U.S. markets opened 2026 on a strong note as major indices and tech stocks surged. The S&P 500 ($SPX) and Dow Jones ($DOWI) both hit record highs in early January, driven by continued enthusiasm for AI and tech companies. Big Tech names led the rally, and even long-mature stocks like Alphabet (GOOG) (GOOGL) are at the forefront.

Google’s parent just hit new all-time highs on Thursday after Cantor Fitzgerald upgraded the stock, calling it the “king of all AI trades.” The bullish view centers on Alphabet’s unique position across the entire AI stack, from data centers and custom chips to large language models and consumer applications.

With AI increasingly embedded across search, cloud, and advertising, the rally raises a timely question for investors: Is Google stock still a buy at record levels? Let's find out the answer.

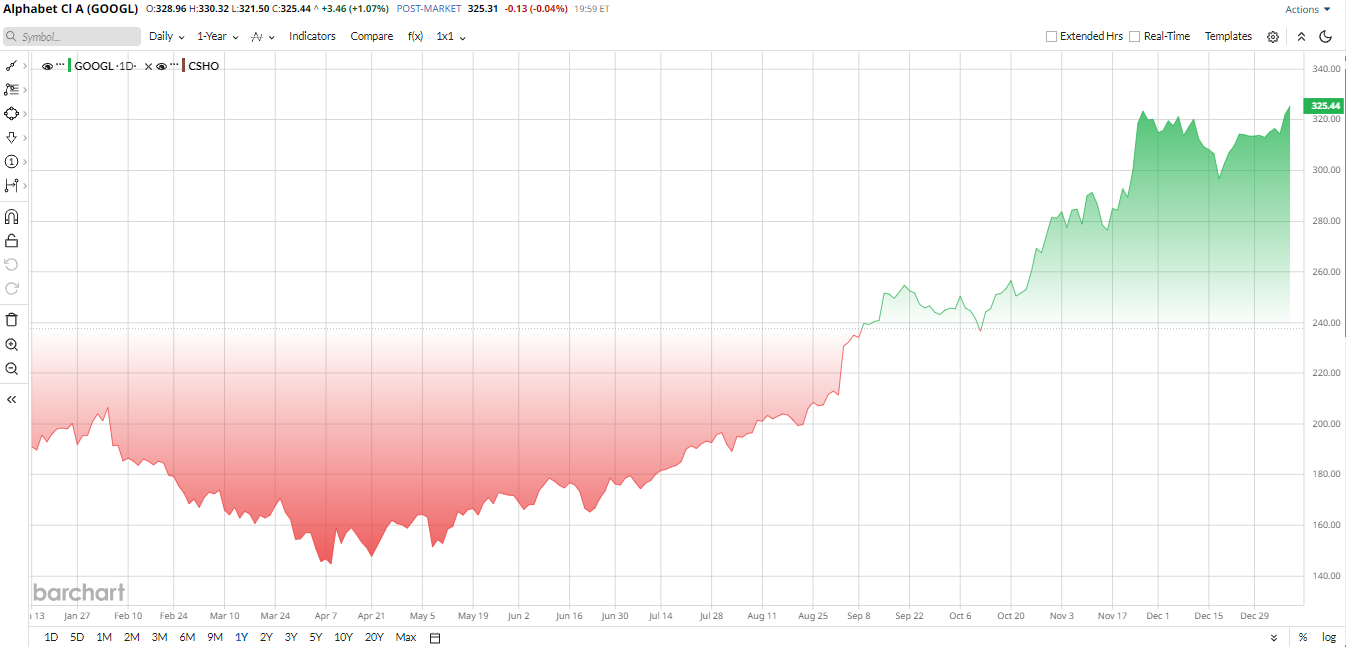

GOOGL Stock Performance

Alphabet is the conglomerate that owns Google and a host of tech businesses. It dominates online search and advertising and owns YouTube, Android, Google Cloud, and a portfolio of “Other Bets,” such as Waymo. The company’s scale is massive, its market cap is on the order of $3.9 trillion, and its broad product moat, like search data, the Android ecosystem, and cloud infrastructure, has kept it a leader in each of its core areas.

In 2025, Alphabet's stock surged roughly two-thirds year-over-year (YoY). Over the past 12 months, the shares gained about 67%, far outperforming the S&P 500 and crowning GOOGL stock as one of the top “Magnificent Seven” winners. This run was fueled by robust ad and cloud growth and investor excitement over Google’s AI push.

Despite the rally, Alphabet’s stock carries a premium valuation. Its trailing P/E is roughly 30× current earnings, far above the 18× median for the Communication Services sector. Likewise, its price-to-sales ratio of 10× greatly exceeds the sector’s mid-single-digit norm. It also sports a PEG near 1.8, reflecting high-growth expectations.

GOOGL Hits All-Time Peak

Yesterday, on Jan. 8, Cantor Fitzgerald upgraded Alphabet to “Overweight,” citing strength in its AI investments. Alphabet’s stock immediately shot up, hitting a new record-high intraday price of about $330.54, about 1.1% on the midday session, and extending its multi-month advance. This upgrade, along with other recent bullish calls, underscores Wall Street’s optimism on Google’s AI-led outlook.

Analysts note solid fundamentals underpinning the rally: last quarter’s revenue and EPS easily beat expectations.

GOOGL Tops Q3 Earnings Esimtate

Alphabet delivered a very strong set of third-quarter 2025 results, comfortably beating analysts’ expectations and reinforcing the stock’s upside narrative.

Revenue reached $102.35 billion, up 16% from a year earlier, with growth spread across the business. Google Services, which includes Search, YouTube, and advertising, generated $87.05 billion in revenue, a 14% increase. Google Cloud continued to stand out, posting revenue of $15.16 billion, up 34%, as enterprise demand remained solid.

The bottom line showed even stronger momentum. Net income rose 33% YoY to $34.98 billion, while earnings per share climbed 35% to $2.87 on a GAAP basis.

Cash generation remained robust. Free cash flow totaled around $24.5 billion for the quarter, supported by strong operating cash flows even as capital spending stayed elevated.

“Alphabet had a terrific quarter, with double-digit growth across every major part of our business. We delivered our first-ever $100 billion quarter,” CEO Sundar Pichai noted. Management did not issue formal Q4 guidance, but it did note continued Cloud momentum and raised full-year capital spending. Pichai announced that 2025 CapEx is now expected to be $91 to 93 billion, reflecting heavy investments in data centers and AI hardware.

Wall Street models imply further growth ahead. On average, analysts forecast about $10.58 of EPS for full-year 2025, up significantly from $6.53 in 2024, implying continued double-digit profit growth.

Recent Developments

In the past two months, Alphabet has been active on many fronts. In December, it announced a $4.75 billion acquisition of Intersect Power, a renewable energy and data center infrastructure firm. The deal is intended to secure more clean power and faster capacity for Google’s cloud and AI data centers.

Separately, regulators remain in focus as the EU is set to decide by Feb. 10 on Alphabet’s proposed $32 billion Wiz cybersecurity buyout. The deal already cleared U.S. review last fall. Any EU conditions could affect the execution of Google’s cloud/cyber strategy.

On the product side, Alphabet is rolling out more AI features across its ecosystem. For example, Google enabled Gemini-powered AI features in Gmail for its 3 billion users, new “AI Overviews” that summarize emails, and automated writing tools, all aimed at boosting user engagement (and ultimately ad/Workspace revenue). YouTube and Search have likewise gotten more generative-AI enhancements recently.

Meanwhile, Waymo set records in 2025, surpassing 450,000 weekly rides and 14 million annual trips, underscoring the growth of Alphabet’s autonomous-vehicle arm.

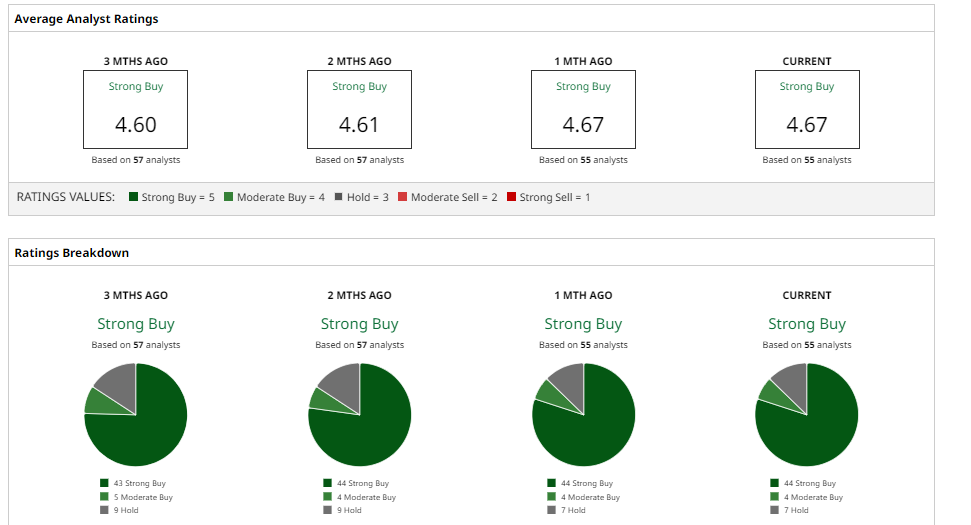

Analyst Outlook and Targets

Wall Street consensus remains strongly bullish. Most analysts rate GOOGL a “Strong Buy,” but the stock is already trading near its average price target of $332, suggesting limited near-term upside.

Notable recent calls include Morgan Stanley “Overweight,” $330 target, and Goldman Sachs “Buy,” $330 target, both issued around late October 2025. More recently, Citigroup’s Ronald Josey set a $350 price target on Dec. 22, and Wedbush also set a $350 price target.

Even more aggressive is J.P. Morgan’s Doug Anmuth, who put a lofty $385 target, anticipating that Google’s AI and cloud expansion will drive further gains.

So it looks like Wall Street is pretty upbeat and assumes that the rise of Alphabet, in particular, the advancement of AI, can support its high price, although they acknowledge that it is not a cheap stock.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia CEO Jensen Huang Warns Investors That the AI Market Is Bigger Than They Realize With Over ‘One and a Half Million AI Models in the World’

- Novo Nordisk Is Getting a Major Boost from Amazon for Its New Wegovy Pill. Does That Make NVO Stock a Buy Here?

- A $200 Billion Reason to Buy Opendoor Stock Today

- Oklo Declares a ‘Major Step in Moving Advanced Nuclear Forward’ Following Meta Deal. Should You Buy OKLO Stock Today?