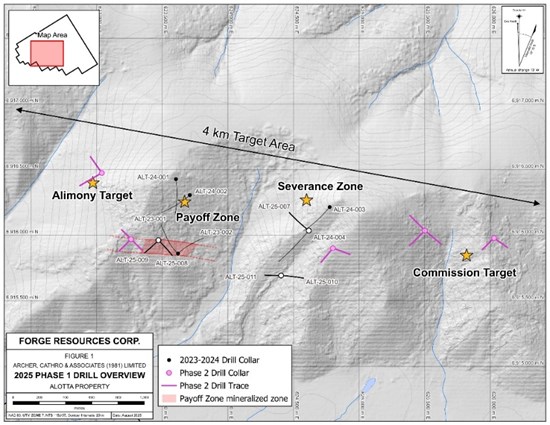

Vancouver, British Columbia--(Newsfile Corp. - August 7, 2025) - Forge Resources Corp. (CSE: FRG) (OTCQB: FRGGF) (FSE: 5YZ) ("FRG" or the "Company"), is pleased to announce the assay results from the first three of five diamond drill holes completed during the Phase 1 diamond drilling program at the Alotta project, with continuous porphyry mineralization including 0.911 g/t au over 20.49 m (Figure 1).

Highlights:

- Significantly increased area of porphyry-related gold mineralization

- Diamond drilling has doubled the known extent of the Payoff Zone to 350 m, returning significant intervals from holes ALT-25-008 and ALT-25-009.

- Hole ALT-25-008 (Payoff Zone) returned 118 m of 0.42 g/t Au, including 20.49 metres of 0.911 g/t Au. Widespread gold mineralization, including visible gold, was encountered throughout the entire length of the hole.

- Hole ALT-25-009 (Payoff Zone) returned 53.22 m of 0.449 g/t Au, including 32.56 m of 0.522 g/t Au. Widespread gold mineralization, including visible gold, was encountered throughout the entire length of the hole.

- At the Severance Zone, hole ALT-25-007 returned 300.72 m of 0.22 g/t Au, 0.48 g/t Ag and 0.03% Cu, including 53.48 m of 0.452 g/t Au from an untested geophysical anomaly. Mineralization was intersected over the entire length of the hole.

- All drill holes completed at Alotta have encountered quartz-sulphide (pyrite, pyrrhotite, molybdenite and chalcopyrite) veins and significant porphyry-style alteration.

Figure 1. Drill Plan Map of Completed and Proposed Phase 1 Diamond Drill Holes.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8680/261628_5154723de42329a0_001full.jpg

Severance Zone

Hole ALT-25-007 tested a magnetic low anomaly that coincides with a copper-gold-molybdenum soil anomaly located west of the 2024 diamond drill holes at the Severance Zone. This hole intersected widespread intervals of strong alteration and associated sulphide veining. Mineralization in the upper parts of the drill hole is dominated by pyrite and quartz-pyrite veins, and lesser quartz-pyrite-chalcopyrite and quartz-molybdenite veins. Strong silicification overprints earlier alteration and is itself overprinted by widespread chlorite, sericite and pyrite alteration. Copper values from this hole have increased compared to holes previously drilled in the Severance and Payoff zones and provide encouraging results for drill targeting. This drill hole ended in mineralization and is open at depth.

Highlight assay results from hole ALT-25-007 are shown in Table 1, below.

Table 1 - ALT-25-007 Assay Highlights

| ALT-25-007 | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) | Cu (%) | Mo (%) | AuEQ* (g/t) |

| 4.28 | 305 | 300.72 | 0.224 | 0.48 | 0.026 | 0.0019 | 0.264 | |

| including | 37.18 | 91.14 | 53.96 | 0.280 | 1.06 | 0.047 | 0.004 | 0.359 |

| And | 147.3 | 148.5 | 1.2 | 3.87 | 0.55 | 0.028 | 0.0007 | 3.91 |

| And | 251.52 | 305 | 53.48 | 0.452 | 0.21 | 0.016 | 0.001 | 0.475 |

| And including | 271.15 | 273 | 1.85 | 5.45 | 0.33 | 0.012 | 0.0025 | 5.48 |

| And including | 295 | 305 | 10.00 | 0.592 | 0.22 | 0.019 | 0.0024 | 0.626 |

*Gold equivalent calculation assumes the following commodity prices (USD): $3428/oz gold, $37.45/oz silver, $4.45/lb copper, $31.24/lb molybdenum (prices as of August 4, 2025). Calculation assumes 100% recovery because no metallurgical or scoping studies have been conducted to date at the Alotta property. Gold equivalent calculation uses the following formula: ((gold value / 31.1) * gold price) + ((silver value / 31.1) * silver price) + ((copper value / 453.6) * copper price) + ((molybdenum value / 453.6) * molybdenum price)

Photo 1. Quartz-pyrite stockwork veining cutting porphyry

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8680/261628_5154723de42329a0_002full.jpg

Payoff Zone

Hole ALT-25-008 is mineralized along its entire length including 0.416 g/t gold over 118.0 metres, with higher grade intercepts returning 9.53 g/t Au over 1.26 m and 16.85 g/t Au over 0.7m.

ALT-25-009 also mineralized top to bottom including 85.27 m returning 0.37 g/t Au, and 53.22 m of 0.449 g/t Au.

Both diamond drill holes completed at the Payoff Zone (ALT-25-008 and -009) returned widespread gold mineralization along their entire lengths. The 2025 drill holes have increased the area of gold mineralization at the Payoff Zone, which now forms a 200 m wide trend of mineralization that has so far been tested over a length of 350 m. This trend remains open in all directions, with additional follow up drilling planned for Phase 2.

Alteration in both 2025 drill holes consists of biotite, sericite, silicification and chlorite. Several quartz veins hosting sulphides and minor base metals were found to also host visible gold. Both holes cut through significant amounts of brecciation, indicating a peripheral location to the main porphyry centre for the Payoff Zone.

Photo 2. ALT-25-008 - Polymetallic quartz veining (pyrite, arsenopyrite, sphalerite, pyrrhotite)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8680/261628_5154723de42329a0_003full.jpg

Highlight assay results from hole ALT-25-008 and -009 are shown in Tables 2 and 3, below.

Table 2 - ALT-25-008 Assay Highlights

| ALT-25-008 | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) | Cu (%) | Mo (%) | AuEQ* (g/t) |

| 6 | 279 | 273 | 0.252 | 0.674 | 0.015 | 0.0004 | 0.274 | |

| including | 43.37 | 264 | 220.63 | 0.295 | 0.54 | 0.016 | 0.0003 | 0.317 |

| including | 43.37 | 53.47 | 10.10 | 0.534 | 0.35 | 0.009 | 0.001 | 0.554 |

| And including | 118.79 | 264 | 145.21 | 0.368 | 0.667 | 0.017 | 0.0004 | 0.393 |

| including | 146.00 | 264.00 | 118.00 | 0.416 | 0.32 | 0.018 | 0.0004 | 0.434 |

| Including | 229.51 | 250.00 | 20.49 | 0.911 | 0.31 | 0.02 | 0.0004 | 0.935 |

| including | 242.25 | 243.51 | 1.26 | 9.53 | 1.04 | 0.016 | 0.0008 | 9.56 |

| including | 242.25 | 242.95 | 0.7 | 16.85 | 1.75 | 0.016 | 0.0012 | 16.89 |

*Gold equivalent calculation assumes the following commodity prices (USD): $3428/oz gold, $37.45/oz silver, $4.45/lb copper, $31.24/lb molybdenum (prices as of August 4, 2025). Calculation assumes 100% recovery because no metallurgical or scoping studies have been conducted to date at the Alotta property. Gold equivalent calculation uses the following formula: ((gold value / 31.1) * gold price) + ((silver value / 31.1) * silver price) + ((copper value / 453.6) * copper price) + ((molybdenum value / 453.6) * molybdenum price)

Photo 3. ALT-25-008 - Polymetallic quartz veining (pyrite, arsenopyrite, sphalerite, pyrrhotite)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8680/261628_5154723de42329a0_004full.jpg

Table 3 - ALT-25-009 Assay Highlights

| ALT-25-009 | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) | Cu (%) | Mo (%) | AuEQ* (g/t) |

| 11.58 | 252 | 240.42 | 0.204 | 0.51 | 0.014 | 0.0003 | 0.223 | |

| including | 66.16 | 252 | 185.84 | 0.252 | 0.51 | 0.015 | 0.0003 | 0.273 |

| including | 67.54 | 68.93 | 1.39 | 1.60 | 0.54 | 0.004 | 0.0007 | 1.61 |

| And including | 149.13 | 234.40 | 85.27 | 0.373 | 0.56 | 0.015 | 0.0003 | 0.394 |

| including | 149.13 | 202.35 | 53.22 | 0.449 | 0.55 | 0.016 | 0.0003 | 0.472 |

| including | 149.13 | 181.69 | 32.56 | 0.522 | 0.70 | 0.017 | 0.0003 | 0.547 |

| including | 149.13 | 151.31 | 2.18 | 2.44 | 6.73 | 0.071 | 0.0002 | 2.58 |

| And including | 173.08 | 181.69 | 8.61 | 0.777 | 0.21 | 0.016 | 0.0003 | 0.796 |

*Gold equivalent calculation assumes the following commodity prices (USD): $3428/oz gold, $37.45/oz silver, $4.45/lb copper, $31.24/lb molybdenum (prices as of August 4, 2025). Calculation assumes 100% recovery because no metallurgical or scoping studies have been conducted to date at the Alotta property. Gold equivalent calculation uses the following formula: ((gold value / 31.1) * gold price) + ((silver value / 31.1) * silver price) + ((copper value / 453.6) * copper price) + ((molybdenum value / 453.6) * molybdenum price)

PJ Murphy, CEO states: "These results have confirmed our exploration model is working and the results show many similarities to the Casino Deposit. To date we have encountered extensive alteration and mineralization similar to the more distal zones away from the Patton Porphyry. Our geophysical and geochemical surveys show similar patterns to the Casino deposit, which will be tested during our Phase 2 exploration program, so we are excited to resume drilling soon on the property."

Assays still pending on Holes ALT-25-010/011. The company will provide further updates as results become available.

Proximity to Proven and Probable Resources

The Alotta property now consists of 230 mineral claims that covers approximately 4,723 hectares in a similar geological setting to Western Copper and Gold's Casino deposit, that is located 50 km to the south-east. The Casino deposit is one of the largest undeveloped copper-gold porphyry mining projects in the world.

About Forge Resources Corp.

Forge Resources Corp. is a Canadian-listed junior exploration company focused on exploring and advancing the Alotta project, a prospective porphyry copper-gold-molybdenum project consisting of 230 mineral claims that cover 4,723 hectares, located 50 km south-east of the Casino porphyry deposit in the unglaciated portion of the Dawson Range porphyry/epithermal belt in the Yukon Territory of Canada.

In addition, the Company holds an 80% interest in Aion Mining Corp., a company that is developing the fully permitted La Estrella coal project in Santander, Colombia. The project contains eight known seams of metallurgical and thermal coal.

Qualified Person

Lorne Warner, President and P. Geo, is a qualified person as defined by National Instrument 43-101 and has reviewed and approved the scientific and technical disclosure in this news release.

On behalf of the Board of Directors

"PJ Murphy", CEO Forge Resources Corp.

info@forgeresources.com

Forward-Looking Statements

Certain of the statements made and information contained herein may contain forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking information includes, but is not limited to, information concerning the Company's intentions with respect to the development of its mineral properties. Forward-looking information is based on the views, opinions, intentions and estimates of management at the date the information is made, and is based on a number of assumptions and subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated or projected in the forward-looking information (including the actions of other parties who have agreed to do certain things and the approval of certain regulatory bodies). Many of these assumptions are based on factors and events that are not within the control of the Company and there is no assurance they will prove to be correct. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by applicable securities laws, or to comment on analyses, expectations or statements made by third parties in respect of the Company, its financial or operating results or its securities. The reader is cautioned not to place undue reliance on forward-looking information. We seek safe harbor.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/261628