Caterpillar (CAT) shares have more than doubled since early April as agriculture and manufacturing markets recovered to create solid demand for its equipment and services across multiple sectors.

The Irvine-headquartered firm is currently the top performer in the Dow Jones Industrial Average ($DOWI), which reflects its strong positioning within heavy machinery and equipment manufacturing.

At the time of writing, Caterpillar stock is up nearly 60% versus the start of this year.

Is This as Far as Caterpillar Stock Goes?

Citi analysts expect continued momentum in the construction and mining sector to drive CAT stock higher over the next 12 months.

According to them, the company’s impressive $40 billion backlog in power generation applications is a major competitive strength, one that could push its share price up further to $690 next year.

Plus, the recent team up with Vertiv (VRT) on developing energy-optimization solutions for data centers positions Caterpillar to capitalize on the growing digital infrastructure demand, they added.

Historically, the industrial stock pops some 1.53% on average in January, which makes it somewhat more attractive to own heading into 2026.

CAT Shares Are Riding the AI Wave

Caterpillar shares are worth owning for the long-term also because the heavy machinery landscape is experiencing significant transformation driven by the artificial intelligence (AI) buildout.

Why? Because it requires extensive construction of data centers, power facilities, and supporting infrastructure across multiple sectors.

This AI-enabled diversification signals additional revenue streams and massive potential for CAT to grow in high-margin applications.

Beyond strong financials (with free cash flow exceeding $3 billion in the third quarter), the NYSE-listed behemoth remains appealing because of its dividend aristocrat status as well.

Note that Caterpillar currently has its 100-day relative strength index set at 59 only, signaling the upward momentum will likely sustain in early 2026.

Caterpillar Remains a ‘Buy’

Wall Street more broadly sees CAT shares as positioned for continued rally in 2026 as well.

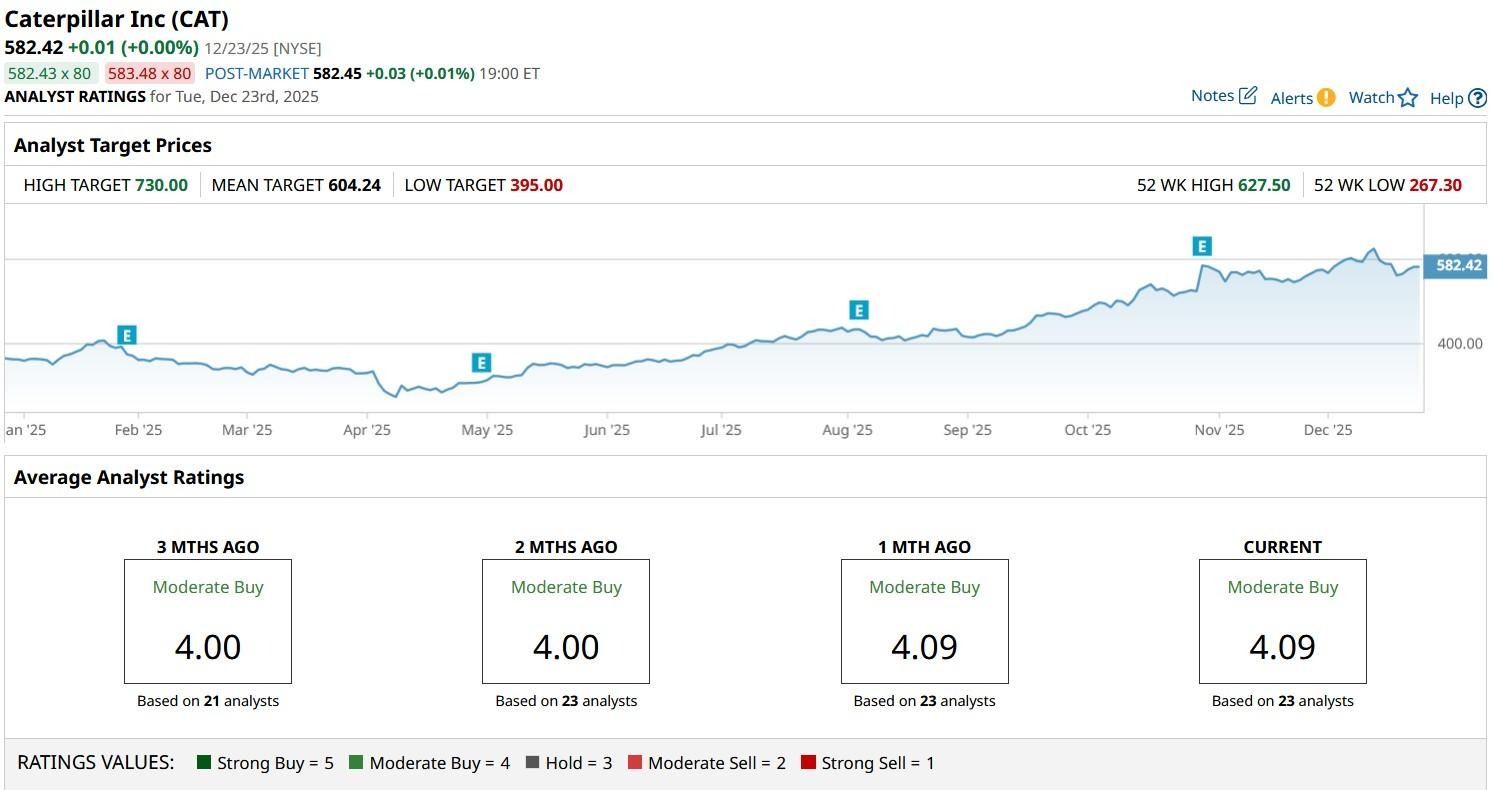

According to Barchart, the consensus rating on Caterpillar stock remains at “Moderate Buy” with the mean target of about $604 indicating potential upside of another 4% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Chipotle Just Launched a New Protein-Packed Menu. Should You Buy CMG Stock for 2026?

- Cathie Wood Is Selling DraftKings Stock. Should You?

- Dan Ives Is Betting That Apple and Google Will Partner in 2026. Should You Buy AAPL Stock First?

- Should You Sell Netflix Stock Before It Wins the Warner Bros Takeover?