Pet food company Freshpet (NASDAQ: FRPT) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 17.6% year on year to $263.2 million. On the other hand, the company’s full-year revenue guidance of $1.14 billion at the midpoint came in 3.2% below analysts’ estimates. Its GAAP loss of $0.26 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Freshpet? Find out by accessing our full research report, it’s free.

Freshpet (FRPT) Q1 CY2025 Highlights:

- Revenue: $263.2 million vs analyst estimates of $259.6 million (17.6% year-on-year growth, 1.4% beat)

- EPS (GAAP): -$0.26 vs analyst estimates of $0.06 (significant miss)

- Adjusted EBITDA: $35.53 million vs analyst estimates of $34.14 million (13.5% margin, 4.1% beat)

- The company dropped its revenue guidance for the full year to $1.14 billion at the midpoint from $1.20 billion, a 5% decrease

- EBITDA guidance for the full year is $200 million at the midpoint, below analyst estimates of $205.1 million

- Operating Margin: -4.4%, down from 3.8% in the same quarter last year

- Free Cash Flow was -$21.68 million compared to -$41.07 million in the same quarter last year

- Organic Revenue was up 17.6% year on year

- Sales Volumes rose 14.9% year on year (30.6% in the same quarter last year)

- Market Capitalization: $3.72 billion

“Despite the recent macro-economic headwinds, we believe Freshpet remains a structurally advantaged business with a long runway for growth in a category with long-term tailwinds. However, our growth year-to-date has not been as robust as we had anticipated so we are adapting our growth plans to the current economic challenges that our consumers are facing while continuing to drive the operational improvements that are essential to our long-term success,” commented Billy Cyr, Freshpet’s Chief Executive Officer.

Company Overview

Standing out from typical processed pet foods, Freshpet (NASDAQ: FRPT) is a pet food company whose product portfolio includes natural meals and treats for dogs and cats.

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $1.01 billion in revenue over the past 12 months, Freshpet is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

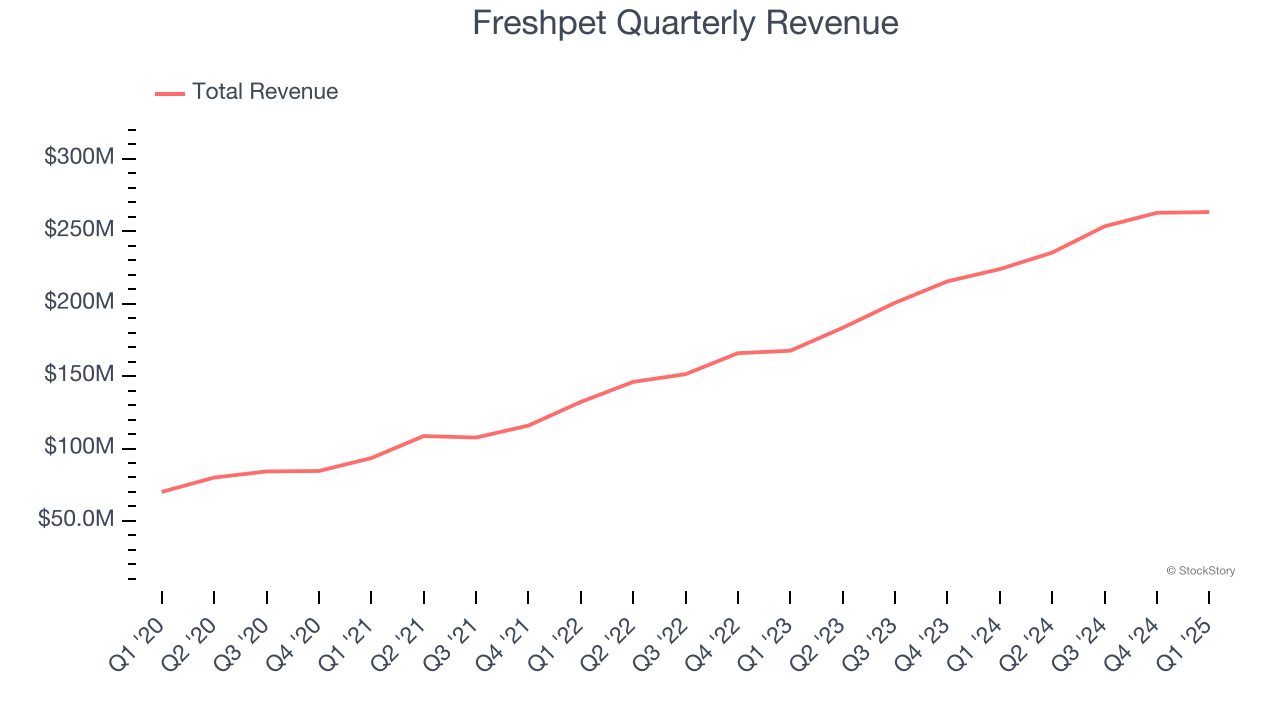

As you can see below, Freshpet’s sales grew at an exceptional 29.8% compounded annual growth rate over the last three years as consumers bought more of its products.

This quarter, Freshpet reported year-on-year revenue growth of 17.6%, and its $263.2 million of revenue exceeded Wall Street’s estimates by 1.4%.

Looking ahead, sell-side analysts expect revenue to grow 21.3% over the next 12 months, a deceleration versus the last three years. Still, this projection is noteworthy and suggests the market is forecasting success for its products.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

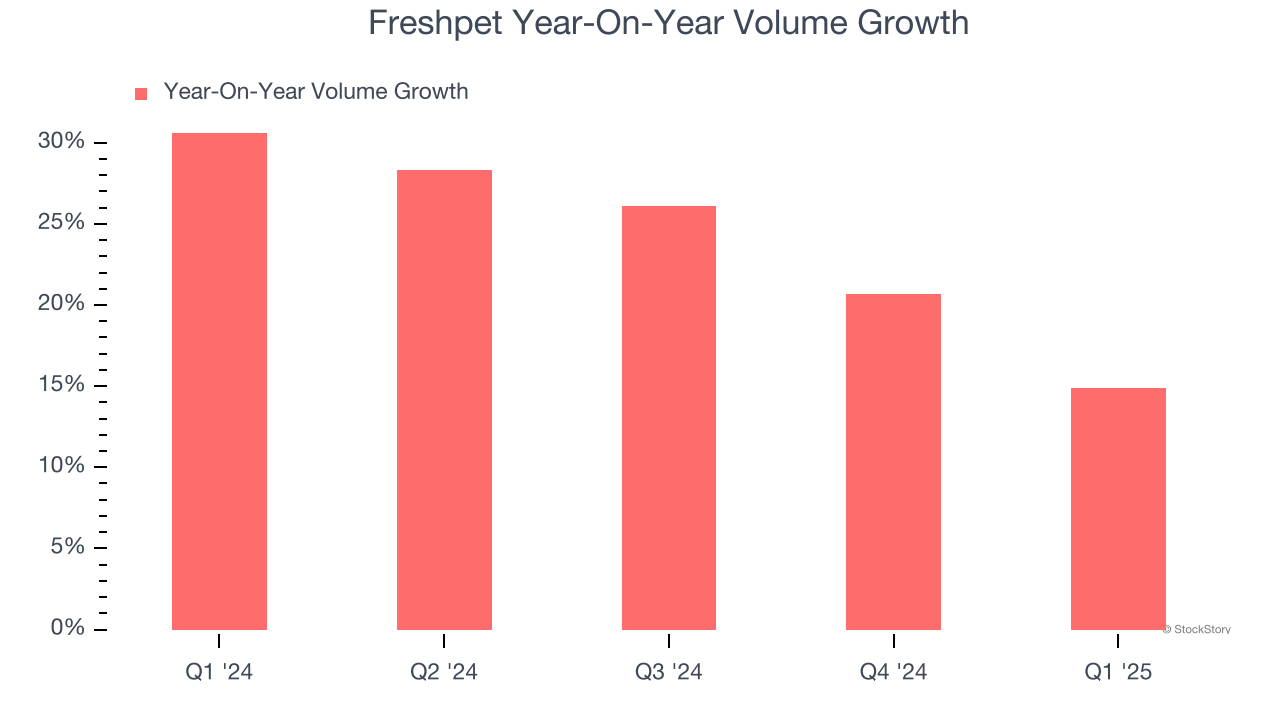

Freshpet’s average quarterly volume growth of 24.1% over the last two years has beaten the competition by a long shot. This is great because companies with significant volume growth are needles in a haystack in the stable consumer staples sector.

In Freshpet’s Q1 2025, sales volumes jumped 14.9% year on year. This result shows the business is staying on track, but the deceleration suggests growth is getting harder to come by.

Key Takeaways from Freshpet’s Q1 Results

We enjoyed seeing Freshpet beat analysts’ revenue and EBITDA expectations this quarter. On the other hand, its full-year revenue guidance missed significantly and its gross margin fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 3.5% to $73.70 immediately after reporting.

Freshpet’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.