The traditional school system carries a price tag most families never fully calculate. Between housing premiums in desirable school districts, daily transportation expenses, and the hidden costs of location dependency, conventional education demands financial sacrifices that extend far beyond tuition. What if families could redirect those thousands of dollars annually toward experiences, savings, or investments instead?

Remote learning doesn't just change where children attend school—it fundamentally reshapes family economics. From eliminating morning commutes to unlocking geographic freedom, virtual schooling creates financial flexibility that traditional brick-and-mortar institutions simply cannot match. The question isn't whether remote learning saves money. The real question is how much.

The True Cost of Traditional Education

Traditional schooling costs more than parents realize. Most focus on tuition and supplies, but the real burden runs deeper.

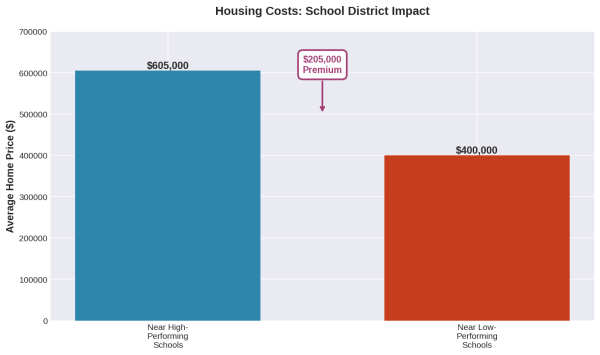

Housing choices drain budgets silently. Research from the Brookings Institution reveals homes near high-performing schools cost an average of $205,000 more than comparable properties near lower-rated schools. Families essentially pay private school prices through inflated housing costs just to access public education. These premium homes command 30 percent fewer rental options and typically include 1.5 more rooms families may not need. Virtual schools like joinprisma eliminate this entire expense category by decoupling education quality from location.

The math gets worse. These premium homes typically include 1.5 more rooms and command 30 percent fewer rental options. Translation? Families face limited housing choices and inflated costs, all for the privilege of attending a neighborhood school.

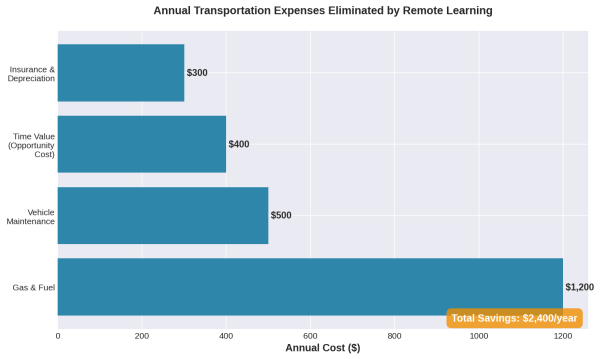

Transportation expenses compound the problem. While some students ride free school buses, over half of American students travel by private vehicle. State and local governments spend an average of $554 per student annually on school transportation, but families driving children themselves face even higher costs. Gas, vehicle maintenance, parking fees, and time all add up.

The hidden opportunity costs are perhaps most significant. Parents organize their entire lives around school schedules, commute patterns, and location restrictions. This geographic inflexibility limits career options, prevents entrepreneurial pursuits, and eliminates lifestyle choices that could improve family finances.

Direct Financial Benefits of Virtual Education

Online learning delivers immediate cost savings.

The numbers tell a clear story. Online private K-12 schools charge an average of $10,952 per year compared to $14,903 for traditional private schools. That's nearly $4,000 in annual savings—money that stays in family budgets instead of going toward campus facilities families may never use.

Public online programs offer even greater savings. Students save over $1,200 per semester on expenses like transportation, housing, and meal plans. For families with multiple children, these savings multiply quickly.

Many online schools offer scholarship opportunities to further reduce costs. Leading virtual schools award substantial scholarships annually, with assistance ranging from 10 to 40 percent off tuition for families with household incomes below $150,000. Research shows around 40 percent of learners at top virtual schools receive financial aid, making quality education accessible to more families.

But direct tuition savings represent just the beginning. The real financial transformation comes from eliminated expenses that traditional schooling requires.

Location Independence: The Ultimate Financial Freedom

Remote learning breaks the geographic chains.

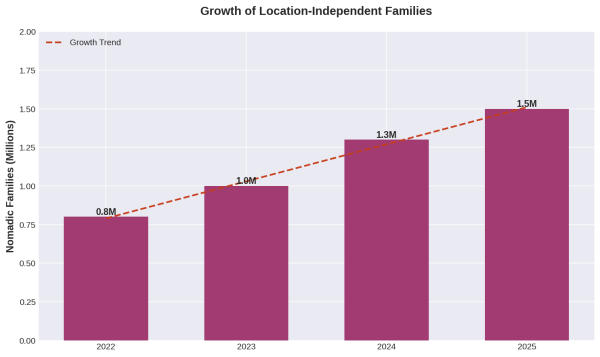

Digital nomad families are exploding in number. As of 2025, an estimated 35 million people worldwide identify as digital nomads, with projections suggesting hundreds of millions by 2030. Approximately 1.5 million nomadic families now travel full-time, relying on virtual schooling to maintain educational continuity.

These families aren't just traveling—they're optimizing their cost of living. Southeast Asia, Eastern Europe, and Latin America offer living expenses 50 to 70 percent lower than major American cities while maintaining comparable quality of life. Location-independent families report spending roughly the same amount traveling full-time as they would maintaining a stationary lifestyle with a mortgage.

The flexibility extends beyond international travel. Many families use virtual schooling to relocate to lower-cost American regions without sacrificing educational quality. A family might move from expensive California suburbs to affordable Tennessee, immediately cutting housing costs in half while accessing the same caliber of online education.

This geographic freedom creates powerful financial options. Families can live near grandparents for free childcare. Parents can accept remote work opportunities in lower-cost regions. Entrepreneurial families can test new markets without disrupting children's education.

The rise of family-friendly digital nomad visas in countries like Portugal, Spain, and Thailand makes extended international stays increasingly practical. These visas allow families to experience new cultures, learn languages, and reduce living costs—all while children maintain consistent, high-quality education through virtual schools.

Housing Costs and School District Premiums

School districts drive housing prices in surprising ways.

Real estate near top-rated schools commands premiums of 10 to 50 percent above comparable properties in average districts. In elite school zones, the markups reach extreme levels. Carroll Independent School District in Southlake, Texas demands a 391 percent premium—homes there cost $2.16 million compared to $439,967 outside the district.

These premiums essentially force families into a financial corner. Parents who want quality public education must either afford expensive housing or accept inferior schooling. There's no middle ground in the traditional model.

Virtual schooling eliminates this dilemma entirely. Families can purchase homes based on actual housing needs, not school zone boundaries. A family might buy a four-bedroom house in an affordable neighborhood for $300,000 instead of squeezing into a two-bedroom condo for $500,000 in a premium school district.

The savings compound over time. Lower housing costs mean smaller mortgages, reduced property taxes, cheaper insurance, and decreased maintenance expenses. Over a 30-year mortgage, the difference between premium and standard housing costs can exceed $200,000—money that could fund college educations, retirement savings, or family experiences.

Rental families benefit similarly. Without school district constraints, they can choose affordable neighborhoods, negotiate better lease terms, or even house-hack by renting portions of larger properties to offset costs.

Transportation Savings Add Up Fast

Daily commutes drain family resources silently.

Transportation remains one of the highest annual consumer expenditures, totaling $12,295 per household in 2023 according to the U.S. Department of Transportation. While not all of this goes toward school-related travel, the daily school run represents a significant portion for families with children.

Consider the math for a typical suburban family. School districts spend approximately $3,000 per student annually on bus transportation. Families driving children themselves face similar or higher costs when accounting for gas, vehicle wear, parking, and time value.

A parent making two daily school trips—morning drop-off and afternoon pickup—drives roughly 20 miles per day at $0.65 per mile (the IRS standard mileage rate). That's $13 daily, $65 weekly, or $2,340 annually for nine months of school. With multiple children or longer distances, costs escalate quickly.

Remote learning students eliminate these expenses entirely. The commute shrinks to walking from bedroom to home office. Families save not just money, but hours of time previously spent in traffic. Those hours translate to increased productivity, reduced stress, and better work-life balance.

The savings extend beyond direct fuel costs. Fewer miles driven means reduced vehicle maintenance, slower depreciation, lower insurance premiums, and delayed vehicle replacement. Over a child's K-12 education, these savings can fund a significant portion of college expenses.

The Total Cost Comparison

Let's calculate real-world scenarios.

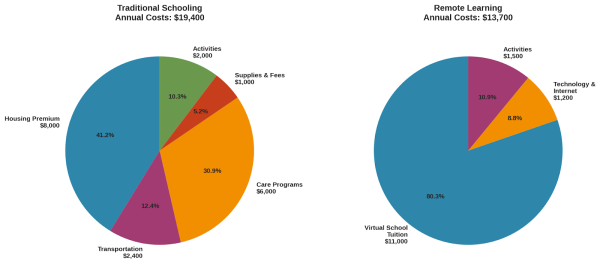

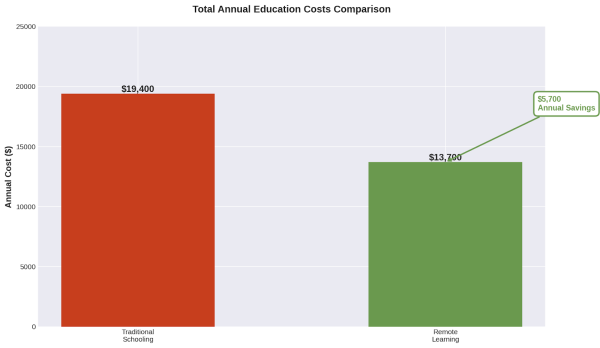

Traditional Schooling Family Annual Costs:

- Housing premium for school district: $8,000 (additional $200,000 home value at 4% interest)

- Transportation expenses: $2,400

- Before/after school care: $6,000

- School supplies and fees: $1,000

- Extracurricular activities: $2,000

- Total: $19,400 annually

Remote Learning Family Annual Costs:

- Virtual school tuition: $11,000

- Technology and internet: $1,200

- Supplemental activities: $1,500

- Total: $13,700 annually

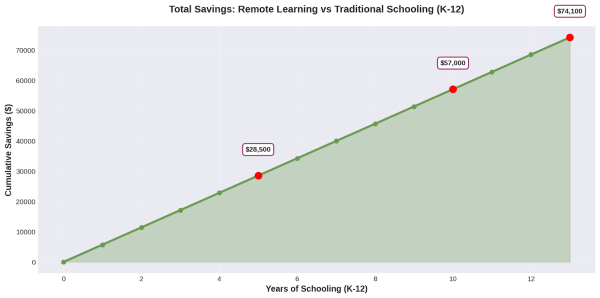

The remote learning family saves $5,700 annually. Over 13 years of schooling (grades K-12), that's $74,100 in direct savings. Factor in investment returns if that money gets saved or invested, and the total exceeds $100,000.

These calculations use conservative estimates. Families who leverage remote learning for geographic arbitrage—moving to lower-cost regions or countries—can save significantly more. Research confirms these financial benefits extend to both educational institutions and students, with institutions reducing facility costs while students mitigate commuting, housing, and material expenses.

The flexibility creates additional earning opportunities. Parents can accept remote work positions with higher salaries in different geographic markets. They can start side businesses during time previously spent commuting. They can relocate near family for free childcare, saving thousands in daycare expenses.

The financial transformation of remote learning extends far beyond simple tuition comparisons. When families eliminate housing premiums, transportation expenses, and location constraints, they unlock thousands of dollars annually while gaining lifestyle flexibility traditional schooling cannot provide. Virtual education platforms deliver quality instruction at a fraction of brick-and-mortar costs, with some families saving over $70,000 throughout their children's K-12 years. The rise of location-independent families—over 1.5 million worldwide in 2025—demonstrates that quality education need not require geographic sacrifice or financial strain. As remote work and digital nomadism continue growing, virtual schooling positions families to optimize both their finances and their lives. The question for families becomes not whether they can afford remote learning, but whether they can afford not to consider it.