Business communications software company 8x8 (NYSE: EGHT) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 1.8% year on year to $181.4 million. On the other hand, next quarter’s revenue guidance of $177.5 million was less impressive, coming in 1% below analysts’ estimates. Its non-GAAP profit of $0.08 per share was in line with analysts’ consensus estimates.

Is now the time to buy 8x8? Find out by accessing our full research report, it’s free.

8x8 (EGHT) Q2 CY2025 Highlights:

- Revenue: $181.4 million vs analyst estimates of $177.5 million (1.8% year-on-year growth, 2.2% beat)

- Adjusted EPS: $0.08 vs analyst estimates of $0.08 (in line)

- Adjusted Operating Income: $16.33 million vs analyst estimates of $16.38 million (9% margin, in line)

- The company reconfirmed its revenue guidance for the full year of $713 million at the midpoint

- Operating Margin: 0.3%, up from -0.8% in the same quarter last year

- Free Cash Flow Margin: 4.1%, up from 1.6% in the previous quarter

- Billings: $185 million at quarter end, up 3.4% year on year

- Market Capitalization: $252.6 million

"Our return to growth this quarter validates the strength of our platform strategy and our alignment with how organizations are engaging customers—intelligently, flexibly, and at scale. We’re executing with purpose, and it’s paying off: product adoption has expanded, consumption-based revenue has accelerated, and we’re building a business that’s not just growing but creating long-term value for shareholders," said Samuel Wilson, Chief Executive Officer at 8x8.

Company Overview

Founded in 1987, 8x8 (NYSE: EGHT) provides software for organizations to efficiently communicate and collaborate with their customers, employees, and partners.

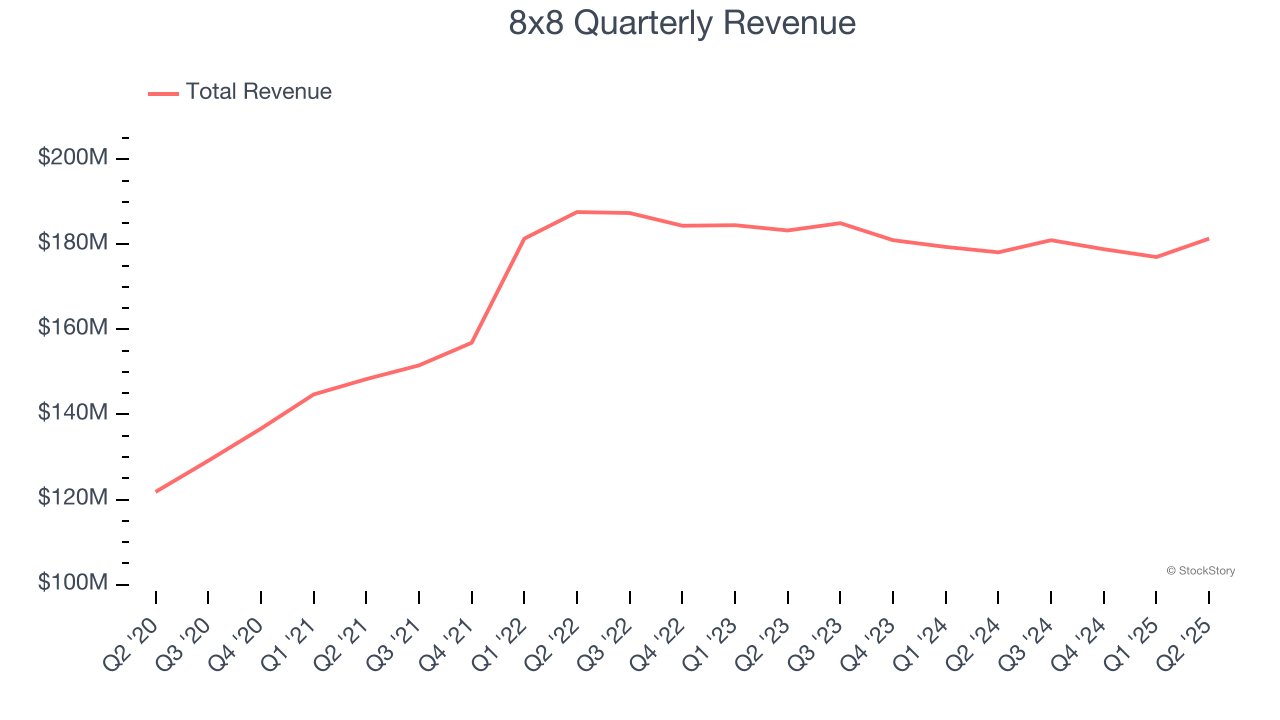

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, 8x8’s 2% annualized revenue growth over the last three years was weak. This was below our standards and is a poor baseline for our analysis.

This quarter, 8x8 reported modest year-on-year revenue growth of 1.8% but beat Wall Street’s estimates by 2.2%. Company management is currently guiding for a 1.9% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a slight deceleration versus the last three years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

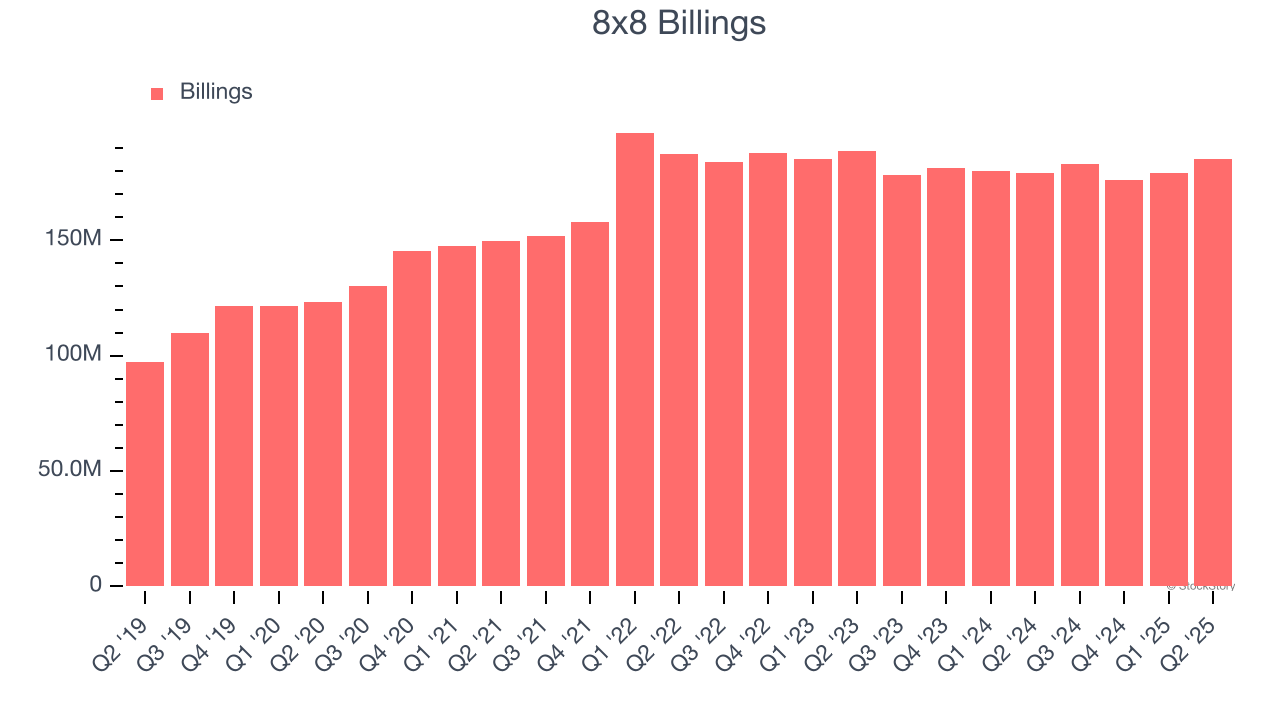

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Over the last year, 8x8 failed to grow its billings, which came in at $185 million in the latest quarter. This performance mirrored its total sales and shows the company faced challenges in acquiring and retaining customers. It also suggests there may be increasing competition or market saturation.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

8x8’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between 8x8’s products and its peers.

Key Takeaways from 8x8’s Q2 Results

We enjoyed seeing 8x8 beat analysts’ billings expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter slightly missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock traded up 3.4% to $1.99 immediately following the results.

Is 8x8 an attractive investment opportunity at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.