As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the online marketplace industry, including Teladoc (NYSE: TDOC) and its peers.

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

The 14 online marketplace stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 4.7% while next quarter’s revenue guidance was in line.

Luckily, online marketplace stocks have performed well with share prices up 12.7% on average since the latest earnings results.

Teladoc (NYSE: TDOC)

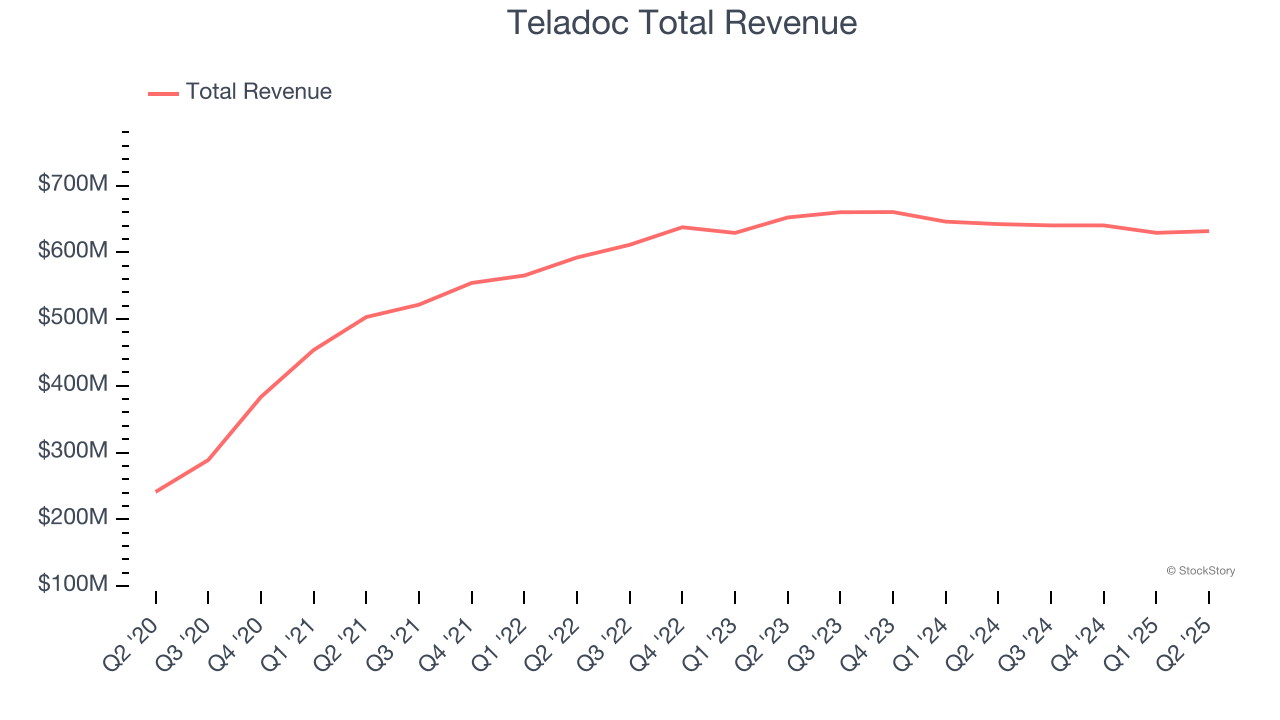

Founded to help people in rural areas get online medical consultations, Teladoc Health (NYSE: TDOC) is a telemedicine platform that facilitates remote doctor’s visits.

Teladoc reported revenues of $631.9 million, down 1.6% year on year. This print exceeded analysts’ expectations by 1.6%. Despite the top-line beat, it was still a mixed quarter for the company with an impressive beat of analysts’ EBITDA estimates but EBITDA guidance for next quarter missing analysts’ expectations significantly.

“I’m pleased with our performance in the second quarter, with consolidated revenue and adjusted EBITDA both at the higher end of our guidance ranges. This reflects continued disciplined execution and builds on our solid results from the first quarter. We continue to work with focus and urgency to advance our strategic priorities, invest in products and capabilities, and deliver solid financial performance,” said Chuck Divita, Chief Executive Officer of Teladoc Health.

Interestingly, the stock is up 11.4% since reporting and currently trades at $8.38.

Read our full report on Teladoc here, it’s free for active Edge members.

Best Q2: Shutterstock (NYSE: SSTK)

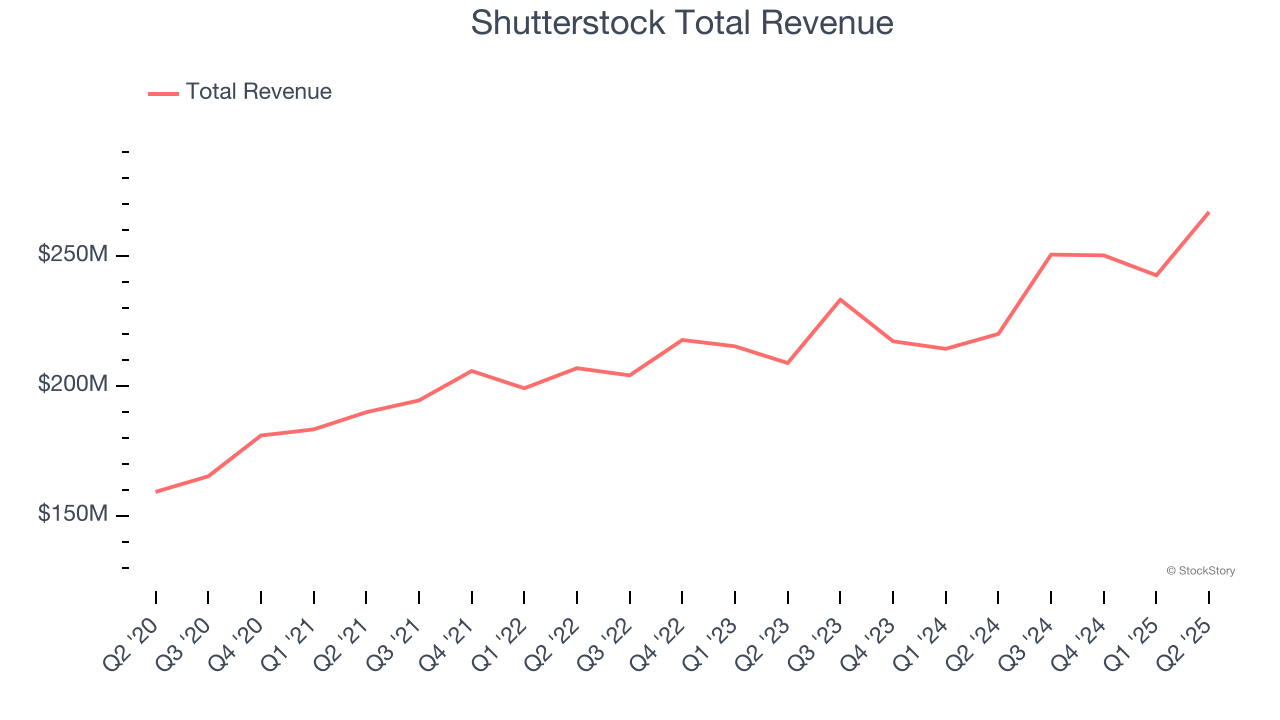

Originally featuring a library that included many of founder Jon Oringer’s photos, Shutterstock (NYSE: SSTK) is now a digital platform where customers can license and use hundreds of millions of pieces of content.

Shutterstock reported revenues of $267 million, up 21.3% year on year, outperforming analysts’ expectations by 7.5%. The business had a stunning quarter with a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 8.1% since reporting. It currently trades at $21.42.

Is now the time to buy Shutterstock? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: ACV Auctions (NYSE: ACVA)

Founded in 2014, ACV Auctions (NASDAQ: ACVA) is an online auction marketplace for car dealers and wholesalers to buy and sell used cars.

ACV Auctions reported revenues of $193.7 million, up 20.6% year on year, falling short of analysts’ expectations by 1.2%. It was a disappointing quarter as it posted a significant miss of analysts’ number of marketplace units estimates and revenue guidance for next quarter missing analysts’ expectations.

ACV Auctions delivered the highest full-year guidance raise but had the weakest performance against analyst estimates in the group. The company reported 210,429 units sold, up 12.8% year on year. As expected, the stock is down 30.3% since the results and currently trades at $9.30.

Read our full analysis of ACV Auctions’s results here.

CarGurus (NASDAQ: CARG)

Bringing transparency to a sometimes opaque process, CarGurus (NASDAQ: CARG) is a digital marketplace where auto dealers can connect with potential customers and where car buyers can browse, purchase, and obtain financing.

CarGurus reported revenues of $234 million, up 7% year on year. This print topped analysts’ expectations by 0.7%. Zooming out, it was a satisfactory quarter as it also recorded EBITDA guidance for next quarter exceeding analysts’ expectations but revenue guidance for next quarter missing analysts’ expectations.

The company reported 33,095 users, up 5.6% year on year. The stock is up 13.1% since reporting and currently trades at $35.54.

Read our full, actionable report on CarGurus here, it’s free for active Edge members.

The RealReal (NASDAQ: REAL)

Founded by consignment store aficionado Julie Wainwright, The RealReal (NASDAQ: REAL) is an online marketplace for buying and selling secondhand luxury goods.

The RealReal reported revenues of $165.2 million, up 14% year on year. This result beat analysts’ expectations by 3.6%. Overall, it was a very strong quarter as it also recorded EBITDA guidance for next quarter exceeding analysts’ expectations.

The company reported 1 million users, up 163% year on year. The stock is up 88.1% since reporting and currently trades at $10.40.

Read our full, actionable report on The RealReal here, it’s free for active Edge members.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.