208 immediately following the results.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.