Harley-Davidson (HOG) is one of America’s most iconic brands. You would think that the White House’s push to boost American manufacturing would be a boon to the Wisconsin company.

The share price suggests not.

The motorcycle manufacturer’s stock is down over 25% in 2025, including 8% since the beginning of December. From its all-time high of $75.87 in November 2006, HOG has lost 70% of its value.

With this kind of shareholder value destruction, it’s easy to overlook, especially when you consider that its Midwest peer, Polaris (PII), is up 40% year-to-date on a relative basis.

Value investors should take a closer look. The stars appear ready to align. However, I’d wait until late January before you buy. Here are three reasons why.

The Fundamentals Aren’t Horrible Considering Consumer Confidence

On Dec. 6, the University of Michigan’s Consumer Sentiment Index was released.

There was a slight uptick, from 51.0 in November to 53.3 in December. However, that’s down considerably, from 71.7 at the beginning of 2025. For context, when HOG stock hit its all-time high in November 2006, the index was 92.1, 73% higher than it is heading into 2026.

Consumer confidence sucks. That’s never good for businesses courting discretionary income. That said, the company’s latest quarter revealed some positives with Harley-Davidson’s fundamentals.

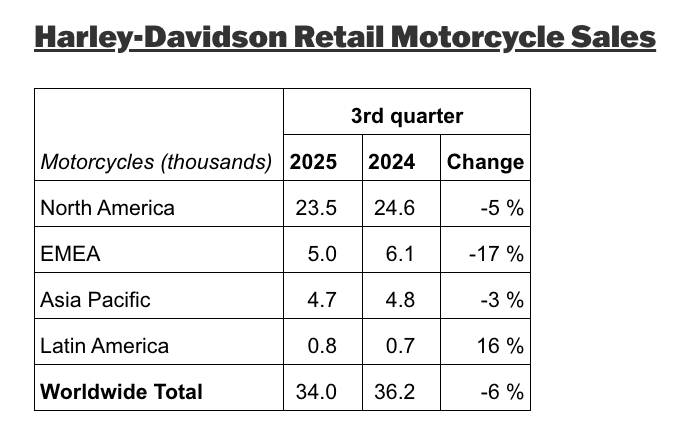

Source: Q3 2025 press release

While the company’s global retail motorcycle sales by unit volume were down 6% (5% in North America, its largest market), motorcycle sales revenue rose 34% to $822 million. Further, global shipments were up 33%, with a 62% increase in U.S. shipments. That’s indicative of a stronger market.

Also, with a focus on higher-priced, higher-margin bikes, Harley-Davidson Motor Company’s (HDMC) operating profit was only 2% lower than a year ago, despite higher input and tariff-related costs.

The most significant gains were at Harley-Davidson Financial Services (HDFS), which saw operating profits increase 472% to $439 million.

That increase comes with an explanation.

Harley’s Financial Services Business Goes Asset Light

During the third quarter, the company announced a transformational transaction in which HDFS sold over $5 billion of its receivables to KKR & Co. (KKR) and Pimco at a premium to par.

With this deal, Harley-Davidson maintains control of HDFS—KKR and Pimco each bought 4.9% stakes in the financial services business—while unlocking $1.25 billion in cash to pay down $450 million in parent-company debt and repurchase $500 million of its shares.

More importantly, it gains two excellent strategic funding partners for its dealers’ customers for the next five years. KKR and Pimco will buy two-thirds of HDFS’s annual retail loan originations at a premium over this period. HDFS will receive fees from its strategic partners for servicing the loans sold to them.

The transaction provides the company with the best of both worlds—a capital-light loan portfolio with secure funding to grow the business once consumers are more confident.

The transaction closed in October, after the end of the third quarter. As a result, $4.1 billion in finance receivables held for sale was derecognized on the balance sheet, increasing cash and reducing its receivables-related liabilities.

The big downside is that HDFS’s profits will now come primarily from servicing fees rather than the spread between the division’s cost of capital and loan interest.

However, the reduced credit risk is a worthwhile tradeoff. Ultimately, the business lives and dies on its motorcycle sales.

While increased global shipments suggest dealers are relatively confident, only time will tell whether they translate into higher sales.

HOG Stock Historically Does Poorly in December and January

Barchart’s Seasonal Returns chart says that between 2010 and 2025, Harley-Davidson’s stock’s monthly performance, on average, is worst in May (-3.35%), followed by January (-1.45%), August (-1.25%), and December (-0.84%).

The worst December performance over the 16 years was -18.48% in 2018. The worst January performance was -11.92% in 2024. The chance of a negative monthly return in December is 50/50, and 62.5% in January.

We’re not even halfway through December, and shares are already down 8%. Unless we see a significant rally in the next three weeks, HOG will likely move lower, as investors harvest their 2025 tax losses.

Adding the historical probability of HOG going lower in January makes it sensible to wait until later in January to buy, or even into February. It reports Q4 2025 results around Feb. 8.

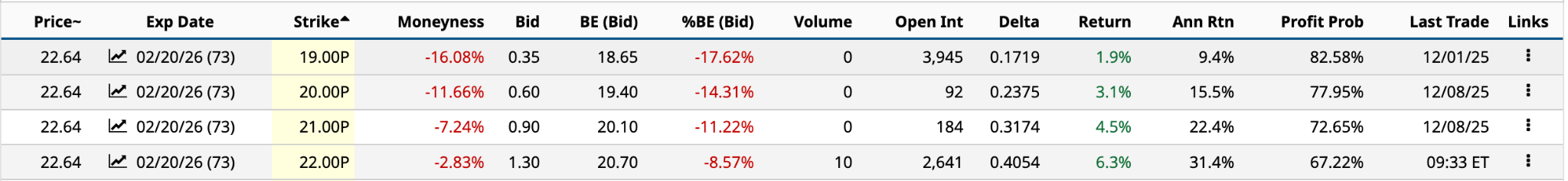

If you’re an aggressive investor, you might consider selling puts for income.

The expected move over the next 73 days is 12.88%, up or down. The lower price is $19.72. The lowest the shares have traded over the past 12 months is $20.45. The $2o strike would generate a 15.5% annualized return, with a $19.40 breakeven.

Of course, the risk here is that Harley delivers a stinker fourth quarter, and the shares drop below $19.40, and you’re forced to buy shares at the $20 strike price for a paper loss.

If you’re aggressive, the risk/reward seems acceptable. If you’re risk-averse, Harley-Davidson isn’t your cup of tea.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- How to Make a 1.1% Yield Shorting One-Month Microsoft Puts

- Down 8% in December, Investors Should Wait Until Late January to Buy Harley-Davidson

- After a Red-Hot Rally on S&P 500 Inclusion, Carvana Stock Needs a ‘Cool’ Option Collar. How to Trade CVNA Here.

- Short vs. Long-Term Covered Calls on WFC: Which Works Better?