“Be fearful when others are greedy, and greedy when others are fearful.”

Warren Buffett said it best: Great investing often involves seeking out unloved names that the market has overlooked or undervalued.

While it's tempting to buy popular stocks like NVIDIA (NASDAQ: NVDA) and Tesla (NASDAQ: TSLA), these high-flyers don't always offer the best returns because much of their potential is already priced in (or worse, overestimated).

And that’s exactly how Buffett and Charlie Munger made a career: finding stocks discarded by markets but still offered great value.

Today, we’ll introduce you to a stock on the cusp of a turnaround. When sentiment is low, but the potential for recovery is high, a prime buying opportunity presents itself.

Let’s dive in.

Ethan Allen Interiors Inc. (NYSE: ETD) is a renowned interior design company that manufactures and retails high-quality home furnishings. The company focuses strongly on the premium, upper-end market segment, with 75% of its products custom-made in the United States.

Despite recent challenges, Ethan Allen’s strong financials and strategic initiatives make it a compelling addition to your portfolio.

Signs of Recovery

The home furnishings industry has experienced a downturn over the past few quarters as consumer spending normalized after the pandemic-induced surge. However, there are promising signs of a potential turnaround.

First, remote work is here to stay. BCG's "Workplace of the Future" survey reveals that companies expect approximately 40% of their employees to utilize a remote working model in the future. This is particularly relevant for Ethan Allen’s premium market segment, which is less affected by broader economic concerns like elevated inflation and interest rate uncertainties.

Homebuilding Catch-Up

The housing shortage in the U.S. is not news; it’s a chronic issue that’s been decades in the making.

Homebuilders are responding and rising to the challenge, unbothered by high mortgage rates.

According to FastCompany, the 10 largest publicly traded homebuilders brought in 18% higher new home orders in Q1 2024 than in Q1 2023, a period when builders were still adjusting to the 2022 mortgage rate shock.

Do you know what new homes mean? New furniture.

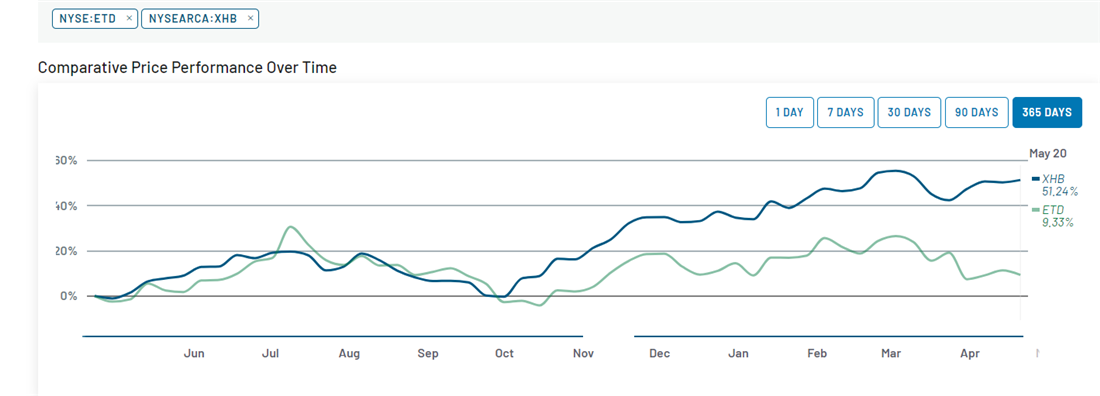

The chart shows what the market is missing—Ethan Allen and the furniture industry in general are due to catch up to the homebuilding boom.

Get Paid to Wait with Reliable Dividends

Despite recent underperformance, Ethan Allen’s financial health remains solid. The company has been paying dividends consistently for the past 29 years, through bull, bear, and sideways markets.

They posted a 61% gross margin in Q1 2024 and hold $181 million in cash with no outstanding debt. This solid financial footing has enabled Ethan Allen to increase their quarterly cash dividend from $0.36 to $0.39 per share, yielding 5.3% at current prices. This yield is higher than those of larger competitors like La-Z-Boy (NYSE: LZB) and RH (NYSE: RH).

A Challenging Quarter, But Bright Spots Shine

In the first quarter of 2024, Ethan Allen faced some hurdles. Net sales declined by 21% year-over-year, and net income dropped by 42%. These declines were largely due to a general dip in demand for home furnishings across the US.

However, the company’s resilience came through as gross margins (60%+) far surpassed the industry average of around 40%. The company is also in the process of re-designing its 175 design centers, partnering with influencers to increase their visibility and market reach.

In addition, the fact that 75% of the company’s custom-built furniture is made in the USA shields it from supply chain disruptions like those experienced during COVID-19. Manufacturing-heavy companies took note - manufacturing jobs listed went from 153k in 2020 to over 400k in 2023.

Conclusion: Ethan Allen Stock Forecast

While Ethan Allen’s sales and profits have declined recently, the potential for recovery is evident. The company’s strong financial position, strategic initiatives, and high gross margins provide a buffer against industry headwinds.

Adding Ethan Allen to your portfolio could be smart, capitalizing on tradition, innovation, and reliable dividends.