What a brutal six months it’s been for ACV Auctions. The stock has dropped 51% and now trades at $7.94, rattling many shareholders. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy ACV Auctions, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Is ACV Auctions Not Exciting?

Even though the stock has become cheaper, we're cautious about ACV Auctions. Here are three reasons we avoid ACVA and a stock we'd rather own.

1. Low Gross Margin Reveals Weak Structural Profitability

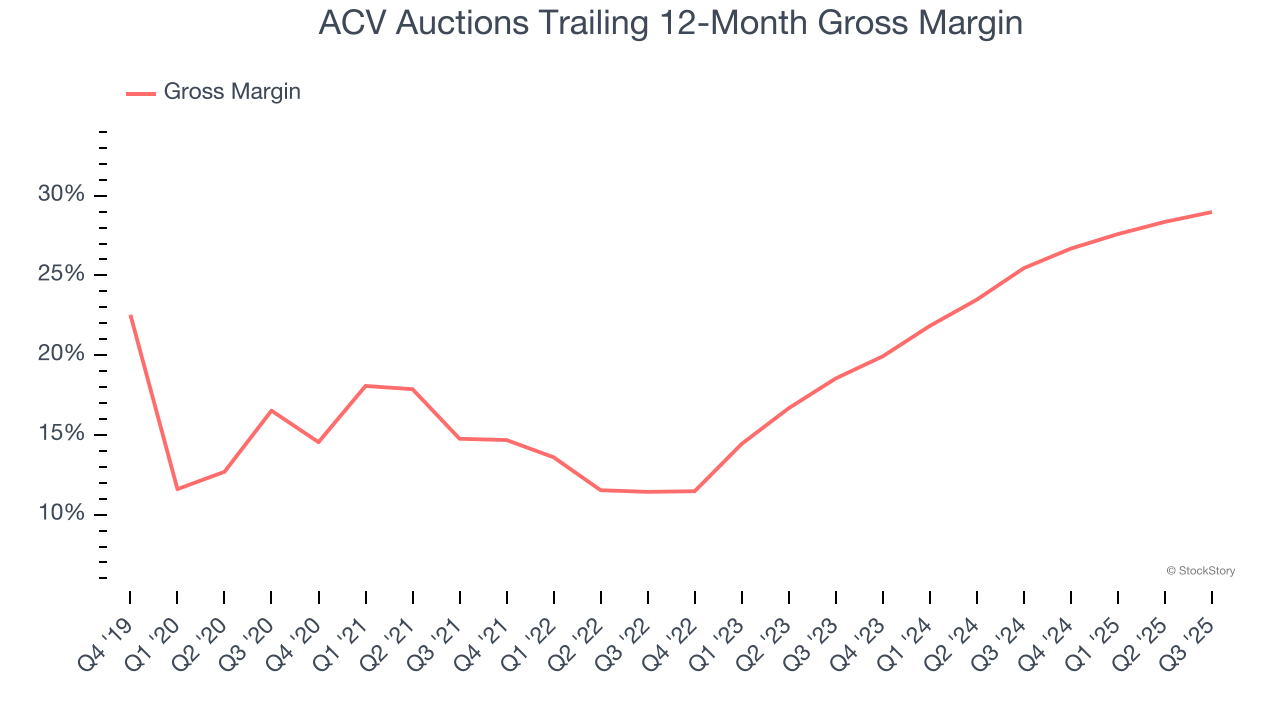

For online marketplaces like ACV Auctions, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include payment processing, hosting, and bandwidth fees in addition to the costs necessary to onboard buyers and sellers, such as identity verification.

ACV Auctions’s unit economics are far below other consumer internet companies, signaling it operates in a competitive market and must pay many third parties a slice of its sales to distribute its products and services. As you can see below, it averaged a 27.4% gross margin over the last two years. Said differently, ACV Auctions had to pay a chunky $72.60 to its service providers for every $100 in revenue.

2. Poor Marketing Efficiency Drains Profits

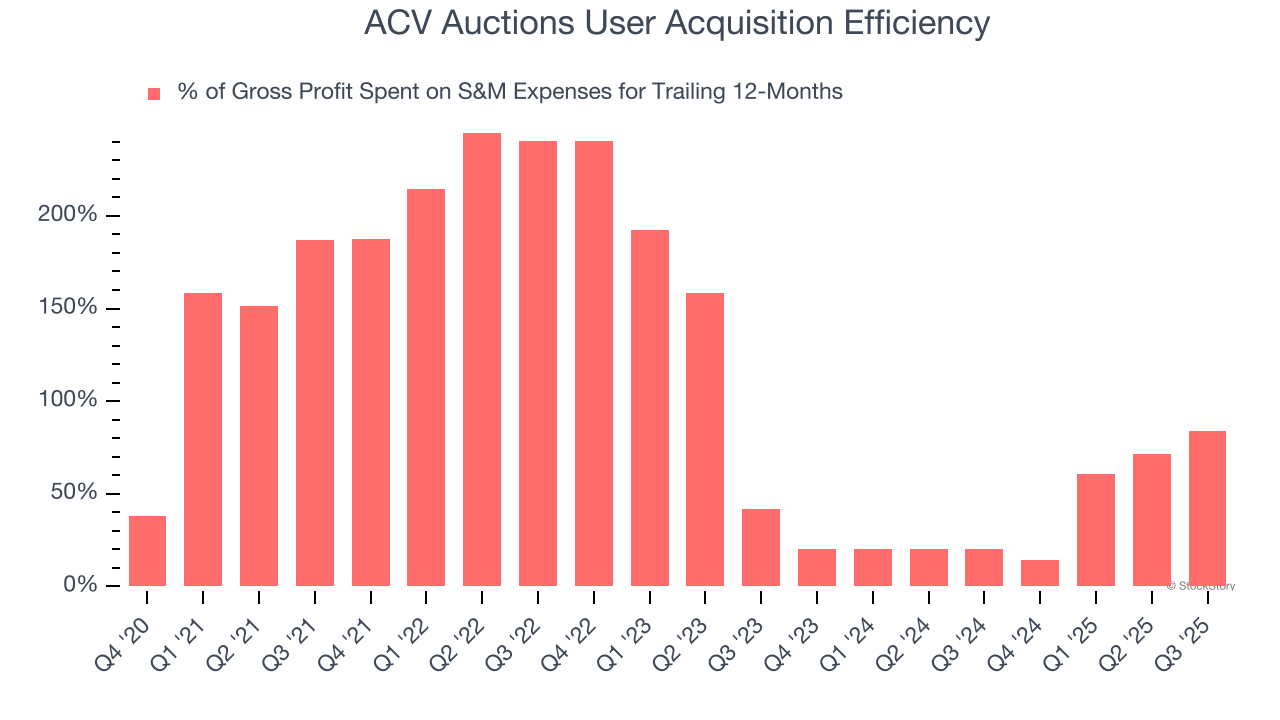

Consumer internet businesses like ACV Auctions grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

It’s very expensive for ACV Auctions to acquire new users as the company has spent 84% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates a highly competitive environment with little differentiation between ACV Auctions and its peers.

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

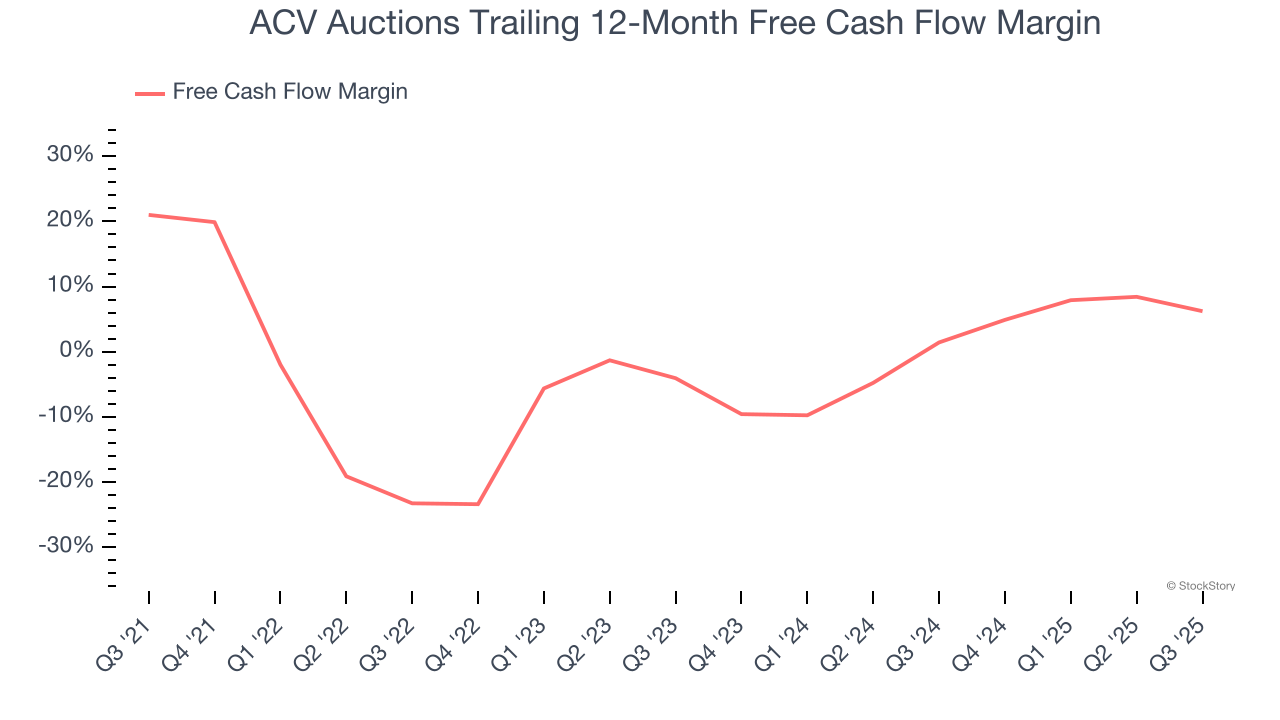

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

ACV Auctions has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.1%, subpar for a consumer internet business.

Final Judgment

ACV Auctions isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 19.9× forward EV/EBITDA (or $7.94 per share). At this valuation, there’s a lot of good news priced in - we think other companies feature superior fundamentals at the moment. We’d suggest looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than ACV Auctions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.