With a market cap of $31.6 billion, Extra Space Storage Inc. (EXR) is a self-administered and self-managed REIT and a member of the S&P 500, making it the largest operator of self-storage properties in the United States. As of September 30, 2025, it owned and/or operated 4,238 stores across 43 states and Washington, D.C., offering approximately 2.9 million units and 326.9 million square feet of rentable space under the Extra Space brand.

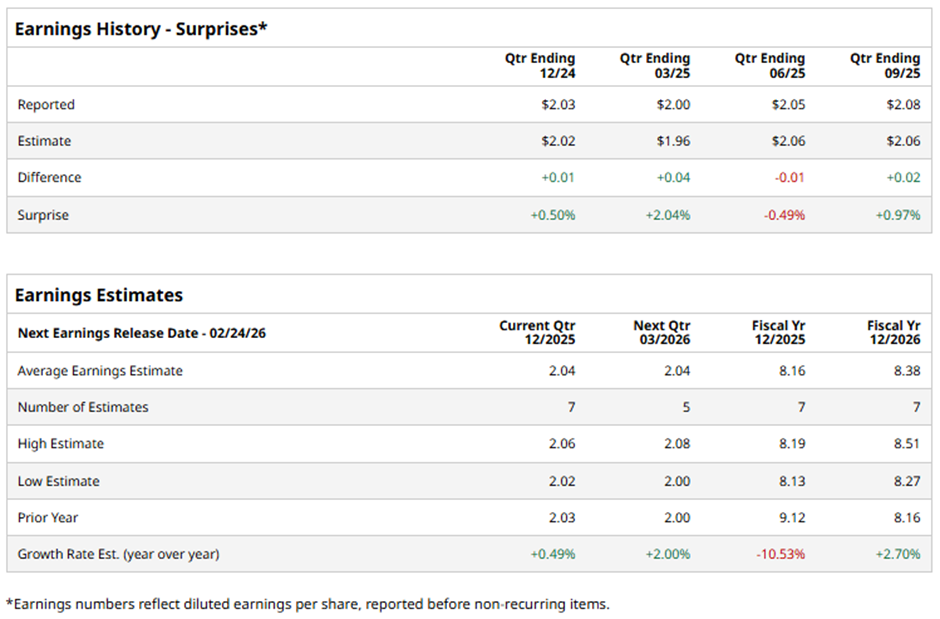

The Salt Lake City, Utah-based company is expected to release its fiscal Q4 2025 results soon. Ahead of this event, analysts project EXR to post a core FFO of $2.04 per share, a marginal rise from $2.03 per share in the year-ago quarter. It has surpassed Wall Street's bottom-line estimates in three of the last four quarterly reports while missing on another occasion.

For fiscal 2025, analysts forecast the self-storage facility REIT to report a core FFO of $8.16 per share, a decrease of 10.5% from $9.12 per share in fiscal 2024. However, core FFO is expected to rise 2.7% year-over-year to $8.38 per share in fiscal 2026.

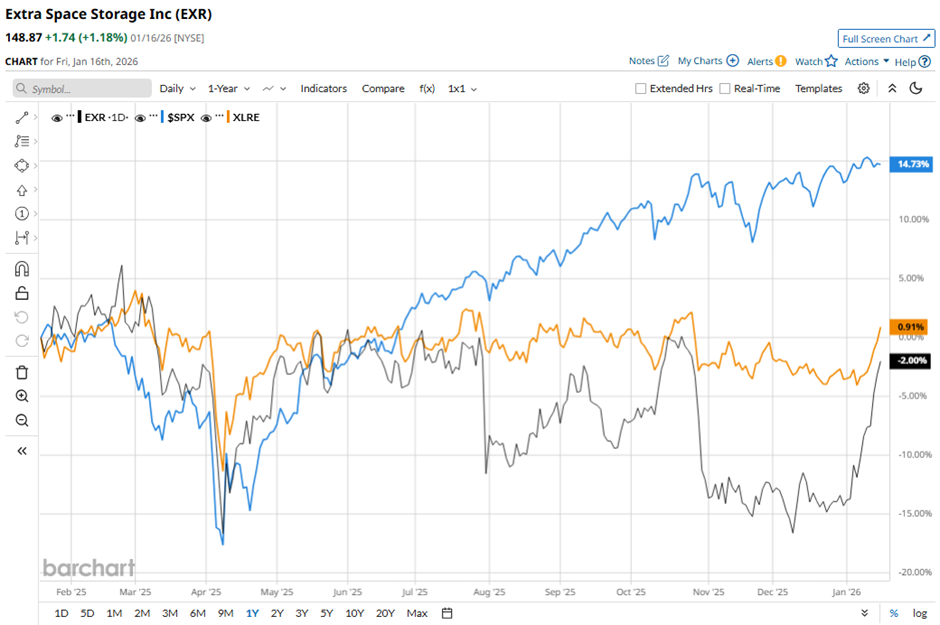

Shares of Extra Space Storage have dipped 1.8% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 16.9% gain and the State Street Real Estate Select Sector SPDR ETF's (XLRE) 2.7% return over the same time frame.

Despite reporting better-than-expected Q3 2025 core FFO of $2.08 per share on Oct. 29, Extra Space Storage shares fell 4.9% the next day as the company missed revenue expectations, posting $858.46 million for the quarter. In addition, net income fell 14.3% year over year to $0.78 per share, hurt by a $105.1 million loss on assets held for sale.

Analysts' consensus view on EXR stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 20 analysts covering the stock, six suggest a "Strong Buy" and 14 recommend a "Hold." The average analyst price target for Extra Space Storage is $151.06, indicating a potential upside of 1.5% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dear Microsoft Stock Fans, Mark Your Calendars for January 28

- Should You Buy Intel Stock Before Earnings on January 22? UBS Analysts Say Yes.

- Is It Time to ‘Squeeze’ Into This Comeback Stock Before It Breaks Out?

- How to Find High-Alpha Stocks That Can Change the Game for Momentum Traders and Investors